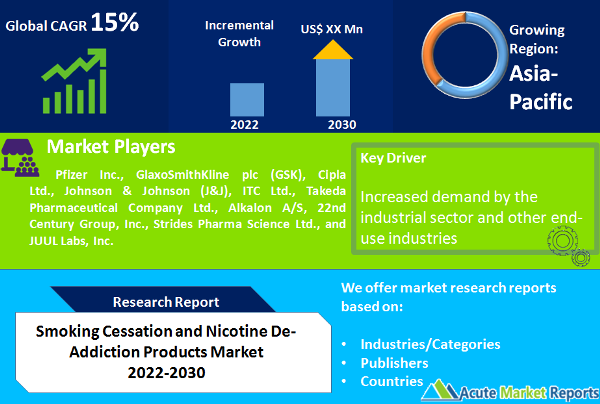

The global market for smoking cessation and nicotine de-addiction products is expected to grow at a CAGR of 15% during the forecast period of 2026 to 2034. Stopping the use of tobacco is a component of kicking the habit of smoking or kicking a nicotine addiction. It is well known that tobacco contains nicotine, which is the addictive component responsible for the release of neurotransmitters including dopamine, gamma-aminobutyric acid (GABA), and glutamate. When it comes to the treatment of cigarette and tobacco addiction, smoking cessation products are really helpful. One of the primary causes that are contributing to the expansion of the smoking cessation and nicotine de-addiction industry is the growing number of people all over the world who are attempting to give up smoking. Because of the harmful effects that nicotine and cigarette addiction have on the cardiovascular and respiratory systems, the government is placing a greater emphasis on the enforcement of stringent rules. Additionally, high tariffs on tobacco products contribute to the expansion of the market. The increase in the number of government measures related to smoking cessation, such as the prohibition of smoking in public places, and the expansion in awareness of the adverse consequences of smoking among the population both have further influences on the market. In addition, a high rate of adoption of unhealthy lifestyle options, rising urbanization, and an increase in disposable income all have a beneficial impact on the market for smoking cessation and nicotine de-addiction products. In addition, government measures raise awareness to create lucrative prospects for market participants during the forecast period. On the other side, hesitation in accepting the treatment is anticipated to be an impediment to the expansion of the market. It is anticipated that a lack of awareness would be a hurdle for the market for smoking cessation and nicotine de-addiction products.

Increase in the Number of People Giving Up Smoking to Benefit the International Market

The World Health Organization (WHO) estimates that tobacco use is responsible for the deaths of more than 8 million people annually. More than 7 million of these deaths are directly attributable to the use of tobacco products, whereas around 1.2 million are attributable to the exposure of non-smokers to second-hand smoke. 8% of the world's 1.3 billion people who use tobacco live in low- or middle-income nations, which have the highest rates of disease and death caused by tobacco use. In the year 2022, 65.3% of young people (students in middle and high school) who used smoking cessation medicine or products were seriously considering giving up the use of all tobacco products. Products that help people quit smoking are an effective form of treatment for people who are addicted to tobacco and cigarettes. Nicotine replacement therapy (NRT), also known as "smoking cessation medications," electronic cigarettes, and therapeutic medication such as antidepressants and nicotine receptor agonists are all examples of smoking cessation tools and medications. These tools and medications help people stop smoking and avoid developing diseases that are caused by smoking. As a result, the rise in the number of people who give up smoking as a direct result of using products designed specifically for this purpose is a primary reason that is driving the global smoking cessation and nicotine de-addiction market.

Stringent Government Regulations and Other Awareness Creation Initiatives to Drive the Market

Warning labels on cigarette packages must now include the phrase "Smoking is harmful to your health," and some nations have even resorted to using graphic images of people who have been harmed by smoking in order to get the message through. On the other hand, this has not exactly been a game-changer in terms of getting people to give up smoking. However, there have been considerable initiatives to quit smoking among the community of smokers because nongovernmental groups and international healthcare organizations have raised awareness about the dangers of smoking. Additionally, the introduction of smoking cessation therapies by various companies has resulted in the growth of a wide variety of alternative therapies in the global smoking cessation and nicotine de-addiction products market. In point of fact, addiction to nicotine is a significant component that contributes to increased sales of cigarettes. As a result, there is a growing demand in the market for nicotine detoxification products such as gums and patches that contain nicotine.

Increasing Therapeutic Alternatives to Expand the Market, E-Cigarettes Especially is a Game Changer

Nicotine replacement therapies (also known as NRTs) were the first products for smoking cessation treatment to be licensed by the Food and Drug Administration (FDA) in the United States. Both Buproprion (brand name Zyban) and Varenicline (brand name Chantix) are non-nicotine treatments for smoking cessation that have been approved by the FDA in the United States. E-cigarettes are another new product that is helping people kick their nicotine addiction. Depending on the user's preference, e-cigarettes can either contain nicotine or be nicotine-free. It is anticipated that the growing demand for electronic cigarettes and nicotine de-addiction products will drive growth in the market for smoking cessation and nicotine de-addiction products. Around 700,000 people were using electronic cigarettes in 2012, but that number is expected to rise to 3.6 million in 2019, then drop to 3.2 million in 2021 and then climb back up to 3.6 million in 2022. Electronic cigarettes are gaining more users because, in comparison to traditional cigarettes, they pose fewer health risks. Electronic cigarettes are another tool that can be used to assist smokers in their quest to kick the habit. As a result, the smoking cessation and nicotine de-addiction business is being driven by the surge in popularity of electronic cigarettes among young users as opposed to traditional cigarettes. The Food and Drug Administration in the U.S. oversees the electronic nicotine delivery systems (ENDS), which include e-cigarettes. E-cigarettes are useful in lowering the risk of developing health disorders that are linked to tobacco use, but nicotine replacement therapies (NRTs) are the most successful in helping people quit smoking. Electronic cigarettes pose a possible danger to traditional tobacco-based cigarettes while also presenting a chance for tobacco manufacturers to break into a new market sector that serves the needs of smokers. Companies such as BAT, Lorillard, Japan Tobacco International, and Philip Morris International (PMI) partnered with or purchased smaller companies that produced electronic cigarettes in order to expand their product lines. This enables large corporations operating in the cigarette sector to compensate for the continuous decline in cigarette sales that they have been experiencing. The market for smoking cessation and nicotine de-addiction products as a whole would receive a significant boost as a result of this development. In addition, the idea that electronic cigarettes are safer than traditional cigarettes, the fact that they come in a variety of nicotine strengths, and the accessibility of these products all contribute significantly to the growth of the market for electronic cigarettes.

Increased Product Recalls Lowering the Confidence of the Users

Product recalls by manufacturers and companies as a result of an increasing number of technical faults and health hazards associated with devices are among the most significant challenges facing the market for smoking cessation and nicotine de-addiction products. Other challenges include the following: For example, in June of 2019, Sainsbury's Argos, a chain of supermarkets in the United Kingdom, initiated a product recall of eight electronic cigarettes because the external batteries that were supplied with the product were not compatible with the electronic cigarettes and, if used, could overheat, potentially resulting in a fire or burn injury. The reason for the recall was that the external batteries supplied with the product were not compatible with the electronic cigarettes. Rising incidences of potentially dangerous health conditions such as epileptic convulsions and aberrant patterns of brain activity are other important concerns that may impede the expansion of the market for smoking cessation and nicotine de-addiction solutions.

NRT Remains as The Largest Revenue Segment, While, E-Cigarettes Market to Command Growth During the Forecast Period

In 2022, the NRT segment commanded the revenue share because of its user-friendliness, increased accessibility, and ability to successfully curb smokers' cravings for nicotine. This is attributable to the wide availability of a variety of nicotine replacement therapy-related products that are also relatively inexpensive all over the world. In addition, the increased effectiveness of such items in comparison to other types leads to substantial profits coming from this market area. Varenicline, Zyban, and Nicorette Buccal are examples of some of the medications that may be used in combination with one another as part of a pharmacological therapy program in order to help smokers overcome the withdrawal symptoms they encounter when they try to quit using tobacco products. Chantix is the brand name used in the United States for the medication varenicline, which is a non-nicotine-based treatment that has been shown to be helpful in helping people quit smoking. Champix is the brand name used in other areas of the world. Zyban is another medication that sees widespread use and is frequently used with NRT in order to achieve optimal outcomes. E-cigarettes are seen as a healthier alternative to traditional cigarettes, and it is anticipated that the market will grow at the highest CAGR during the forecast period of 2026 to 2034. It is generally agreed that the growing popularity of electronic cigarettes, which is supported by the product's electronic function, is the primary element regarded to be contributing to the product's growing demand.

Direct Sales of Smoking De-Addiction Products Led the Market Currently, While Online Segment to Open Significant Opportunities

In 2022, direct sales through stores accounted for the lion's share of the market's total value. The fact that hypermarkets and supermarkets have such a comprehensive range of smoking cessation goods enables them to attract the lion's share of the market for retail establishments that specialize in food retailing. In addition, customers prefer to buy their groceries from these stores since they can receive discounts on the sales of certain products at these stores if they make such purchases there. This leads to a significant increase in the use of products connected to nicotine de-addiction that are sold at these establishments. Users also have the ability to select according to their individual preferences. However, it is anticipated that the internet sector would expand at a significant compound annual growth rate during the forecast period.

North America Led the Market, UK Follows

In 2022, North America led the market for smoking cessation and nicotine de-addiction markets. This high market share might be attributable to the developed healthcare infrastructure as well as the growing incomes available for discretionary spending. As a result of the region's strong demand for e-cigarette products, North America is anticipated to maintain a preeminent position in the global market for smoking cessation and nicotine de-addiction products for the duration of the forecast period. The market for smoking cessation and nicotine de-addiction is the largest in the world in the United States, and the country's contribution, both in terms of value and volume, is significant. The significantly high usage of e-cigarettes among adolescents in the United States can be attributed to a large portion of the country, particularly in the United States. The percentage of high school pupils in the United States who used electronic cigarettes went from 1.5% in 2011 to 19.6% in 2021. It is anticipated that the North American region will expand at a significant rate due to the shifting preferences of consumers towards the utilization of plant-based, nicotine de-addiction-related products in countries such as the United States and Mexico. This is expected to drive the growth of the region. This is anticipated to boost demand in the region for the many types of nicotine de-addiction-related products that are made up of extracts of plants such as camellia Sinensis, cloves, lobelia, and others.

In addition to this, Europe is a significant market for products that help people quit smoking and overcome their addiction to nicotine. After the United States, the United Kingdom is the world's second-largest market for smoking cessation and nicotine de-addiction products and services. It is the largest market in Europe for nicotine de-addiction treatment as well as smoking cessation products. The over-the-counter (OTC) smoking cessation products that contain nicotine are the nicotine replacement therapy (NRT) products that are most popular in the United Kingdom. The market in Europe is being driven by an increase in people's knowledge of the benefits of quitting smoking as well as an increase in the number of programs that teach people how to quit smoking.

The Asia Pacific to Offer Significant Opportunities During the Forecast Period

During the forecast period of 2026 to 2034, it is anticipated that the Asia Pacific region will have profitable growth with a CAGR of approximately 14%. The presence of a huge base of the target population, a high rate of economic growth, opportunities stemming from geographical business expansions, and a significant amount of unexplored market potential are the primary reasons that are contributing to the expansion of the market in this region. Tobacco goods are subject to a variety of taxes, including value-added taxes (VAT), excise taxes, and ordinary sales taxes, which are levied by governments. This results in higher pricing for tobacco and the products that are directly associated with it, which in turn serves to lower the amount of tobacco that is consumed. For example, the World Health Organization (WHO) started a program in October 2015 called "national smoke-free law" in the Asia Pacific region. This program's goal was to reduce the number of people who actively smoke cigarettes and, as a result, reduce their exposure to the risks that are associated with smoking. The presence of a large number of tobacco users in countries such as China and India, which in turn results in the large usage of tobacco de-addiction-related products among these users, accounts for the largest share of the Asia Pacific region. This share is attributed to the fact that these countries are home to a large number of tobacco consumers. Tobacco-Free Kids Organization estimates that as of October 2021, 26.6% of the population of China engages in daily cigarette smoking. These findings are based on research that was given by the organization. In addition, an increasing number of people in the population are becoming aware of the risks associated with using tobacco-related goods, which is another factor contributing to the market expansion in the region.

Strategic Partnership and Acquisitions to Enhance Market Position of the Key Market Players

In an effort to improve their standing in the market, the businesses operating in this sector are increasingly engaging in activities such as mergers, acquisitions, and collaborations. Takeda Pharmaceutical Company Ltd., for example, has the exclusive distribution right for the over-the-counter drug Nicorette manufactured by Johnson & Johnson and sold in Japan. The purpose of the arrangement was to grow Revolymer plc's product portfolio in the United States. The leading companies in the global market for smoking cessation and nicotine de-addiction include Pfizer Inc., GlaxoSmithKline plc (GSK), Cipla Ltd., Johnson & Johnson (J&J), ITC Ltd., Takeda Pharmaceutical Company Ltd., Alkalon A/S, 22nd Century Group, Inc., Strides Pharma Science Ltd., and JUUL Labs, Inc.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Smoking Cessation and Nicotine De-Addiction Products market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Distribution Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report