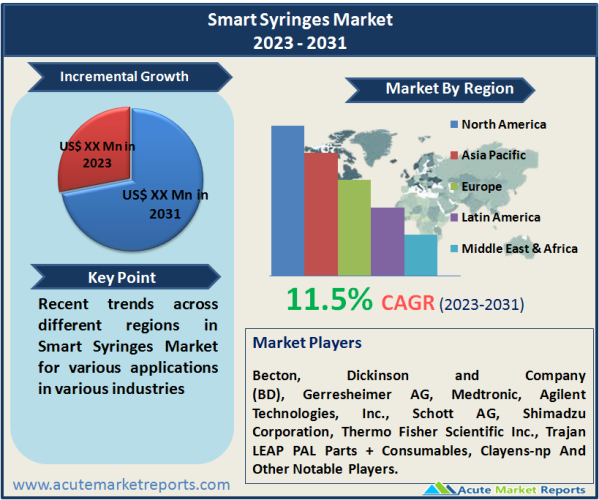

The smart syringes market is a critical component of the healthcare industry, poised for strong growth with an expected CAGR of 11.5% during the forecast period of 2026 to 2034. The market is driven by concerns over needlestick injuries, vaccination programs, and advancements in drug delivery technologies. Cost remains a restraint, necessitating collaborative efforts to enhance affordability. Competitive trends suggest that key players will focus on safety, innovation, and global expansion to meet the evolving demands of healthcare providers and pharmaceutical companies.

Rising Concerns Over Needlestick Injuries

In 2025, the smart syringes market was driven by the escalating concerns over needlestick injuries among healthcare workers. These injuries posed significant health risks and prompted the adoption of safer injection practices. Auto-disable syrin Growing Emphasis on Vaccination Programs ges and active safety syringes emerged as key solutions, designed to prevent needle reuse and reduce the risk of needlestick injuries. This trend is expected to continue, with the highest Compound Annual Growth Rate (CAGR) anticipated in the active safety syringes segment during the forecast period from 2026 to 2034. Regulatory initiatives and healthcare organizations' commitment to worker safety are expected to drive the market's expansion in this segment.

Growing Emphasis on Vaccination Programs

The year 2026 witnessed a growing emphasis on vaccination programs worldwide, driven by the need to combat infectious diseases and pandemics. Smart syringes, particularly passive safety syringes, gained prominence in vaccine administration due to their precise dosage delivery and built-in safety mechanisms. Passive safety syringes are designed to automatically retract the needle after use, reducing the risk of needlestick injuries and ensuring proper vaccination procedures. This trend is expected to continue, with the highest revenue growth and CAGR anticipated in the passive safety syringes segment during the forecast period from 2026 to 2034. The global commitment to vaccination campaigns and immunization is likely to bolster the market's growth.

Advancements in Drug Delivery

In 2025, the smart syringes market experienced advancements in drug delivery technologies, contributing to its growth. Auto-disable syringes and active safety syringes played a vital role in ensuring accurate drug dosage and minimizing medication errors. The adoption of these syringes by healthcare providers and pharmaceutical companies is expected to continue, with the highest CAGR projected in the auto-disable syringes segment during the forecast period from 2026 to 2034. These syringes are essential in ensuring patient safety and the efficacy of drug delivery, further propelling their market growth.

Restraint in the Smart Syringes Market

One significant restraint in the smart syringes market is the cost associated with these advanced syringes. While the benefits of needlestick injury prevention and precise drug delivery are evident, the initial investment in smart syringes can be higher compared to traditional syringes. Healthcare facilities, especially in resource-constrained settings, may face challenges in adopting these costlier alternatives. Overcoming this restraint requires collaborative efforts between healthcare organizations, governments, and manufacturers to make smart syringes more affordable and accessible, thereby addressing the issue of cost-effectiveness.

Market Segmentation by Product: Passive Safety Syringes Dominate the Market

In 2025, the Smart Syringes Market exhibited the highest revenue in the Passive Safety Syringes product segment. This segment's dominance can be attributed to its widespread adoption in healthcare settings due to the built-in safety mechanisms that reduce the risk of needlestick injuries and enhance patient and healthcare worker safety. Passive safety syringes, with their automatic needle retraction feature, have gained prominence in drug delivery, vaccination, and blood specimen collection applications. During the forecast period from 2026 to 2034, the passive safety syringes segment is expected to maintain its leadership position, exhibiting the highest Compound Annual Growth Rate (CAGR). This growth is driven by the global commitment to safer injection practices and the prevention of needlestick injuries.

Market Segmentation by Application: Drug Delivery Dominates the Market

In 2025, the Smart Syringes Market generated the highest revenue in the Drug Delivery application segment. This segment's prominence is attributed to the increasing adoption of smart syringes, particularly active safety and passive safety syringes, in ensuring precise drug dosage delivery and minimizing medication errors. Healthcare providers and pharmaceutical companies have recognized the importance of smart syringes in enhancing patient safety and the efficacy of drug delivery. During the forecast period from 2026 to 2034, the Drug Delivery application segment is expected to maintain its dominance, exhibiting the highest CAGR. The global emphasis on accurate drug administration and the prevention of needlestick injuries are expected to drive market growth in this segment.

North America Remains as the Global Leader

From 2026 to 2034, the smart syringes market is expected to experience the highest CAGR in the Asia-Pacific region. This growth is fuelled by increasing healthcare infrastructure development, rising awareness about needlestick injuries, and expanding vaccination programs in countries like India and China. North America is projected to maintain its position as the region with the highest revenue percentage as it was in 2025, driven by robust healthcare systems and regulatory initiatives promoting the adoption of smart syringes. Europe is expected to show steady growth, particularly in drug delivery applications, contributing to the global market's diversification.

Market Competition to Intensify during the Forecast Period

In 2025, the smart syringes market witnessed intense competition among key players. Companies such as Becton, Dickinson and Company (BD), Gerresheimer AG, Medtronic, Agilent Technologies, Inc., Schott AG, Shimadzu Corporation, Thermo Fisher Scientific Inc., Trajan LEAP PAL Parts + Consumables, and Clayens-np. dominated the market. These industry leaders focused on strategies like product innovation, expanding their product portfolios, and global market expansion through partnerships and acquisitions. As we move into the forecast period from 2026 to 2034, it is expected that these players will continue to prioritize safety features and precision in smart syringes. Additionally, they will explore collaborations with healthcare organizations and governments to expand their customer base and solidify their positions in this dynamic and evolving industry.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Smart Syringes market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Volume

|

|

Product

|

|

Application

|

|

Age Group

|

|

End User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report