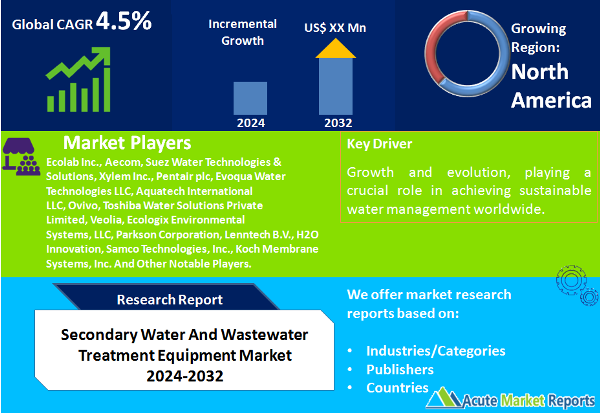

The secondary water and wastewater treatment equipment market is a critical component of the global effort to address water pollution and ensure sustainable water management. The secondary water and wastewater treatment equipment market is expected to grow at a CAGR of 4.5% during the forecast period of 2026 to 2034. The industry's commitment to advancing treatment technologies, addressing sludge management challenges, and exploring diverse treatment approaches is evident in the drivers and trends shaping the market. The challenges in industrial applications highlight the need for a balanced approach to ensure both treatment efficacy and operational feasibility. The segmentation showcases the diverse applications and geographic trends that contribute to the global nature of the market. As the market moves into the forecast period from 2026 to 2034, the secondary water and wastewater treatment equipment industry is poised for continued growth and evolution, playing a crucial role in achieving sustainable water management worldwide.

Advancements in Activated Sludge Systems: Optimizing Biological Treatment Processes

Advancements in Activated Sludge Systems stand out as a prominent driver in the secondary water and wastewater treatment equipment market. The market has witnessed continuous developments in activated sludge technology, contributing to the optimization of biological treatment processes for wastewater. In 2025, the adoption of advanced activated sludge systems gained momentum, showcasing improved nutrient removal efficiency and enhanced overall treatment performance. These technological innovations play a pivotal role in meeting stringent water quality standards and environmental regulations. The highest Compound Annual Growth Rate (CAGR) from 2026 to 2034 is anticipated in this segment, indicating the industry's commitment to advancing biological treatment methodologies. This driver emphasizes the ongoing efforts to refine and elevate the efficiency of secondary wastewater treatment.

Focus on Innovative Sludge Treatment Solutions: Addressing the Challenges of Sludge Management

Market growth is significantly influenced by a focus on innovative sludge treatment solutions. In 2025, the industry observed a surge in the development and adoption of advanced technologies for sludge treatment, aiming to address the challenges associated with managing residual sludge generated during wastewater treatment. These innovations not only streamline sludge handling processes but also contribute to resource recovery and environmental sustainability. The highest CAGR during the forecast period from 2026 to 2034 is projected in Sludge Treatment, reflecting the industry's recognition of the importance of efficient sludge management. This driver underscores the ongoing efforts to find sustainable and effective solutions for handling the by-products of secondary water and wastewater treatment.

Continuous Development in Other Treatment Technologies: Diversification for Comprehensive Water Treatment

Continuous development in other treatment technologies emerges as a driving force in the secondary water and wastewater treatment equipment market. Evidence points to a diversified approach, with ongoing efforts to enhance various treatment methods beyond activated sludge and sludge treatment. In 2025, the market saw investments in technologies such as membrane bioreactors, biological nutrient removal systems, and advanced oxidation processes. These innovations aim to provide comprehensive solutions for water and wastewater treatment, addressing specific contaminants and improving overall treatment efficiency. The highest CAGR during the forecast period from 2026 to 2034 is anticipated in the category of Other Treatment Technologies, signaling the industry's commitment to exploring diverse and advanced approaches to secondary treatment. This driver emphasizes the importance of a well-rounded and adaptable approach to water and wastewater treatment.

Challenges in Industrial Application: Balancing Treatment Efficacy and Operational Complexity

A significant restraint in the secondary water and wastewater treatment equipment market is associated with challenges in industrial applications. Evidence includes complexities in balancing treatment efficacy with the operational challenges introduced by advanced treatment technologies. In 2025, these challenges posed obstacles to optimizing secondary treatment processes, particularly in industrial settings where diverse and complex contaminants are present. This restraint underscores the industry's need to carefully evaluate and tailor solutions for industrial applications to ensure that the benefits of treatment efficacy are not outweighed by increased operational challenges. As the market evolves, stakeholders must navigate this delicate balance to achieve effective and sustainable secondary water and wastewater treatment solutions for industrial use.

By Equipment: Activated Sludge Systems Dominates the Market

In 2025, the secondary water and wastewater treatment equipment market exhibited substantial revenue from Activated Sludge Systems, indicating a strong emphasis on optimizing biological treatment processes. Sludge Treatment also contributed significantly, reflecting the industry's commitment to addressing the challenges of sludge management. Other Treatment Technologies emerged as a major contributor to market revenue, underlining the importance of diversifying treatment approaches for comprehensive water management. The highest CAGR during the forecast period from 2026 to 2034 is expected in Activated Sludge Systems, emphasizing the continuous efforts to enhance the biological treatment of wastewater. This segmentation highlights the diverse range of equipment driving growth in the market and its pivotal role in addressing various aspects of secondary water and wastewater treatment.

By Application: Municipal Applications Dominate the Market

The market showcased notable revenue from Municipal applications in 2025, indicating a continued focus on providing effective secondary water treatment solutions for urban areas. Industrial applications also played a crucial role, particularly in addressing the specific challenges associated with industrial wastewater. The highest CAGR during the forecast period from 2026 to 2034 is anticipated in Industrial applications, underscoring the industry's dedication to tailoring solutions for the unique needs of industrial water treatment. This segmentation reflects the varied applications of secondary water and wastewater treatment equipment across different sectors.

North America Remains the Global Leader

Geographically, the secondary water and wastewater treatment equipment market demonstrated dynamic trends in 2025, with North America leading in both revenue generation and the highest CAGR. This reflects the region's strong emphasis on advanced water treatment solutions and stringent environmental standards. Europe also contributed substantially to revenue, with a slightly lower but steady CAGR indicative of mature market growth. The Asia-Pacific region exhibited notable growth, underlining the increasing recognition of the importance of secondary water treatment in emerging economies. This geographic segmentation underscores the global nature of the secondary water and wastewater treatment equipment market, with different regions playing distinct roles in shaping its trajectory.

Global Presence to Enhance the Market Performance of Key Competitors

In the competitive landscape, top players such as Ecolab Inc., Aecom, Suez Water Technologies & Solutions, Xylem Inc., Pentair plc, Evoqua Water Technologies LLC, Aquatech International LLC, Ovivo, Toshiba Water Solutions Private Limited, Veolia, Ecologix Environmental Systems, LLC, Parkson Corporation, Lenntech B.V., H2O Innovation, Samco Technologies, Inc., and Koch Membrane Systems, Inc. play pivotal roles in steering the secondary water and wastewater treatment equipment market. These industry leaders, with their innovative solutions and global presence, significantly influence market dynamics. In 2025, these companies reported substantial revenues, setting the tone for competitive trends. The overall outlook of the market is characterized by continuous innovation, strategic partnerships, and a focus on providing comprehensive and sustainable water treatment solutions. As the market progresses from 2026 to 2034, the competitive landscape is expected to witness further dynamism, with key players continuing to shape the future of secondary water and wastewater treatment equipment through technological advancements and a commitment to environmental stewardship.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Secondary Water And Wastewater Treatment Equipment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Equipment

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report