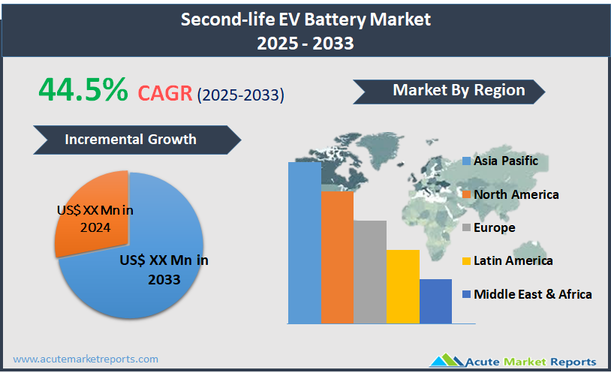

The Second-Life EV battery market refers to the industry centered around the repurposing of electric vehicle (EV) batteries that have reached the end of their automotive life cycle but still possess sufficient capacity for less demanding applications. Typically, these batteries are deemed unsuitable for vehicle use when their capacity falls below 80% of their original state. The second-life applications of these batteries include energy storage systems for residential, commercial, or industrial use, backup power, and integration into renewable energy systems, among others. This market leverages the residual value of EV batteries to extend their usable life, thus contributing to environmental sustainability by delaying the recycling process and reducing waste. The Second-Life EV battery market is experiencing explosive growth, with a projected compound annual growth rate (CAGR) of 44.5% from 2025 to 2033. This remarkable growth is driven primarily by the rapid expansion of the electric vehicle market, which is continuously increasing the volume of batteries reaching the end of their primary use phase. As the stock of aged EV batteries grows, so does the potential for their application in secondary markets. This trend is supported by advancements in battery management systems that enhance the efficiency and safety of reused batteries in various applications.

Expansion of the Electric Vehicle Market

The rapid expansion of the electric vehicle (EV) market serves as a primary driver for the Second-Life EV battery market. As the adoption of EVs accelerates globally, the volume of batteries that reach the end of their automotive lifecycle also increases significantly. Many of these batteries, though no longer suitable for vehicle use, retain substantial residual capacity that can be repurposed for less demanding applications such as stationary energy storage. This growing supply of used EV batteries is creating vast opportunities for their reuse in various sectors, including renewable energy integration and grid stabilization. This trend is supported by increasing consumer and governmental interest in sustainable practices, which drives demand for recycling and repurposing technologies to reduce waste and environmental impact.

Increasing Demand for Energy Storage Solutions

There is a growing demand for energy storage solutions globally, driven by the increasing penetration of renewable energy sources like solar and wind, which require storage to mitigate their intermittency. Second-life EV batteries provide a cost-effective and environmentally friendly solution for storing renewable energy, thus facilitating a more stable and reliable energy supply. This application not only extends the useful life of EV batteries but also supports the energy sector’s transition towards sustainability. The scalability of second-life battery projects, combined with declining costs of renewable technologies, presents a significant opportunity for market expansion and the development of new business models centered around battery reuse.

Technical and Economic Challenges

One significant restraint in the Second-Life EV battery market is the technical and economic challenges associated with battery aging and degradation. As batteries age, their capacity to hold charge decreases, and their performance becomes less predictable, which can complicate their integration into secondary applications. Additionally, the initial cost of refurbishing batteries, coupled with the need for sophisticated management systems to ensure safety and efficiency, can be economically prohibitive. These factors can deter potential market entrants and limit the economic viability of second-life battery projects, especially in regions where regulatory and technical support infrastructure is lacking.

Regulatory and Safety Standards

Navigating the complex landscape of regulatory and safety standards poses a significant challenge in the Second-Life EV battery market. There is a lack of comprehensive international standards regarding the testing, certification, and operation of repurposed batteries, which creates uncertainty and risk for businesses and consumers. Additionally, ensuring consistent safety and performance standards across repurposed batteries is critical, as failures can pose serious safety risks and undermine public confidence in second-life battery products. Developing and harmonizing these standards is essential to facilitate the safe and effective integration of used EV batteries into new applications and to foster market growth.

Market Segmentation by End-use

The Second-Life EV battery market is segmented into Commercial, Residential, and Industrial end-uses. The Commercial sector currently generates the highest revenue, leveraging these batteries predominantly in large-scale energy storage and EV charging stations where the demand for continuous power is critical. Commercial facilities benefit from the cost efficiency and sustainability aspects of utilizing second-life batteries, making this segment dominant in terms of revenue generation. However, the Industrial segment is expected to exhibit the highest CAGR from 2025 to 2033. This growth is driven by the increasing use of second-life batteries in manufacturing facilities, data centers, and large-scale renewable energy projects, which require substantial energy storage solutions to ensure operational continuity and energy management. As industries continue to focus on reducing carbon footprints and energy costs, the adoption of second-life batteries is anticipated to accelerate significantly.

Market Segmentation by Application

Within the application-based segmentation of the Second-Life EV battery market, categories include EV Charging, Grid Connected, Renewable Energy Storage, Power Backup, and Others. Grid Connected applications currently account for the highest revenue, as utilities and energy providers use these batteries for peak shaving, load leveling, and frequency regulation within the grid. This application leverages the inherent storage capabilities of second-life batteries to enhance grid stability and efficiency. On the other hand, Renewable Energy Storage is poised to witness the highest CAGR over the forecast period. The growing integration of renewable energy sources like solar and wind into the energy mix is escalating the demand for effective storage solutions to address intermittency issues. Second-life EV batteries are increasingly recognized as a viable solution for storing excess energy generated during peak production times, which can be used when production drops, thereby ensuring a steady energy supply and supporting the broader adoption of renewable energy technologies.

Geographic Segment

The Second-Life EV battery market is globally dispersed, with distinct regional trends influencing its dynamics. In 2024, the Asia-Pacific region accounted for the highest revenue percentage, bolstered by robust EV adoption rates in countries like China, Japan, and South Korea. This region benefits from advanced battery manufacturing capabilities and significant investments in renewable energy, which create a conducive environment for the deployment of second-life battery solutions. However, Europe is expected to exhibit the highest CAGR from 2025 to 2033. The growth in this region is driven by strong regulatory frameworks supporting sustainability, the circular economy, and aggressive carbon reduction targets. European countries are actively promoting the adoption of renewable energy sources and energy efficiency measures, which in turn fuels the demand for second-life battery applications such as energy storage systems and grid stabilization projects.

Competitive Trends

In 2024, key players in the Second-Life EV battery market included Enel X S.r.l., Nissan Motors Corporation, Fortum, Renault Group, Mercedes-Benz Group, Hyundai Motor Company, RWE, Mitsubishi Motors Corporation, BELECTRIC, and BeePlanet Factory. These companies dominated the market by leveraging their technological expertise and strategic partnerships to enhance the viability and efficiency of second-life battery applications. Nissan and Renault were particularly notable for their initiatives in repurposing batteries from their own EV fleets, focusing on applications ranging from portable power packs to large-scale energy storage systems. Companies like Enel X and RWE capitalized on integrating these batteries into renewable energy projects and grid services, enhancing energy sustainability and reducing system costs. From 2025 to 2033, these companies are expected to intensify their focus on expanding geographic reach and diversifying application areas. Strategic collaborations with technology providers, energy firms, and regional governments are anticipated to be key strategies. This approach will likely include the development of new business models to manage the lifecycle of EV batteries more effectively and sustainably, aiming to solidify their positions in a rapidly evolving market landscape.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Second-life EV Battery market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

End-use

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report