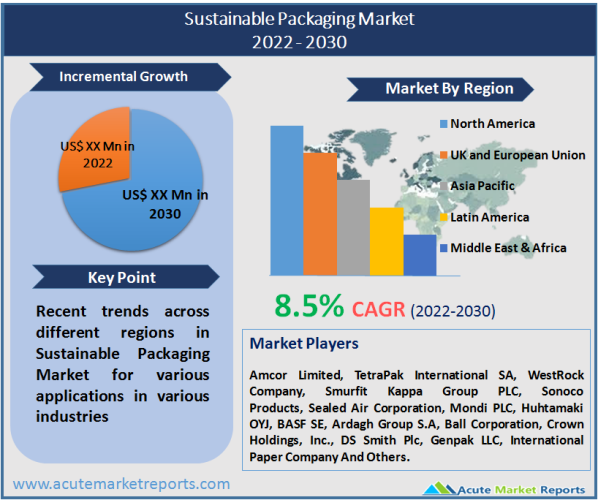

The global sustainable packaging market is expected to expand at a CAGR of 8.5% during the forecast period of 2025 to 2033. The market expansion is attributable to the government's stringent laws on sustainable development and the packaging industry's rising need for recycled packaging materials. The production and use of packaging that enhances sustainability are referred to as sustainable packaging. It relies heavily on life cycle analyses and inventories to guide packaging selections and reduce its environmental impact. Benefits offered by sustainable packaging products such as strength, transparency, insulation, and water resistance, the growing use of sustainable packaging in industries such as healthcare, pharmaceutical, automobile, nutraceuticals, and fashion, the increase in global plastic pollution, the use of a wide range of sustainable packaging products by modern agricultural practices to increase productivity, and the ability of sustainable packaging to preserve a product's integrity are all discussed. However, the high cost of raw materials hinders the expansion of the global market. In contrast, increased demand from end-use sectors, less reliance on petroleum resources, and advances in research and development (R&D) will create new growth prospects for the global industry in the future years.

Stringent Environmental Regulations to Boost the Market Growth

Beijing regulations and the possibility of a ban on conventional plastics, such as single-use non-biodegradable plastics such as cutlery, plastic bags, and packaging, have been motivated by environmental pollution concerns. As a result, manufacturers have also been focusing on expanding the usage of corn, sugar, and other crops in the production of biodegradable plastics. Jilin Province and the tropical island of Hainan will adopt further prohibitions on single-use plastics and non-biodegradable food service goods by mid-2021, it was revealed. In 2021, for instance, Maine was the first U.S. state to pass a law-making firm responsible for packaging trash. Manufacturers will be responsible for the recycling and disposal of plastic containers, cardboard, and non-recyclable packaging under the Extended Producer Responsibility program. Later, Oregon became the second state in the U.S. to pass a packaging law.

Changing Consumer Behaviour to Lead to Market Expansion

According to a recent poll conducted by Capgemini on sustainability and transforming consumer behavior, 79% of consumers are altering their purchase patterns mostly owing to social responsibility, inclusion, and environmental effect. In addition, 53% of consumers and 57% of those between the ages of 18 and 24 have switched to lesser-known brands because they are more environmentally friendly. A bit more than 52% of customers claimed to have an emotional connection with sustainable companies or organizations.

Increasing Consumer Awareness to Escalate Market Revenues

Before purchasing a product, consumers assess a variety of things, including the brand image and packaging designs of the company. Consumers are aware of sustainable products and their significance in environmental protection as a result of government awareness initiatives and legislation. Numerous businesses face severe criticism from various consumer groups regarding their packaging practices and are under pressure to implement sustainable packaging alternatives. Several global occurrences have occurred in recent years, compelling many businesses to increase their investments in R&D programs for the development of recyclable packaging and their support of various government initiatives for sustainable development. Nestlé S.A., a Switzerland-based food and beverage manufacturing company, stated in January 2021 that it would invest about $2.03 billion in innovative sustainable packaging solutions. The investment was made in accordance with Nestlé S.A.'s 2018 pledge to utilize 100 percent recyclable or reusable packaging by 2025.

Trends In Compact Packaging and Green Packaging to Favor Market Expansion

The increasing attention of key companies on packaging reduction to lower production costs is expected to boost the market growth. For example, Rene just introduced (the Fab 5 Collection) with five various lip colors in a single tube, which not only expands the range of products available to clients but also minimizes the amount of raw materials utilized in packaging. In addition, ladies favor it because of its compact packaging, which allows them to carry fewer products while receiving a greater variety. Green packaging is a growing global trend that manufacturers must follow to remain competitive in the market. Typically, FMCG businesses conduct downsizing strategies to reduce their raw material prices. This feature will promote market expansion during the forecast period. Manufacturers of personal care products are changing their focus to eco-friendly options by minimizing the amount of raw materials utilized in product packaging. This is a result of evolving consumer packaging sustainability attitudes.

The Availability of Inexpensive Packaging Alternatives to Limit Market Growth

The wide availability of low-cost alternatives to sustainable packaging, such as paper bubble wrap, paper tape, and cornflour packaging, is a significant factor impeding the growth of the worldwide sustainable packaging industry. The recycling of packaging materials is a highly expensive procedure, and the price fluctuations of raw materials pose significant commercial hurdles. In addition, the absence of recycling facilities and inadequate storage units, particularly in emerging regions, provides additional obstacles that may impede the market's growth in the coming years.

High Cost of Raw Materials to Constraint the Market Revenues

The lack of manufacturing facilities that generate sustainable packaging is anticipated to impede market expansion. The high cost of raw materials is another factor that is anticipated to restrain market expansion.

Corporate Strategies to Embrace Sustainable Packaging to Open Significant Opportunities

Diverse food service providers are substituting single-use plastic straws, closures, lids, caps, cups, and food trays with paper or compostable alternatives. This effort is anticipated to generate substantial growth prospects throughout the foreseeable future. To advance their green ambitions, companies such as Unilever and Procter & Gamble have begun incorporating post-consumer recycled plastics into their packaging solutions. In the near future, such measures are anticipated to present prospective growth prospects for the key companies.

Government Subsidies Across the Globe to Pave Way to New Opportunities

As governments around the world are aware of the challenges posed by environmental issues, numerous efforts and legislation have been enacted to promote producers of sustainable packaging. Government efforts that provide subsidies to package makers, particularly in industrialized nations, offer market participants lucrative chances to increase their existing production output. As a result of these government measures, significant market participants have begun investing in the creation of various recycling programs for waste packaging materials generated by industries and commercial establishments.

Market By Material: The Paper and Paperboard Segment Is Expected to Dominate the Market

On the basis of material type, the paper and paperboard segment was the largest market in 2021, accounting for more than two-fifths of the worldwide sustainable packaging market share, and is anticipated to maintain its dominance during the forecast period. This is due to the fact that paper and paperboard are more recyclable, biodegradable, and non-toxic than other materials and have a low environmental impact. In contrast, the others group is anticipated to experience the highest CAGR of 8.5% during the forecast period of 2025 to 2033. The other segment includes glass used in a variety of products, such as packaging, dinnerware, and buildings & structures. Transparency, dust resistance, water resistance, color availability, recyclability, UV stability, weather and rust resistance, ease of molding, electrical insulation, and sustainability are a few of its many benefits.

Market By Packaging Type: Rigid Packaging Segment to Continue its Dominance During the Forecast Period

During the forecast period, the rigid packaging segment will maintain its dominant position. In 2021, based on packaging type, the rigid packaging category controlled nearly three-fifths of the global market for sustainable packaging. Food, medicine, electronics, toys, personal care goods, office supplies, and tools are among the many things that utilize rigid packaging. Moreover, it is inexpensive and highly impact-resistant. From 2025 to 2033, the segment of flexible packaging is forecast to experience the highest CAGR, at 7.5%. Rapid changes in lifestyles have increased the demand for handy items for which bioplastics are commonly employed in flexible packaging. This may be one of the primary factors driving the expansion of the bioplastics market for flexible packaging.

Market by Process: Recycled Packaging to Dominate the Market During the Forecast Period

It is anticipated that Recycled Packaging would dominate the global market throughout the forecast period due to the increasing environmental concerns worldwide. Common sustainable packaging solutions employed by businesses include packaging downsizing or lightening as well as boosting the usage of recycled content and renewable resources. Compared to virgin paper, recycled paper is easily accessible and more environmentally beneficial. Recycling paper reduces air pollution by 74% and water usage by 50%. Due to their minimal environmental effect, the Degradable Packaging segment is anticipated to have considerable expansion in the near future. This is a result of their increasing application across a wide range of industries. In addition, an increasing number of product innovations, such as intelligent and active packaging solutions, are expanding product availability.

Market by End User: F&B Anticipated to be The Dominant Market

The food and beverage segment is anticipated to lead the global market over the projected period due to the increasing acceptance of recycled plastic, which is accessible at a low price and is environmentally beneficial. In addition, the cosmetics and personal care industry is anticipated to experience considerable growth in the near future. This is due to the increased demand for sustainable packaging as consumers become more environmentally conscious and the government takes steps to promote eco-friendly packaging. In 2020, for instance, the sector witnessed an infusion of alternatives designed to stimulate the industry. Colgate introduced its recyclable tube; Cosmogen introduced the notion of glue-free makeup brushes, and Quadpack was preparing to debut its Nordic Collection jars made from compostable wood and biopolymer-based materials.

APAC Continues to be the Global Leader

Based on region, Asia-Pacific was the largest market in 2021, accounting for more than two-fifths of the worldwide sustainable packaging market share, and is anticipated to continue to lead the pack during the forecast period. The same segment is anticipated to exhibit the highest CAGR over the projection period, at 7.8%. In the Asia-Pacific region, urbanization has facilitated the expansion of the sustainable packaging market. In addition, the presence of big manufacturing enterprises, primarily in the healthcare, pharmaceutical, and cosmetic sectors, contributes to the expansion of the regional market. The largest Chinese e-commerce sites and expedited shipping companies have actively reduced their use of packaging materials. SF Express, for instance, utilized recyclable packing cartons that can be recycled approximately ten times on average. In domestic first-tier and numerous second-tier cities, the company has adopted more than one hundred thousand of these boxes, mostly to replace paper boxes and plastic bags and to reduce the use of foam blocks and tape. The company noted that its activities are in response to the need for sustainable growth in the logistics industry. In August 2020, eight departments, including the State Post Bureau (SPB) of China, issued a directive declaring that the country would introduce required national standards by 2025 to ensure that the express delivery industry employs hazard-free packing materials. This would build a complete standard system for sustainable packaging with specific priorities and an optimal structure. In accordance with the requirements of the guideline, the appropriate departments must enhance their sustainable packaging standard practices throughout the entire process, from design, materials, and recycling through disposal.

Countries such as France, Germany, and the United Kingdom go above and beyond the European Union's stringent recycling laws with Extended Producer Responsibilities (EPRs). In Asia, Thailand has declared a ban on single-use plastic bags in major stores beginning on January 1, 2020. It intended for a complete prohibition by 2021 in order to prevent plastic pollution. Due to increasing government attempts to limit trash sent to landfills, Europe is predicted to experience the greatest increase throughout the projection period. For example, the government has suggested that beginning in 2024, every local authority in England should offer separate weekly food waste collection for households. Over 600 manufacturers participate in the UK-wide On-Pack Recycling Label (OPRL) recycling scheme. Due to favorable government policies that are boosting demand for sustainable and biodegradable packaging, North America is likely to experience considerable growth over the forecast period. Moreover, prominent firms are implementing solutions for compostable packaging. For instance, No Evil Foods' vegetarian meat substitutes are packaged in compostable Kraftpak containers with plant-based printing. Previously, No Evil Foods utilized butcher paper with non-biodegradable stickers, making the butcher paper difficult to compost.

The Intensity of Competition to Rise During the Forecast Period

The global market for sustainable packaging is quite fragmented and therefore significantly competitive. Amcor Plc, TetraPak International SA, WestRock Company, Smurfit Kappa Group PLC, and Sonoco Products Company are market leaders. This is a result of continual research and development (R&D) and the efforts of value chain partners. In addition, important firms are employing various company growth methods to extend their regional and international footprint. Amcor Limited, Westrock Company, TetraPak International S.A., Sonoco Products Company, Smurfit Kappa Group PLC, Sealed Air Corporation, Mondi PLC, Huhtamaki OYJ, BASF SE, Ardagh Group S.A, Ball Corporation, Crown Holdings, Inc., DS Smith Plc, Genpak LLC, and International Paper Company are some of the key players in the global sustainable packaging market.

In April of 2025, WestRock Company announced a partnership with Recipe Unlimited to adopt a series of recyclable paperboard packaging with the goal of diverting 31 million plastic containers annually from Canadian landfills. In October 2021, the package became available at all Swiss Chalet restaurants. In April 2025, Sealed Air announced a partnership for an advanced recycling program centered on recycling flexible plastics from the food supply chain and recreating them into new certified circular food-grade packaging.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Sustainable Packaging market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Form

| |

Type

| |

Material

| |

Process

| |

End User

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report