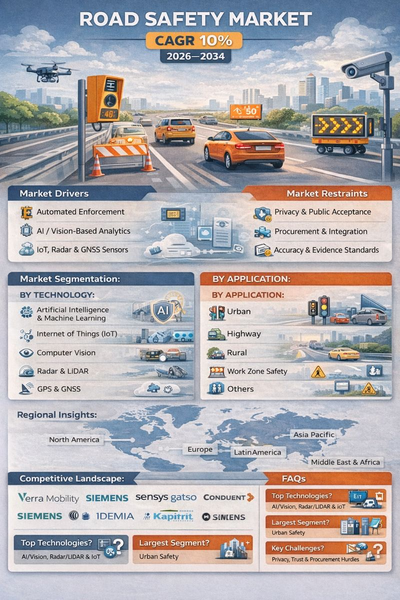

The road safety market is expected to grow at a CAGR of 10.0% during 2026–2034, driven by rising road traffic volumes, stronger enforcement focus, and increasing investment in smart mobility and intelligent transportation systems. Road safety solutions include speed and red-light enforcement, incident detection, traffic analytics, connected infrastructure, work zone safety systems, and data platforms that support safer road operations. Growth is supported by adoption of AI-based analytics, computer vision for detection and violation capture, wider sensor deployment (radar, LiDAR, IoT), and cloud/edge platforms that enable real-time response, evidence management, and performance monitoring for road authorities.

Market Drivers

Market growth is driven by government and city programs to reduce fatalities and serious injuries through enforcement, safer infrastructure design, and better traffic management. Increased adoption of automated enforcement (speed, red-light, bus lane, toll compliance) supports demand for radar and vision-based systems with reliable evidence capture and back-office processing. AI/ML and computer vision are accelerating adoption by improving detection accuracy, vehicle classification, and incident recognition, while enabling analytics to identify high-risk locations and optimize enforcement placement. IoT and connected roadside infrastructure support continuous monitoring of traffic conditions and faster incident response, which is important for both urban corridors and high-speed highways. Work zone safety is a growing driver due to rising construction and maintenance activity, where temporary detection, warning systems, and connected signage improve worker and driver safety. Insurance and fleet safety programs also support demand for data-led enforcement and compliance solutions in selected regions.

Market Restraints

The market faces restraints due to privacy concerns, regulatory requirements, and public acceptance issues related to automated enforcement and camera-based monitoring. Procurement cycles can be long because solutions often require multi-agency approvals, budget allocation, and performance validation. Integration complexity is a challenge when road safety systems must connect with legacy ITS infrastructure, police enforcement workflows, court processes, and payment platforms. Accuracy requirements, false positives, and evidence standards can increase cost for calibration, testing, and ongoing maintenance. Cybersecurity risks and data governance requirements increase compliance burden for cloud-connected systems. In rural areas, limitations in power and connectivity can constrain deployment and raise operating costs.

Market Segmentation

By Technology

By technology, the market is segmented into artificial intelligence and machine learning, Internet of Things (IoT), computer vision, radar and LiDAR, GPS and GNSS, and cloud and edge computing platforms. Computer vision and AI/ML are high-growth areas because they improve detection, classification, and analytics for enforcement and incident management, while enabling scalable video-based monitoring. Radar and LiDAR remain important for speed measurement, detection reliability, and multi-lane monitoring in both urban and highway environments. IoT supports connected infrastructure, sensor networks, and condition monitoring, enabling faster response and predictive maintenance. GPS and GNSS support location-based safety services, fleet compliance, and integration with navigation and incident reporting systems. Cloud and edge platforms are becoming core enablers for real-time processing, evidence storage, analytics dashboards, and centralized management across city and highway networks, with edge computing used to reduce latency and bandwidth needs.

By Application

By application, the market is segmented into urban, highway, rural, work zone safety, and others. Urban applications hold major demand due to higher traffic density, complex intersections, pedestrian safety needs, and strong enforcement and congestion management programs. Highway deployments are driven by speed enforcement, incident detection, and traffic flow monitoring, where safety benefits are linked to faster response and reduced secondary collisions. Rural applications are growing selectively, often focused on high-risk corridors, speed management, and targeted enforcement where accident severity is higher and coverage is limited. Work zone safety is a fast-growing segment supported by road expansion and maintenance projects, using temporary detection, warning systems, connected signage, and analytics to reduce crashes and protect workers. Others include school zones, tunnels, bridges, and special event traffic safety deployments where risk levels and compliance needs are high.

Regional Insights

North America shows strong demand supported by active automated enforcement programs in selected jurisdictions, increasing investment in connected infrastructure, and expansion of data-led safety strategies. Europe is supported by mature enforcement frameworks in many markets and continued investment in safer road networks, with strong focus on data protection and performance standards. Asia Pacific represents high growth potential due to rapid urbanization, expanding road networks, and rising adoption of smart city and ITS programs, especially in large metro areas. Latin America shows growing demand in major cities and high-risk corridors, with adoption influenced by public-private models and funding availability. The Middle East & Africa shows selective growth tied to smart city investments, highway modernization, and enforcement programs in high-traffic areas, with deployments shaped by procurement models and local operating capacity.

Competitive Landscape

The market is competitive and contract-driven, with differentiation based on enforcement accuracy, reliability, evidence workflow support, analytics capability, and ability to deliver integrated end-to-end solutions including back-office processing. Vendors compete through technology portfolios across cameras, radar, analytics software, and cloud platforms, along with long-term managed service offerings. Public-private partnership models are common in automated enforcement, making service delivery, compliance, and stakeholder management important competitive factors. Key strategies include expanding AI-enabled analytics, improving cybersecurity and privacy controls, integrating edge processing for real-time detection, and building scalable platforms that can support multi-city and multi-corridor deployments. Key companies operating in the market include Conduent, Cubic, IDEMIA, Jenoptik, Kapsch TrafficCom, Motorola Solutions, Sensys Gatso, Siemens, and Verra Mobility.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Road Safety market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Technology

|

|

Application

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Frequently Asked Questions

What is the growth outlook for the road safety market?

The market is expected to grow at a CAGR of 10.0% during 2026–2034, driven by increased enforcement, smart mobility investment, and adoption of AI-enabled monitoring and analytics.

Which technologies are most important for next-generation road safety?

Computer vision, AI/ML, radar/LiDAR, and cloud/edge platforms are key for accurate detection, real-time response, and scalable enforcement and analytics.

Which application segment drives the largest demand?

Urban road safety drives major demand due to high traffic density, intersection risk, and strong focus on pedestrian and vulnerable road user safety.

What are the key challenges in this market?

Major challenges include privacy and public acceptance concerns, long procurement cycles, integration with enforcement and legal workflows, cybersecurity requirements, and accuracy and evidence standards.

Who are the key players in this market?

Key participants include Verra Mobility, Sensys Gatso, Kapsch TrafficCom, Jenoptik, Motorola Solutions, Siemens, Conduent, Cubic, and IDEMIA.