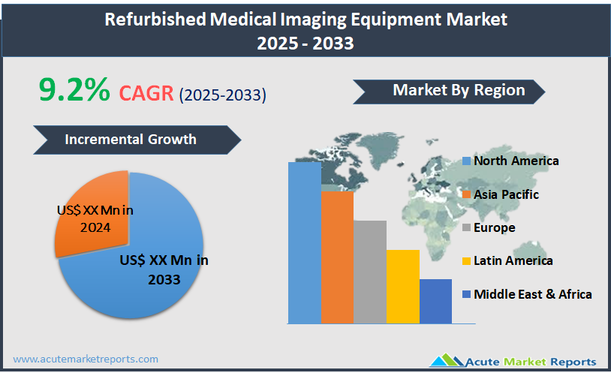

The refurbished medical imaging equipment market includes diagnostic imaging systems that have been restored to original manufacturer specifications through repair, replacement of parts, software updates, and thorough testing processes. Refurbished imaging devices such as MRI machines, CT scanners, X-ray systems, ultrasound machines, and nuclear imaging equipment offer healthcare providers cost-effective alternatives to purchasing brand-new systems. These products are typically certified by either original equipment manufacturers (OEMs) or specialized third-party refurbishers to ensure performance, safety, and regulatory compliance, thereby extending the lifecycle and utility of high-cost medical imaging technologies. The refurbished medical imaging equipment market is witnessing significant growth, driven by the rising demand for affordable diagnostic solutions, the increasing burden of chronic diseases, and the need for advanced healthcare infrastructure, particularly in emerging economies. With a projected Compound Annual Growth Rate (CAGR) of 9.2%.

Increasing Demand for Affordable Imaging Solutions

A key driver for the refurbished medical imaging equipment market is the increasing demand for affordable diagnostic solutions across both developed and developing healthcare systems. New imaging equipment such as MRI machines, CT scanners, and high-end ultrasound devices involve significant capital investments that can strain healthcare budgets, especially for small to mid-sized hospitals, independent diagnostic centers, and facilities in emerging economies. Refurbished imaging devices offer a cost-effective alternative, often priced 30–50% lower than new equipment, enabling healthcare providers to expand or upgrade their diagnostic capabilities without compromising on quality or performance. This affordability allows healthcare institutions to allocate resources toward other critical areas such as staffing, treatment technologies, or facility expansion. Additionally, refurbished equipment provides an opportunity for smaller healthcare facilities to access advanced imaging technologies, thereby improving diagnostic accuracy, patient outcomes, and the overall standard of care. With healthcare demand rising globally due to aging populations and increasing chronic disease prevalence, the need for reliable yet economically viable imaging solutions is expected to further fuel the demand for refurbished medical imaging systems over the coming years.

Rising Focus on Sustainable Healthcare Practices

An important opportunity in the refurbished medical imaging equipment market lies in the growing emphasis on sustainability and environmental responsibility within the healthcare sector. Refurbishing imaging equipment extends product lifecycles, reduces electronic waste, and conserves the raw materials and energy required to manufacture new devices. As global awareness around the environmental impact of medical waste rises, healthcare providers are increasingly seeking solutions that align with green procurement policies and sustainability targets. Refurbished imaging systems, when properly restored and certified, offer hospitals a way to contribute to circular economy initiatives while meeting clinical demands. Moreover, international regulatory bodies and environmental organizations are encouraging refurbishment practices by providing guidelines and certifications to ensure the safety, efficacy, and eco-friendliness of refurbished medical equipment. Companies that can demonstrate both environmental benefits and financial advantages are likely to find strong market opportunities, particularly among institutions looking to balance cost efficiency with corporate social responsibility goals. As sustainable healthcare continues to gain momentum, demand for certified refurbished imaging devices is expected to expand across public and private healthcare sectors.

Concerns Regarding Product Reliability and Warranty Support

A major restraint in the refurbished medical imaging equipment market is the lingering concern among healthcare providers regarding the reliability, performance, and warranty support of pre-owned devices. Despite advancements in refurbishment standards and certification processes, some healthcare facilities perceive refurbished equipment as less dependable compared to new devices, particularly in high-acuity settings where imaging quality and uptime are critical to patient care. Fear of frequent maintenance requirements, potential hidden defects, and limited availability of replacement parts can deter organizations from investing in refurbished options. Additionally, warranty periods for refurbished equipment are often shorter and less comprehensive than those offered with new systems, adding to the perceived risk of ownership. In many cases, lack of standardization among third-party refurbishers leads to inconsistent refurbishment quality, making it difficult for buyers to evaluate product dependability. While original equipment manufacturers offering certified pre-owned programs have helped improve trust, overcoming reliability concerns remains a crucial barrier to the broader acceptance of refurbished medical imaging systems, especially in premium healthcare segments.

Limited Access to Latest Technology Upgrades

One of the major challenges in the refurbished medical imaging equipment market is the limited access to the latest technological advancements compared to brand-new systems. Refurbished devices are typically based on previous-generation platforms, which may lack newer features such as advanced imaging software, artificial intelligence integration, faster processing speeds, and enhanced image resolution capabilities that are increasingly becoming standard in the medical imaging industry. As healthcare providers strive to offer cutting-edge diagnostic services to remain competitive, the technological gap between refurbished and new equipment can impact purchasing decisions, particularly for facilities targeting specialized imaging applications such as precision oncology, neurology, or advanced cardiovascular imaging. Furthermore, compatibility with newer hospital IT systems, cybersecurity standards, and electronic health record (EHR) integration can be more challenging for older refurbished models. Although software upgrades and retrofitting are possible to some extent, they may not fully match the capabilities of newer systems. Addressing this challenge requires refurbishers to focus on more recent-generation equipment and invest in comprehensive upgrade programs that bring refurbished systems closer to current technological benchmarks while maintaining cost advantages.

Market Segmentation by Product Type

In the refurbished medical imaging equipment market, the X-ray Devices segment generated the highest revenue in 2024 and is anticipated to maintain its dominance while also registering the highest CAGR from 2025 to 2033. X-ray machines are fundamental diagnostic tools used across a wide range of clinical settings, including emergency rooms, outpatient clinics, dental offices, and hospitals, leading to consistently high demand for affordable refurbished systems. Their relatively lower cost compared to advanced imaging modalities and frequent use for routine diagnostics such as fracture detection, chest imaging, and dental evaluations make X-ray devices the most widely refurbished and adopted imaging equipment globally. The Ultrasound Systems segment also captured a significant market share in 2024, driven by the broad utility of ultrasound across various specialties like obstetrics, cardiology, and general imaging, combined with the high portability and lower operating costs of ultrasound units, which make them ideal candidates for refurbishment and reuse. The CT Scanners segment witnessed robust demand as well, particularly in middle-income regions where healthcare providers seek cost-effective solutions to expand diagnostic capabilities for trauma care, cancer detection, and internal injury assessments. The MRI Equipment segment, while smaller in overall volume compared to X-ray and ultrasound, experienced strong interest due to the high original acquisition costs of MRI systems, encouraging providers to choose refurbished alternatives for neurology, musculoskeletal, and cardiovascular imaging applications. The Others category, including refurbished nuclear imaging equipment and mammography systems, held a smaller share but showed steady growth, particularly in oncology and women's health programs aiming to enhance diagnostic capacity without extensive capital expenditure.

Market Segmentation by Application

By application, the Oncology segment accounted for the highest revenue in 2024 and is projected to register the highest CAGR from 2025 to 2033 within the refurbished medical imaging equipment market. The increasing global burden of cancer, combined with the critical role of imaging modalities such as CT, MRI, ultrasound, and PET in early detection, staging, and monitoring of cancer, drives strong demand for high-quality yet affordable imaging equipment in oncology care settings. Healthcare institutions, particularly in developing and resource-constrained regions, rely heavily on refurbished imaging systems to expand oncology diagnostic services and support early intervention initiatives. The Cardiovascular segment also captured a significant share, as cardiovascular diseases remain the leading cause of mortality worldwide and require regular imaging diagnostics such as echocardiograms, cardiac CT, and MRI scans for assessment and management, creating demand for cost-effective refurbished solutions to support cardiology departments. The Gynecology segment showed steady growth, fueled by the increased adoption of ultrasound systems for obstetric imaging, gynecological diagnostics, and fertility monitoring, where refurbished units offer an economical alternative for clinics and hospitals expanding their maternal health services. The Orthopedic segment, covering imaging for bone fractures, joint conditions, and sports injuries, benefited from demand for refurbished X-ray and MRI systems, especially in outpatient specialty clinics and smaller healthcare centers aiming to offer advanced musculoskeletal diagnostics. The Others category, including neurology, dental, and urology imaging applications, contributed to market growth through steady adoption of refurbished equipment to address specific specialty diagnostic needs without the significant financial burden of purchasing new systems.

Geographic Segment

In the refurbished medical imaging equipment market, North America accounted for the highest revenue in 2024, driven by the strong presence of leading refurbished equipment suppliers, well-established healthcare infrastructure, increasing preference for cost-effective diagnostic solutions among independent imaging centers, and growing demand for secondary healthcare facilities to expand imaging capabilities without significant capital investments. The United States led the regional growth, supported by a favorable regulatory environment for refurbished medical devices, rising healthcare costs prompting budget-conscious procurement strategies, and the trend of replacing older systems in mid-tier hospitals with certified refurbished alternatives. Meanwhile, Asia Pacific is projected to register the highest CAGR from 2025 to 2033, supported by the rapid expansion of healthcare infrastructure, growing medical tourism, increasing focus on affordable healthcare delivery in countries such as China, India, Indonesia, and Vietnam, and heightened investments in diagnostic services to meet rising chronic disease burdens. Asia Pacific’s growing private healthcare sector and public-private partnerships to improve diagnostic access are expected to further fuel demand for refurbished imaging equipment across urban and semi-urban settings. Europe maintained a substantial market share in 2024, especially in Germany, France, and the United Kingdom, driven by the region’s strong emphasis on sustainable healthcare practices, favorable government policies promoting the reuse of medical equipment, and a well-developed secondary healthcare market seeking economical imaging solutions. Latin America and the Middle East & Africa contributed smaller shares in 2024 but are expected to experience steady growth from 2025 to 2033, driven by increasing healthcare investments, economic development, rising public awareness about early disease diagnosis, and strategic efforts by global players to strengthen distribution networks in emerging regions.

Competitive Trends and Key Strategies

In 2024, the competitive landscape of the refurbished medical imaging equipment market was shaped by major players such as CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.), Carestream Health (ONEX Corporation), GE Healthcare (General Electric Company), Hologic, Inc., Koninklijke Philips N.V., Shimadzu Corporation, Siemens Healthineers AG, and Fujifilm Holdings Corporation, who pursued strategies centered on product quality assurance, service reliability, and expanding their refurbished portfolios through certified pre-owned programs. CANON MEDICAL SYSTEMS CORPORATION reinforced its market position by offering certified refurbished imaging systems with full warranties and service packages, focusing particularly on CT and MRI systems to support cost-sensitive healthcare providers. Carestream Health (ONEX Corporation) concentrated on expanding its refurbished X-ray and digital radiography portfolio, providing comprehensive support and flexible financing solutions to hospitals and diagnostic centers aiming to upgrade imaging capabilities. GE Healthcare maintained leadership by offering a broad range of GoldSeal refurbished systems, emphasizing quality testing, original component replacements, and extended service contracts to ensure performance comparable to new systems, while targeting both developed and emerging markets. Hologic, Inc. focused on providing refurbished mammography and women’s health imaging systems, promoting their solutions as an economical way to expand breast cancer screening programs globally. Koninklijke Philips N.V. emphasized circular economy principles by expanding its Refurbished Systems business, delivering high-quality ultrasound, CT, and MRI devices with upgraded software and parts, supporting sustainable healthcare models. Shimadzu Corporation strengthened its refurbished imaging equipment offerings, particularly in X-ray and fluoroscopy, emphasizing reliability, safety, and efficient service support. Siemens Healthineers AG expanded its refurbished systems portfolio under the "ecoline" brand, offering factory-certified refurbished MRI, CT, and molecular imaging equipment along with remote servicing and predictive maintenance tools to ensure operational continuity. Fujifilm Holdings Corporation capitalized on its strength in ultrasound and digital radiography segments, providing refurbished imaging solutions optimized for small and mid-sized healthcare facilities.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Refurbished Medical Imaging Equipment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Application

| |

End-user

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report