"Advancements in Screen Technologies Aiding the Smartphone Display Market Growth"

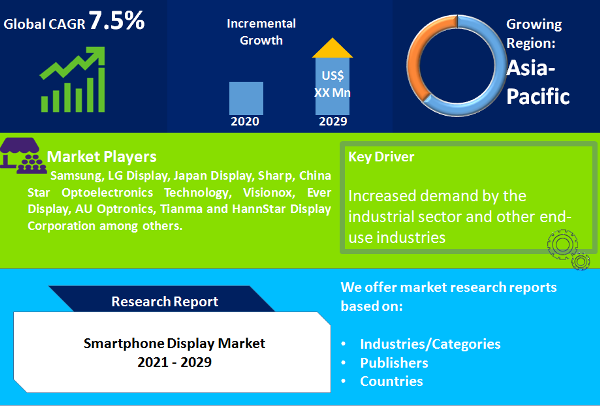

The smartphone display market was valued at US$ 50.29 Bn in 2021 and expected to grow at a CAGR of 7.5% during the forecast period from 2021 to 2030. It is no secret that the design of the smartphone has come a long way ever since the first cell phone was launched decades ago. Thus with the launch of the Samsung SPH-1300 in 2001, the journey of the smartphone began. The screen of a smartphone is of paramount importance when it comes to making a purchase decision for a smartphone. Since the era of the earlier black & white screen mobile phones, the display screen has evolved and today technology has reached the milestone of making flexible screens. One of the most prominent factors complimenting the smartphone display market growth can be attributed to the increasing sales of smartphones worldwide. For instance, the worldwide smartphone sales in 2021 witnessed a growth of 2.7% over 2019. In 2021, smartphone sales totaled 1,536.5 million units as against 1,496.0 million units in 2019. Technological advancements in screen technology is another major factor contributing to the growth of the market. Today smartphones with 4K screen resolution are available in the market and are usually found on flagship models. Moreover, the fact that full screen smartphones have gained immense popularity in recent years further contributes to the smartphone display market growth.

"An Increasing Number of Smartphones to Adopt AMOLED Screens in the Coming Years"

In 2021, the LCD segment led the overall smartphone display market worldwide, in terms of value. The cost to manufacture and procure a LCD screen is comparatively cheaper to that of AMOLED. This factor makes LCD displays to be commonly found on most of the budget smartphones. However, with constant advancements taking place in the LED display technology, the market share of the same expected to increase in the coming years. The fact that AMOLED screens performs better in terms of battery consumption expected to play a crucial role in its increasing adoption in future smartphones. However, in the coming years, Micro-LED displays segment expected to witness a significant growth. Currently, this display technology is yet not commercialized or in mass production. Considering the advantages of micro-LED displays such as it being lighter, thinner, brighter, low power display, etc., the segment expected to give a tough competition to the LCD and LED technology during the forecast period.

"R&D Activities to Remain on the Center Stage for the Players Operating in the Smartphone Display Market"

Research and development activities is one of the most common strategies adopted by the players operating in the smartphone display market. These activities are directed towards improving the existing products as well as developing new ones. For instance, recently Samsung announced a bendable and unbreakable screen for smartphones. The new display uses plastic instead of glass and therefore is not prone to shattering or cracking. Moreover, the display survived the break test when dropped from a height of 4-6 feet. Another recent development witnessed in the area of smartphone display is the breakthrough achieved by the phone makers in embedding the fingerprint scanner inside the screen. Vivo and Xiaomi were among the first smart phones to be launched with this new technology. Similarly, Taiwanese electronics company, AUO, developed a developed a 5-inch AMOLED display which is capable of bending 1.5 million times without breaking.

"Asia Pacific to Remain the Hub for Smartphone Display Manufacturing"

Asia Pacific was the largest regional market for smartphone displays worldwide in 2021. The region expected to maintain its dominance throughout the forecast period. A large number of smartphone display manufacturers headquartered in the region is one of the most prominent factors aiding the market growth. Some of the leading smartphone display manufacturers headquartered in Asia Pacific includes Samsung, LG Display, Japan Display, Sharp and BOE among others. Moreover, in order to address the increasing demand from smartphone makers, the manufacturers of smartphone display have been building new plants. For instance, Chinese manufacturers such as China Star Optoelectronics Technology and BOE have built plants for OLED panels in order to catch up with South Korea's Samsung Electronics. Moreover, the facts that the Chinese government has been instrumental in providing funds and plants manufacturing LCD and OLED panels are both eligible for billions of dollars of subsidies are the other major factors complimenting the smartphone display market growth in Asia Pacific.

Key players profiled in the report include Samsung, LG Display, Japan Display, Sharp, China Star Optoelectronics Technology, Visionox, Ever Display, AU Optronics, Tianma and HannStar Display Corporation among others.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Smartphone Display market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Technology

|

|

Screen Size

|

|

Resolution

|

|

Distribution Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report