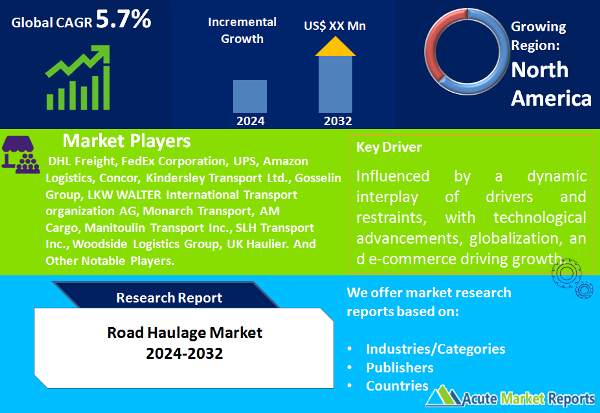

The road haulage market is a dynamic sector crucial for transporting goods across various industries and is expected to grow at a CAGR of 5.7% during the forecast period of 2026 to 2034. The road haulage market's trajectory is influenced by a dynamic interplay of drivers and restraints, with technological advancements, globalization, and e-commerce driving growth. However, environmental regulations pose challenges, necessitating a shift toward sustainable practices. The market's segmentation reveals nuanced trends, with a dual emphasis on both international and domestic road haulage and varying performances across application sectors. Geographically, Asia-Pacific exhibits high growth potential, while North America contributes significantly to overall revenue. In terms of competition, industry leaders like DHL Freight, FedEx Corporation, UPS, and Amazon Logistics are pivotal players, employing diverse strategies to maintain their market positions. As the road haulage market evolves from 2026 to the forecast period of 2034, adapting to changing dynamics and embracing innovation will be key for sustained success in this dynamic and vital industry.

Technological Advancements in Fleet Management

Technological advancements have played a pivotal role in reshaping the road haulage landscape. Fleet management systems equipped with GPS tracking, telematics, and real-time monitoring have significantly enhanced operational efficiency. For instance, companies like Trimble Navigation have introduced advanced fleet management solutions that optimize route planning, reduce fuel consumption, and improve overall fleet performance. These technologies not only streamline operations but also contribute to cost savings and environmental sustainability, making them a cornerstone for the road haulage sector's growth.

Globalization and Increasing International Trade

The road haulage market has benefited from the ongoing trend of globalization and the subsequent surge in international trade. Companies engaged in international road haulage, such as DHL Freight and FedEx Corporation, have experienced increased demand for cross-border logistics solutions. The interconnectedness of global supply chains has necessitated efficient and reliable road transport for the timely delivery of goods. This driver is expected to persist, especially as businesses continue to expand their global footprint, driving the demand for international road haulage services.

Rise in E-commerce and Last-Mile Delivery

The booming e-commerce sector has been a significant catalyst for the road haulage market. The increasing preference for online shopping has led to a surge in parcel deliveries, emphasizing the importance of last-mile logistics. Companies like UPS and Amazon Logistics have invested heavily in their road haulage capabilities to ensure swift and reliable last-mile deliveries. The convenience of doorstep deliveries and the need for prompt order fulfillment have fueled the demand for road haulage services, making it a key driver in the market's growth trajectory.

Environmental Regulations and Sustainability Challenges

Despite the market's growth, environmental concerns pose a formidable restraint. Stringent regulations aimed at reducing carbon emissions and promoting sustainable practices have compelled road haulage companies to adapt to greener technologies. The transition to electric and alternative fuel-powered vehicles involves substantial investments and operational changes. Companies like Tesla and Nikola Corporation are at the forefront of developing electric trucks, addressing the need for eco-friendly transport. However, these changes pose challenges, including high initial costs and the need for extensive charging infrastructure.

Market Analysis by Haulage Type: international road haulage Dominates the Market

In 2025, international road haulage emerged as the highest revenue-generating segment, driven by global trade dynamics. However, domestic road haulage exhibited the highest CAGR during the forecast period (2026-2034). The demand for efficient local logistics solutions, particularly in densely populated regions, fueled the growth of domestic road haulage. This duality in performance highlights the diverse needs of the market and the importance of catering to both international and domestic logistics requirements.

Market Analysis Application: Automotive and Retail sectors Dominate the Market

In terms of revenue, the road haulage market's application segmentation in 2025 was led by the Automotive and Retail sectors. These segments capitalized on the need for timely deliveries and streamlined supply chains. Conversely, the Mining and construction sector exhibited the highest CAGR during the forecast period, emphasizing the industry's responsiveness to evolving market dynamics. The differentiated performance across sectors underscores the need for tailored logistics solutions in diverse applications.

North America Remains the Global Leader

Geographically, the road haulage market experienced notable trends in different regions. Asia-Pacific emerged with the highest CAGR, driven by rapid industrialization and increasing trade activities. North America, with its well-established logistics infrastructure, contributed the highest revenue percentage. The regional dynamics highlight the varying growth rates and revenue contributions, necessitating region-specific strategies for market players.

Market Competition to Intensify during the Forecast Period

In 2025, the road haulage market's competitive landscape witnessed prominent players such as DHL Freight, FedEx Corporation, UPS, Amazon Logistics, Concor, Kindersley Transport Ltd., Gosselin Group, LKW WALTER International Transport organization AG, Monarch Transport, AM Cargo, Manitoulin Transport Inc., SLH Transport Inc., Woodside Logistics Group and UK Haulier. These industry giants adopted diverse strategies, including technological innovation, strategic acquisitions, and network expansions. DHL Freight, for instance, focused on strengthening its international road haulage capabilities, aligning with the globalization trend. FedEx Corporation emphasized last-mile delivery solutions, catering to the growing e-commerce demand. UPS and Amazon Logistics strategically expanded their fleets and optimized route planning to enhance overall operational efficiency. As of 2026, these top players are expected to continue shaping the road haulage market during the forecast period (2026-2034). The industry outlook suggests a continued focus on technology integration, sustainability measures, and strategic collaborations to navigate the evolving landscape.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Road Haulage market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Vehicle Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report