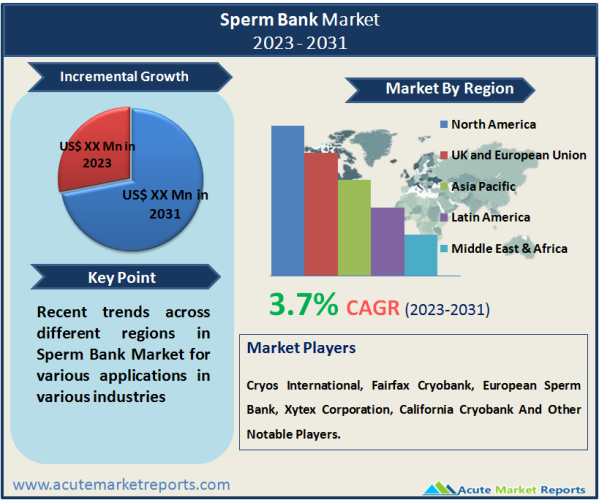

The sperm bank market is expected to witness a CAGR of 3.7% during the forecast period of 2026 to 2034, driven by factors such as increasing infertility rates, advancements in reproductive technologies, and growing awareness and acceptance of assisted reproductive procedures. In terms of an overview, a sperm bank is a facility that collects, processes, stores, and distributes donated sperm for use in assisted reproductive procedures, such as in vitro fertilization (IVF) and intrauterine insemination (IUI). Sperm banks play a crucial role in helping individuals and couples overcome fertility challenges, including male infertility, same-sex couples, and single women looking to conceive. The market revenue of the sperm bank industry has been steadily rising and is projected to continue its upward trajectory in the coming years. While specific revenue figures may vary, the global sperm bank market is estimated to be worth billions of dollars. This growth can be attributed to factors such as changing lifestyles, delayed parenthood, increasing awareness about fertility treatments, and the expanding reach of fertility clinics. Sperm banks operate under strict regulatory guidelines to ensure the safety, quality, and traceability of donated sperm. Donors typically undergo a comprehensive screening process, which includes medical history evaluations, genetic testing, and infectious disease screenings to minimize the risk of transmission of hereditary diseases or infections. This ensures that only healthy and viable sperm is made available for fertility treatments.

Increasing Infertility Rates

The rising prevalence of infertility is a significant driver for the growth of the sperm bank market. Various factors contribute to infertility, including lifestyle changes, environmental factors, and age-related fertility decline. According to a study published in the journal Human Reproduction Update, the global infertility rate has been steadily increasing, affecting approximately 15% of couples worldwide. The need for assisted reproductive technologies, such as sperm banks, becomes crucial in helping individuals and couples overcome fertility challenges and achieve their reproductive goals.

Advancements in Reproductive Technologies

Technological advancements in the field of reproductive medicine have played a vital role in driving the growth of the sperm bank market. Assisted reproductive technologies, such as in vitro fertilization (IVF) and intrauterine insemination (IUI), rely on the availability of quality donor sperm. Advances in cryopreservation techniques have improved the success rates of sperm storage and thawing, ensuring the viability of stored sperm for extended periods. Additionally, techniques like intracytoplasmic sperm injection (ICSI) have expanded the scope of assisted reproduction, further driving the demand for donor sperm. These advancements have increased the accessibility and effectiveness of fertility treatments, contributing to the growth of the sperm bank market.

Growing Awareness and Acceptance of Assisted Reproductive Procedures

Changing societal attitudes and increased awareness about fertility treatments have significantly contributed to the growth of the sperm bank market. As conversations around reproductive health become more open, individuals and couples are more willing to seek assistance in building their families through assisted reproductive procedures. The growing acceptance of alternative family-building options, including single parenthood and same-sex parenting, has also fueled the demand for donor sperm. A study published in the Journal of Assisted Reproduction and Genetics found that the overall acceptance of assisted reproductive technologies has increased over the years, reflecting a positive attitude toward fertility treatments.

Regulatory Challenges and Ethical Considerations

The sperm bank market faces several restraints, primarily related to regulatory challenges and ethical considerations surrounding the industry. One of the key restraints is the need for stringent regulations and ethical guidelines to ensure the safety and well-being of donors, recipients, and resulting children. The regulatory landscape varies across countries, making it challenging for sperm banks to navigate different legal frameworks and maintain consistent standards. For example, some countries have strict regulations regarding anonymity and disclosure of donor information, while others allow varying degrees of donor identification. These variations can create complexities in international sperm donation and limit the pool of available donors. Ethical considerations surrounding issues such as informed consent, donor compensation, and the potential risks associated with long-term anonymity or disclosure of donor information further contribute to the restraint. An example is the debate over whether children conceived through donor sperm should have access to their donor's identity. These regulatory and ethical challenges pose hurdles for the sperm bank market, necessitating the establishment of clear guidelines and standards to ensure transparency, protect the rights of all parties involved, and address the evolving ethical landscape of assisted reproductive technologies.

Anonymous Donors Segment Dominates the Market by Donor Type

The donor type segment in the sperm bank market consists of three categories: ID Disclosure Donors, Anonymous Donors, and Known Donors. Among these, the ID Disclosure Donors segment is expected to exhibit the highest CAGR during the forecast period of 2026 to 2034. ID Disclosure Donors refer to sperm donors who agree to disclose their identity to the offspring conceived using their donated sperm once they reach a certain age, typically 18 or 21 years old. This donor type has gained popularity due to the growing demand for transparency and the desire for offspring to have the option to access their donor's information. The ID Disclosure Donors segment is expected to experience a high CAGR as more individuals and couples seek donor options that allow their future children to have the opportunity to learn about their genetic heritage. However, in terms of the highest revenue, the Anonymous Donors segment currently held the dominant position in 2025. Anonymous Donors are those who choose to remain anonymous throughout the process, with their identifying information kept confidential from the recipients and future offspring. This segment has historically been the most prevalent and has generated substantial revenue due to the preference for anonymity among both donors and recipients. The Anonymous Donors segment continues to contribute significantly to the overall revenue of the sperm bank market. Lastly, the Known Donors segment involves individuals who have a personal relationship with the recipient or intend to have ongoing involvement in the life of the resulting child. This segment occupies a relatively smaller share of the market compared to ID Disclosure and Anonymous Donors but serves a niche market where recipients prioritize a close connection or ongoing relationship with the donor.

Donor Insemination Segment Dominates the Market by Fertilization Techniques

The fertilization techniques segment in the sperm bank market encompasses two primary methods: Donor Insemination and In Vitro Fertilization (IVF). Among these techniques, the In Vitro Fertilization segment is anticipated to have the highest CAGR during the forecast period of 2026 to 2034. IVF involves the process of fertilizing an egg with donor sperm in a laboratory setting and transferring the resulting embryo into the recipient's uterus. This technique has gained significant popularity due to its higher success rates compared to other fertility treatments and its ability to address various infertility factors. The increasing prevalence of infertility and advancements in IVF technologies are expected to drive the growth of this segment. However, in terms of generating the highest revenue, the Donor Insemination segment currently held the dominant position in 2025. Donor Insemination refers to the direct placement of donor sperm into the recipient's uterus, typically performed via intrauterine insemination (IUI). This technique has been widely used for several decades and continues to contribute significantly to the revenue of the sperm bank market. Donor Insemination is a simpler and less invasive procedure compared to IVF, making it a preferred choice for certain individuals and couples. The cost-effectiveness and accessibility of Donor Insemination also contribute to its revenue generation.

North America Leads the Revenues and the Growth During the Forecast Period

North America held a significant share of the market in 2025 and is expected to witness a high CAGR during the forecast period of 2026 to 2034. This can be attributed to factors such as advanced healthcare infrastructure, favorable reimbursement policies, and increasing awareness about fertility treatments. Additionally, the region has witnessed a rise in same-sex couples and single women opting for assisted reproductive procedures, driving the demand for donor sperm. In terms of revenue percent, Europe currently dominates the market due to its well-established healthcare systems, favorable regulatory frameworks, and higher acceptance of assisted reproductive technologies. Europe has a robust network of sperm banks and fertility clinics, facilitating easy access to donor sperm and comprehensive fertility services. However, it is important to note that other regions, such as Asia Pacific and Latin America, are expected to showcase substantial growth potential. These regions are experiencing an increasing demand for fertility treatments, driven by factors like changing lifestyles, rising infertility rates, and growing awareness about available options. Additionally, improving healthcare infrastructure and rising disposable incomes are contributing to the growth of the sperm bank market in these regions. As fertility treatments become more accessible and socially accepted, the demand for donor sperm is expected to rise across various geographic regions.

Market Competition to Intensify during the Forecast Period

The sperm bank market is highly competitive, with several key players striving to establish their presence and cater to the increasing demand for donor sperm and fertility services. Some of the top players in the market include Cryos International, Fairfax Cryobank, European Sperm Bank, Xytex Corporation, and California Cryobank. These companies have established themselves as leaders in the industry and have a strong customer base. To maintain their competitive edge, these players adopt various strategies and initiatives. One of the key strategies is expanding its donor database and ensuring a diverse range of donor profiles. By offering a wide selection of donors with different characteristics, such as physical attributes, education, and medical history, these companies aim to meet the diverse needs and preferences of their clients. They also prioritize rigorous donor screening processes to ensure the quality and safety of donated sperm, including medical and genetic testing. Another important aspect of their strategies is the establishment of a robust distribution network. These companies have established partnerships with fertility clinics, healthcare facilities, and reproductive specialists to ensure convenient access to their services globally. This enables them to reach a wider customer base and provide timely delivery of donor sperm to clients worldwide. Moreover, these top players invest in research and development to stay at the forefront of technological advancements in reproductive medicine. They continuously explore new techniques and innovations to improve the success rates of assisted reproductive procedures, such as cryopreservation techniques, sperm quality assessment methods, and genetic screening technologies. By leveraging these advancements, they enhance the quality and effectiveness of their services, thereby attracting more clients and maintaining customer loyalty.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Sperm Bank market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Donor Type

|

|

Type Of Vials

|

|

Service

|

|

Fertilization Techniques

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report