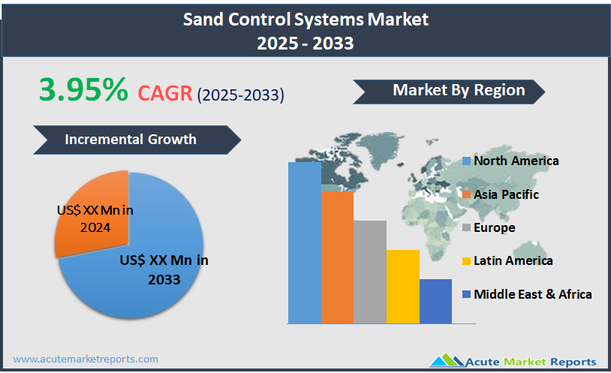

The sand control systems market refers to the industry involved with the design, manufacture, and deployment of technologies and solutions aimed at managing and minimizing sand production during hydrocarbon extraction. Sand control systems are critical components in oil and natural gas production facilities, particularly in reservoirs where sand can pose significant operational challenges. These systems help maintain the integrity of the wellbore by preventing sand from entering the production tubing and surface equipment, which can lead to erosion, reduced production efficiency, and even catastrophic failure of equipment. The sand control systems market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.95%.

Expanding Offshore Drilling Activities

The primary driver for the sand control systems market is the expansion of offshore drilling activities, particularly in regions with complex geological formations that are prone to sand production. As oil and gas exploration pushes further into these challenging environments, the need for effective sand control solutions becomes critical to maintaining the integrity of wellbores and preventing equipment failure. Offshore reservoirs often contain loose sand layers, which can enter production equipment and cause blockages, erosion, and other operational issues that significantly impact production efficiency and safety. Sand control systems, such as screens and gravel packs, are deployed to mitigate these risks by filtering out sand while allowing hydrocarbons to flow freely. This need is underscored by ongoing developments in deepwater and ultra-deepwater fields, where high pressures and corrosive environments make effective sand control even more crucial.

Technological Innovations in Sand Control

A significant opportunity within the sand control systems market lies in technological innovations aimed at enhancing the efficiency and effectiveness of sand management. As the oil and gas industry evolves, there is a growing demand for advanced sand control technologies that can adapt to the varying conditions of new and existing wells. Innovations in materials science, for instance, have led to the development of more durable and corrosion-resistant sand screens and other control devices that can withstand harsher extraction environments and more abrasive sand particles. Furthermore, the integration of smart technologies and real-time monitoring systems into sand control solutions provides operators with critical data to optimize production and preemptively address issues before they lead to shutdowns or accidents.

Economic Downturns and Investment Cycles

A major restraint impacting the sand control systems market is the susceptibility of the oil and gas industry to economic downturns and fluctuating investment cycles. The capital-intensive nature of oil and gas projects, combined with the volatility in oil prices, can lead to significant fluctuations in investment in exploration and production activities. During periods of low oil prices or economic instability, projects, especially those in high-cost offshore or unconventional environments, may be delayed or canceled, directly affecting the demand for sand control systems. This economic sensitivity can result in unpredictable market conditions for sand control system manufacturers and service providers, challenging their capacity to plan and allocate resources effectively.

Adapting to Environmental Regulations and Sustainability Goals

One of the key challenges in the sand control systems market is adapting to increasingly stringent environmental regulations and sustainability goals within the global energy sector. As governments and regulatory bodies impose tougher standards to reduce the environmental impact of oil and gas extraction, operators must ensure that their sand control solutions not only enhance production efficiency but also comply with environmental protection standards. This challenge is compounded in regions with sensitive ecosystems, particularly offshore fields, where the potential for environmental damage is higher. Sand control system providers must continuously innovate and improve their technologies to meet these regulatory demands while maintaining operational effectiveness and cost-efficiency.

Market Segmentation by Technique

In the sand control systems market, the techniques include Gravel Packing, Stand Alone Screens, Resin Coated Gravel, Plastic Consolidation, and Others. Gravel Packing is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to its effectiveness in a wide range of well conditions, particularly in offshore environments where wellbores face high levels of sand and other particulates. This technique, which involves placing gravel around the screen to stabilize the formation while allowing oil or gas to flow, is favored for its reliability and adaptability to different geological formations. Meanwhile, Stand Alone Screens command the highest revenue within this segment. These screens are extensively used due to their simplicity, cost-effectiveness, and efficiency in preventing sand from entering the wellbore without significantly restricting hydrocarbon flow. The widespread adoption of stand-alone screens in both onshore and offshore settings contributes to their dominance in terms of revenue generation in the market.

Market Segmentation by Application

The sand control systems market is segmented by application into Onshore and Offshore. The Offshore segment is expected to witness the highest CAGR, driven by increasing investments in offshore exploration and production activities. Offshore wells, especially those in deep-water and ultra-deep-water environments, present unique challenges such as higher pressure and more complex reservoir properties, which necessitate robust sand control systems. The stringent requirements for equipment reliability and performance in these challenging conditions fuel the demand for advanced sand control solutions. On the revenue front, the Onshore segment generates the highest revenue. Despite the higher growth rate in offshore applications, onshore remains the largest segment due to the sheer volume of global onshore oil and gas projects. Onshore projects typically require less specialized equipment and entail lower operational risks and costs, making them more prevalent and thus driving higher overall revenue in this segment.

Geographic Segment

The sand control systems market is influenced by diverse geographic trends, driven by regional energy production focus and the varying complexity of oilfield environments. The Middle East region is expected to register the highest Compound Annual Growth Rate (CAGR) from 2024 to 2033 due to its vast oil reserves and ongoing investments in enhancing oil recovery technologies to maintain production levels. This region's focus on sustaining its oil production capabilities, despite challenging reservoir conditions prone to sand production, necessitates robust sand control solutions. North America, specifically the United States and Canada, accounted for the highest revenue in 2024, bolstered by extensive onshore and offshore activities, particularly in shale reserves and deep-water exploration areas in the Gulf of Mexico. The substantial existing infrastructure and continual technological advancements in extraction techniques in these regions support a high adoption rate of sand control systems.

Competitive Trends and Key Players

In 2024, the competitive landscape of the sand control systems market was characterized by the dominance of major players such as Schlumberger Limited, Halliburton, Baker Hughes, Weatherford International plc, Grit Industries, Inc., RPC, Inc., Superior Energy Services, Inc., Variperm Canada Limited, and The 3M Company. These companies focused extensively on technological innovations to enhance the efficiency and reliability of sand control systems in complex reservoirs. Schlumberger, Halliburton, and Baker Hughes, in particular, led the market with comprehensive sand control solutions tailored for both onshore and offshore applications, integrating advanced materials and monitoring technologies to optimize well performance and minimize downtime.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Sand Control Systems market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Technique

| |

Application

| |

Well Completion

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report