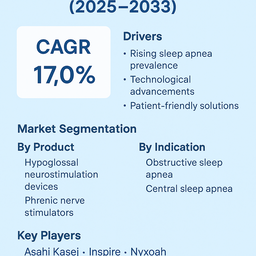

The global sleep apnea implants market is projected to grow at a CAGR of 17.0% from 2026 to 2034, driven by the rising prevalence of sleep apnea, growing awareness about implant-based therapies, and continuous advancements in neurostimulation technologies. Sleep apnea implants offer a long-term treatment alternative for patients who cannot tolerate or adhere to continuous positive airway pressure (CPAP) therapy. By providing targeted stimulation to airway-related nerves, these devices improve breathing function during sleep, reduce apnea events, and enhance overall quality of life. The increasing focus on minimally invasive, patient-friendly, and durable solutions is further fueling the market’s adoption globally.

Rising Demand for Implant-Based Sleep Apnea Therapies

With millions of patients worldwide suffering from obstructive and central sleep apnea, demand for alternative treatment methods beyond CPAP is rapidly increasing. Hypoglossal neurostimulation implants are gaining traction as they directly activate tongue muscles to keep the airway open, thereby reducing the frequency of obstructive sleep apnea events. Phrenic nerve stimulators are increasingly used for central sleep apnea by targeting respiratory control signals, providing relief where other therapies fall short. Growing clinical evidence, rising patient preference for effective and discreet solutions, and expanding regulatory approvals are key factors accelerating market adoption.

Challenges: High Costs and Limited Awareness

Despite strong growth prospects, the market faces challenges such as high device and surgical procedure costs, which limit adoption in cost-sensitive regions. Reimbursement coverage remains inconsistent across healthcare systems, restricting access to advanced neurostimulation therapies. Awareness levels among both patients and healthcare providers remain limited compared to traditional CPAP devices. Additionally, the invasive nature of implant procedures and concerns about potential side effects create adoption hesitancy in some patient groups. However, expanding clinical success rates, growing healthcare education programs, and broader insurance support are expected to reduce these barriers over time.

Market Segmentation by Product

By product type, the market is segmented into hypoglossal neurostimulation devices and phrenic nerve stimulators. Hypoglossal neurostimulation devices dominate the market due to their strong effectiveness in treating obstructive sleep apnea, particularly in patients who fail CPAP therapy. Phrenic nerve stimulators, while a smaller segment, are expanding quickly due to rising diagnosis of central sleep apnea and growing acceptance of nerve-targeted implantable therapies.

Market Segmentation by Indication

By indication, the market is divided into obstructive sleep apnea and central sleep apnea. Obstructive sleep apnea represents the larger share of the market, as it accounts for the majority of diagnosed cases worldwide. Central sleep apnea, though less prevalent, is a growing area of focus due to its association with cardiovascular conditions and the limited effectiveness of traditional CPAP treatment in these patients. The demand for implantable therapies in both categories is expected to rise as clinical adoption expands and awareness increases.

Regional Insights

In 2025, North America led the sleep apnea implants market, supported by high diagnosis rates, favorable reimbursement frameworks, and early adoption of neurostimulation technologies. Europe followed closely, with strong adoption in countries like Germany, the UK, and France driven by advancements in sleep medicine and supportive healthcare policies. Asia Pacific is the fastest-growing region, fueled by the rising prevalence of sleep disorders in China, India, and Japan, as well as increasing investments in digital health and minimally invasive therapies. Latin America and the Middle East & Africa are emerging markets where adoption remains at an early stage but is expected to accelerate as awareness, healthcare spending, and access to advanced implantable devices improve.

Competitive Landscape

The 2025 competitive landscape was defined by specialized medtech companies pioneering implantable therapies for sleep apnea. Inspire remains a market leader with its well-established hypoglossal neurostimulation system, supported by strong clinical outcomes and growing global adoption. Nyxoah is emerging as a key competitor, focusing on innovative implantable solutions designed to improve patient comfort and adherence. Asahi Kasei is also active in this space, leveraging its healthcare expertise to expand presence in respiratory and implantable device segments. Competition is centered around product innovation, long-term clinical validation, affordability, and expanding distribution networks. Partnerships with healthcare providers and ongoing regulatory approvals are expected to shape the next phase of competitive growth in this market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Sleep Apnea Implants market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Indication

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report