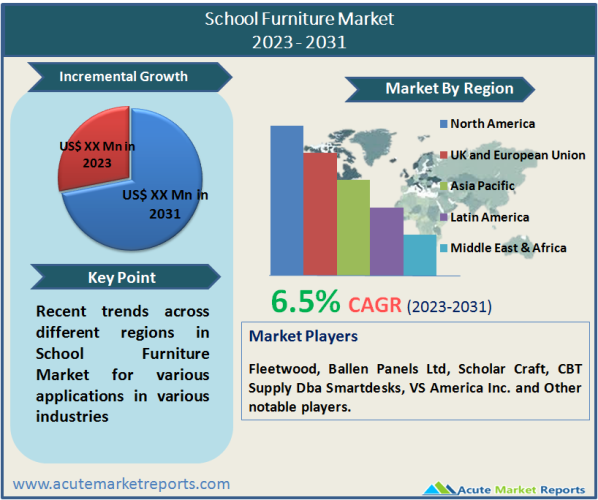

The global market for school furniture market is expected to grow at a CAGR of 6.5% during the forecast period of 2026 to 2034. Increasing emphasis on expanding access to education in rural regions, towns, and cities has been a significant element driving market expansion. According to the National Centre for Education Statistics (NCES), there were 130,930 K-12 schools in the U.S. in 2021, with an average of 2,618 per state.

According to the same report, the average number of students per school has doubled. The market was severely affected by the COVID-19 pandemic. Initially, the online form of instruction required pupils to complete their education from home, resulting in large school closures. Second, the domestic and international supply of furniture-manufacturing components, services, raw materials, and other consumables experienced difficulties during the epidemic. The rapid fall in demand for school furniture had a devastating financial impact on industry participants and the vast majority of producers. The increasing demand for flexible classroom seating is also anticipated to enhance product demand. This school furniture is based on evolving space layouts and can aid in preventing children's increasing posture issues. These help youngsters to have better postures, offer comfortable ergonomic solutions, can support the weight of pupils, and offer adequate space for movement. Multiple seating alternatives, such as chairs, yoga balls, couches, and spring-loaded stools, are gaining popularity.

Increasing Construction of Schools

The U.S. government has contributed significantly to programs that promote the construction of schools and the enrolment of students in them. The Obama Administration contributed $1 billion in 2009 to provide preschool education to all children, prompting states to increase their investments in early education. All three- and four-year-olds in the country will receive a high-quality, universal pre-kindergarten education under the current administration led by Joe Biden. Consequently, such programs are anticipated to boost market revenue.

Increasing Innovation

Innovations in this business have also increased the demand for school furnishings. For instance, in November 2021, MiEN Company, a provider of innovative furniture items to the education field, released its DIY backless chair. The device is intended for learning environments that encourage students to strengthen their core while in a ready-to-learn stance. Because it lacks a back, the chair may be readily hidden under tables when students choose to stand.

Demand for Aesthetic and Convenient Furniture

Traditional school furniture is being replaced by innovative, aesthetically pleasing, multifunctional, and more comfortable modern furniture as the education sector in the United States continues to improve. Modern dynamic teaching methods, such as blended learning and flipped classrooms, necessitate furniture that is adaptable, portable, and quickly reconfigurable. As a result, there is a rise in ergonomic designs, enhanced aesthetics, and multifunctionality of school furniture.

Classroom Furniture Dominated the Market by Applications

In 2025, the classroom segment dominated the application type with a 75% revenue share. Increased innovation in the use of raw materials for the creation of classroom furniture has led to a greater emphasis on cooperation, reconfiguration, and ergonomically derived classroom furniture. The rising number of students enrolled in schools across the nation has increased the demand for seats and tables in classrooms.

The library and labs segment is anticipated to develop at a 5% CAGR over the forecast period. This growth is facilitated by the large amounts of time students spend in libraries and labs on homework, projects, and assignments, as well as participating in discussions regarding these topics. In recent years, furniture that fosters and facilitates interactive and collaborative learning in libraries and laboratories has gained popularity.

Seating Furniture Dominated the Product Market

In terms of revenue, the seating furniture product accounted for around 55% of the school furniture market in 2025. This post is due to its widespread demand in all educational institutions. Every learning environment necessitates ergonomic and comfy furniture that ensures students' total concentration and focus on the learning process. The Next Education Manager at Kinnarps, a maker of office furniture emphasizing the significance of quality school furniture, reports that fifty percent of kids believe that the physical environment has a significant impact on how they feel during the school day. This is one reason why there has been an increase in demand for ergonomic seating furniture on school grounds.

A 5.5% CAGR is anticipated for the storage units market throughout the forecast period. The trend of providing personal cabinets to pupils in the United States is anticipated to positively impact the growth of the school furniture market throughout the forecast period. This segment's growth is anticipated to be driven by the increased demand for storage cabinets in school administrative offices, classrooms, laboratories, libraries, and activity halls.

Market Competition to Intensify during the Forecast Period

The school furniture market is fragmented and highly competitive. To remain competitive, businesses are introducing new seating, lab, and storage products to the market. Fleetwood, Ballen Panels Ltd, Scholar Craft, CBT Supply Dba Smartdesks, and VS America Inc. are the key participants in the examined market. The market is comprised of a large number of well-established firms as well as several small and medium-sized competitors. To increase their market share in the country, businesses are placing a greater emphasis on product innovation and technological integration.

Market participants are also engaging in mergers and acquisitions to reduce competition and expand their customer base. For example:

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of School Furniture market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Application

|

|

Distribution Channel

|

|

Material

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report