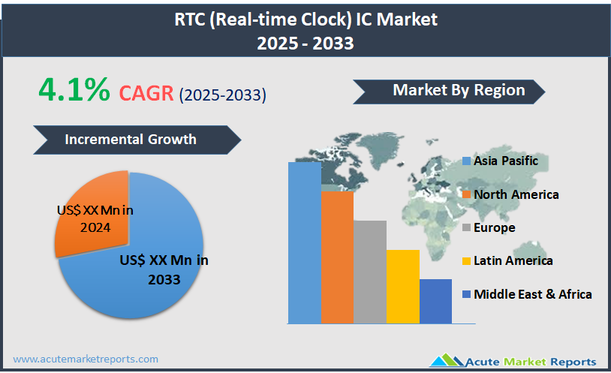

A Real-Time Clock (RTC) Integrated Circuit (IC) is a specialized microchip embedded in electronic devices to keep track of the current time and date. These ICs are crucial for applications where accurate timekeeping is essential, even when the main device is powered off. RTC ICs typically include features like battery backup capabilities, ensuring that timekeeping continues uninterrupted during power outages or when the device is disconnected from its power source. They are widely used in various applications, including computers, embedded systems, industrial machinery, consumer electronics, and communication equipment. The global RTC (Real-time Clock) IC market is poised for steady growth, with a projected Compound Annual Growth Rate (CAGR) of 4.1% through the forecast period. This growth is primarily driven by the increasing integration of RTC ICs across a wide range of applications. As digitalization and automation in industries such as manufacturing, automotive, and telecommunications expand, the demand for precise and reliable timekeeping solutions also increases.

Driver: Expansion of IoT and Smart Devices

The increasing expansion of the Internet of Things (IoT) and the proliferation of smart devices significantly drive the RTC (Real-Time Clock) IC market. As IoT devices become integral to industries like healthcare, automotive, and home automation, the need for precise timekeeping becomes critical. RTC ICs ensure that devices can perform scheduled tasks, maintain accurate logs, and synchronize operations without human intervention. For example, in smart home systems, RTC ICs enable devices to execute actions at specific times, such as adjusting thermostats or opening blinds, enhancing user convenience and energy efficiency. In automotive applications, RTCs ensure that systems like GPS and black box recorders maintain accurate time stamps, which are crucial for navigation and safety. The reliability and accuracy of RTC ICs in managing time-sensitive tasks in these connected devices underscore their growing demand across various sectors.

Opportunity: Advancements in Low Power RTC Technology

Emerging advancements in low-power RTC technology present significant opportunities for the RTC IC market. As electronic devices, particularly portable and wearable technologies, emphasize battery life optimization, the demand for RTC ICs that consume minimal power while providing accurate timekeeping increases. Innovations that reduce the size of the IC and extend the life of the onboard battery are particularly attractive. This development is crucial for applications in remote sensing and long-term environmental monitoring systems, where replacing batteries frequently is impractical. By leveraging advancements in low-power RTC technology, manufacturers can cater to a broader range of applications, enhancing the attractiveness and utility of their devices in energy-sensitive markets.

Restraint: Integration Complexity and Cost

A major restraint in the RTC IC market is the complexity and cost associated with integrating these chips into existing systems. RTC ICs often require additional components, such as separate batteries and oscillators, which can complicate the design and increase the overall cost of the electronic device. This is particularly challenging for small-scale manufacturers or applications where cost constraints are stringent. Additionally, the integration process can require significant expertise, especially when precision and long-term reliability are critical, adding to the engineering challenges and increasing the time to market for new products.

Challenge: Maintaining Accuracy and Reliability

One of the key challenges in the RTC IC market is maintaining the accuracy and reliability of the clocks over extended periods and under varying environmental conditions. RTC ICs must consistently provide precise timekeeping despite temperature fluctuations, humidity, and electromagnetic interference, which can affect their accuracy. Ensuring that RTC ICs can operate effectively in diverse and harsh environments is essential, especially in industrial and automotive applications where conditions can be extreme. Manufacturers must continually innovate and test their products to meet these stringent requirements, ensuring that their RTC ICs remain competitive and reliable in all operating conditions.

Market Segmentation by Interface

The RTC (Real-Time Clock) IC market is segmented by interface types, primarily I2C (Inter-Integrated Circuit) and SPI (Serial Peripheral Interface). I2C interfaces lead in revenue generation within this market segment due to their widespread adoption in consumer electronics and automotive applications. I2C's simplicity and efficiency in connecting multiple slave devices to master controllers using only two wires make it highly favored for applications where space and power consumption are concerns. Despite I2C’s dominance in terms of revenue, SPI interfaces are projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expected growth is attributed to SPI’s higher speed capabilities, which are increasingly demanded in applications requiring fast data transfer rates such as in advanced communication devices and high-performance embedded systems. SPI’s ability to operate with a larger number of connected devices without significant slowdowns enhances its applicability in complex digital environments, driving its adoption rate.

Market Segmentation by Mounting Type

In terms of mounting type, the RTC IC market includes surface mount and through-hole technologies. Surface mount technology (SMT) accounts for the highest revenue within the market due to its compatibility with modern automated manufacturing processes, which allow for more compact device designs and higher circuit densities. The preference for surface mount RTC ICs is driven by the electronics industry's ongoing trend towards miniaturization and cost-effective mass production. On the other hand, through-hole mounting is expected to witness the highest CAGR over the forecast period. This growth can be attributed to certain niche applications where high reliability and strong mechanical bonds are required, such as in aerospace and military electronics. Through-hole technology, while generally bulkier and more costly to implement than SMT, offers enhanced durability and heat tolerance, making it suitable for devices subjected to harsh environments and mechanical stresses.

Geographic Segment

The RTC (Real-Time Clock) IC market exhibits strong regional variances, with Asia-Pacific leading in revenue generation in 2024. This region's dominance is driven by its robust electronics manufacturing sector, particularly in countries like China, South Korea, and Taiwan, which host major semiconductor and electronic device production hubs. The high concentration of consumer electronics, automotive, and industrial equipment manufacturing in Asia-Pacific fuels the demand for RTC ICs. North America, noted for its advanced technological infrastructure and innovation in applications such as telecommunications and automotive systems, is expected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033. This anticipated growth is spurred by the increasing integration of IoT and smart technologies across various sectors, necessitating reliable real-time clock solutions for timing and synchronization.

Competitive Trends and Top Players

In 2024, the competitive landscape of the RTC IC market was marked by intense activity from key players including ABLIC Inc., Abracon, LLC, Diodes Incorporated, Analog Devices, Inc. (Maxim), Microchip Technology Inc., Micro Crystal AG, NXP Semiconductors, Renesas Electronics Corporation, RICOH Electronic Devices Co., Ltd., ROHM CO., LTD., Seiko Epson Corp., STMicroelectronics, and Texas Instruments Incorporated. These companies focused on expanding their product portfolios and enhancing their technological capabilities to address the growing demands for high-performance, low-power, and compact RTC solutions. For instance, innovations aimed at enhancing the accuracy, power efficiency, and integration features of RTC ICs were particularly emphasized. From 2025 to 2033, these companies are expected to continue their efforts in R&D to push the boundaries of RTC technology further. Strategic partnerships and acquisitions are also anticipated to play a crucial role in expanding their reach and capabilities, particularly in emerging markets where digital transformation is accelerating. Additionally, these companies are likely to focus on developing solutions that meet the stringent requirements of advanced applications in automotive and industrial automation, ensuring compliance with global standards and regulations.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of RTC (Real-time Clock) IC market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Interface

| |

Mounting Type

| |

Operating Voltage

| |

End-use Industry

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report