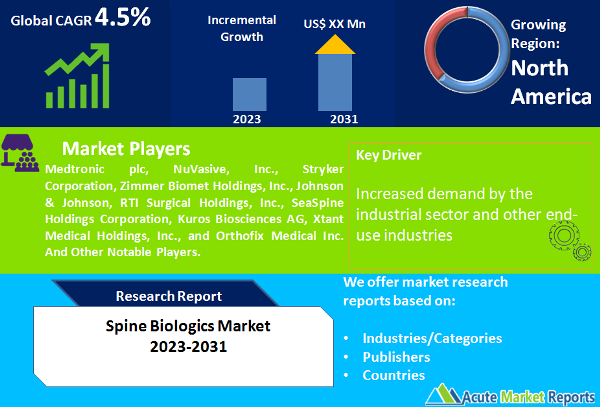

The spine biologics market is expected to experience a CAGR of 4.5% during the forecast period of 2025 to 2033, driven by advancements in biotechnology and increasing demand for minimally invasive procedures in the treatment of spinal disorders. Spine biologics refer to biological substances that are used in spinal fusion surgeries to enhance bone growth, promote healing, and improve spinal stability. These biologics include bone grafts, growth factors, stem cells, and other naturally occurring substances that stimulate bone formation and tissue regeneration. The market for spine biologics is witnessing a steady increase in revenue, primarily due to the rising prevalence of spinal disorders such as degenerative disc disease, spinal stenosis, and spinal fractures. These conditions often require surgical intervention, and spine biologics offer a promising solution by providing an alternative to traditional bone grafting techniques. The market revenue is further propelled by the growing adoption of minimally invasive surgical procedures, which offer reduced recovery time, lower risk of complications, and improved patient outcomes.

Increasing Prevalence of Spinal Disorders

The first driver of the Spine Biologics market is the growing prevalence of spinal disorders worldwide. Conditions such as degenerative disc disease, spinal stenosis, and spinal fractures are becoming increasingly common, leading to a higher demand for effective treatment options. According to a study published in the Global Spine Journal, the prevalence of degenerative disc disease is estimated to be around 20% in individuals aged 40 years and above. This rising prevalence of spinal disorders is driving the need for innovative solutions, including spine biologics, to address the associated pain, instability, and functional limitations.

Shift Towards Minimally Invasive Procedures

Another significant driver of the Spine Biologics market is the increasing preference for minimally invasive surgical procedures. Minimally invasive techniques offer several advantages over traditional open surgeries, such as smaller incisions, reduced blood loss, shorter hospital stays, and faster recovery times. Spine biologics play a crucial role in these procedures as they facilitate bone fusion, promote tissue regeneration, and enhance overall surgical outcomes. A study published in the Journal of Neurosurgery: Spine found that patients who underwent a minimally invasive lumbar fusion with the use of spine biologics experienced significant improvements in pain relief and functional outcomes.

Advancements in Biotechnology

Advancements in biotechnology have significantly contributed to the growth of the Spine Biologics market. Researchers and companies in the biotechnology sector have made substantial progress in developing innovative spine biologics that offer improved efficacy and safety profiles. For instance, the use of stem cells in spine biologics has shown promising results in promoting bone growth and tissue regeneration. Additionally, advancements in tissue engineering techniques have led to the development of scaffold-based spine biologics that provide structural support and enhance bone fusion. These technological advancements are driving the adoption of spine biologics in spinal surgeries, fueling market growth.

Regulatory Challenges and Approval Process

One significant restraint facing the Spine Biologics market is the regulatory challenges and complex approval process associated with the development and commercialization of spine biologics. The introduction of new biologics in the market requires rigorous testing, safety assessments, and compliance with regulatory standards to ensure their efficacy and patient safety. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have specific guidelines and requirements for the approval of spine biologics. These regulations aim to ensure the safety and effectiveness of these products before they can be marketed and used in clinical practice. The approval process for spine biologics involves preclinical studies, clinical trials, and extensive documentation to demonstrate the product's safety and efficacy. These processes are time-consuming, resource-intensive, and subject to regulatory scrutiny. The need to comply with complex regulatory requirements and provide sufficient evidence of the product's benefits and risks can pose challenges for manufacturers and delay the commercialization of spine biologics. Furthermore, changes in regulatory policies or the introduction of new guidelines can impact the market dynamics and add further complexity to the approval process.

PLIF Segment to Lead the Growth during the Forecast Period

Among the various surgery segments in the Spine Biologics market, Anterior Cervical Discectomy and Fusion (ACDF) is anticipated to have the highest compound annual growth rate (CAGR) and generate the highest revenue. ACDF is a widely performed surgical procedure for the treatment of cervical spine disorders, including disc herniation and degenerative disc disease. The procedure involves the removal of the damaged disc and fusion of the adjacent vertebrae using spine biologics to promote bone growth and stability. The growing prevalence of cervical spine disorders and the increasing adoption of ACDF procedures are driving the demand for spine biologics in this segment. Additionally, the Posterior Lumbar Interbody Fusion (PLIF) segment is expected to exhibit significant CAGR during the forecast period of 2025 to 2033 and contribute to substantial revenue in the Spine Biologics market. PLIF is a surgical technique used to treat lower back pain and instability by fusing the lumbar vertebrae. Spine biologics play a crucial role in promoting bone fusion and facilitating successful outcomes in PLIF procedures. The increasing incidence of lumbar spine conditions, such as degenerative disc disease and spondylolisthesis, is propelling the demand for spine biologics in PLIF surgeries.

The Bone Graft Substitutes Segment Dominates the Revenues

Among the product segments in the Spine Biologics market, the Bone Graft segment is expected to witness the highest CAGR during the forecast period of 2025 to 2033. Bone grafts are widely used in spine surgeries to promote bone healing and fusion. They can be sourced from the patient's own body (autograft) or obtained from a donor (allograft). The increasing prevalence of spinal disorders, such as degenerative disc disease and spinal fractures, drives the demand for bone grafts in the Spine Biologics market. Autografts, specifically from the iliac crest, have been a popular choice due to their superior osteogenic properties, but allografts are gaining prominence due to advancements in processing techniques and the reduced morbidity associated with harvesting autografts. The bone graft substitutes segment is also contributed significantly to the revenue of the spine biologics market in 2024. These substitutes are synthetic or natural materials that mimic the properties of bone and stimulate bone regeneration. They offer advantages such as ease of use, availability, and reduced risk of disease transmission compared to traditional bone grafts. Calcium-based substitutes, demineralized bone matrix, and growth factors are some examples of bone graft substitutes used in spine surgeries. The increasing adoption of these substitutes, driven by their efficacy and convenience, fuels the growth of this segment.

Hospital Remains the Dominant End User

The end-user segment in the Spine Biologics market encompasses various healthcare facilities and providers. Among them, the Hospitals segment is expected to witness the highest CAGR during the forecast period of 2025 to 2033 and generated the highest revenue in 2024. Hospitals serve as primary centers for spine surgeries and provide comprehensive care to patients requiring spine biologics interventions. With advancements in surgical techniques and the increasing prevalence of spinal disorders, hospitals play a crucial role in catering to the growing demand for spine biologics products. These facilities have well-equipped operating rooms, specialized spine care units, and a multidisciplinary team of surgeons, anesthesiologists, and nursing staff.

North America Remains as the Global Leader

North America dominated the market in 2024 and is expected to continue its leading position in terms of revenue generation during the forecast period. The region's strong healthcare infrastructure, favorable reimbursement policies, and high adoption of advanced spine biologics technologies contribute to its market dominance. Additionally, the increasing prevalence of spinal disorders, coupled with the growing aging population, further drives market growth in North America. Europe is another key market for Spine Biologics, characterized by the presence of well-established healthcare systems and a rising incidence of spinal disorders. The region showcases a significant demand for advanced spine biologics products and procedures. The increasing focus on minimally invasive spine surgeries and the availability of favorable reimbursement policies contribute to the market's growth in Europe. The Asia Pacific region is expected to witness substantial growth during the forecast period of 2025 to 2033 in the Spine Biologics market due to several factors. Rising healthcare expenditure, expanding medical tourism, and improving healthcare infrastructure are driving the demand for spine biologics products in this region. Additionally, the growing awareness about advanced treatment options, increasing disposable income, and a large patient pool contribute to market growth. Emerging economies like China and India are experiencing rapid development in the healthcare sector, further propelling the market in the Asia Pacific region.

Market Competition to Intensify during the Forecast Period

The spine biologics market is highly competitive, with several key players striving to gain a significant market share. These players are focusing on various strategies to maintain their competitive edge and expand their presence in the market. They are investing in research and development activities to introduce innovative and advanced spine biologics products. Additionally, strategic partnerships, collaborations, and acquisitions are common strategies adopted by market players to enhance their product portfolios and expand their global footprint. Some of the top players in the Spine Biologics market include Medtronic plc, NuVasive, Inc., Stryker Corporation, Zimmer Biomet Holdings, Inc., Johnson & Johnson, RTI Surgical Holdings, Inc., SeaSpine Holdings Corporation, Kuros Biosciences AG, Xtant Medical Holdings, Inc., and Orthofix Medical Inc. These companies have a strong market presence and offer a wide range of spine biologics products. To maintain their competitive position, these players focus on product innovation and development. They continuously invest in research and development to introduce novel spine biologics solutions that cater to the evolving needs of patients and healthcare professionals. These companies also prioritize regulatory compliance and obtain necessary approvals and certifications to ensure the safety and efficacy of their products. The market is expected to witness continued advancements in spine biologics technologies, driven by the efforts of these players to meet the evolving needs of patients and healthcare professionals. As the market expands, competition is likely to intensify, leading to further innovations and advancements in spine biologics treatments.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Spine Biologics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Surgery Type

| |

Product

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report