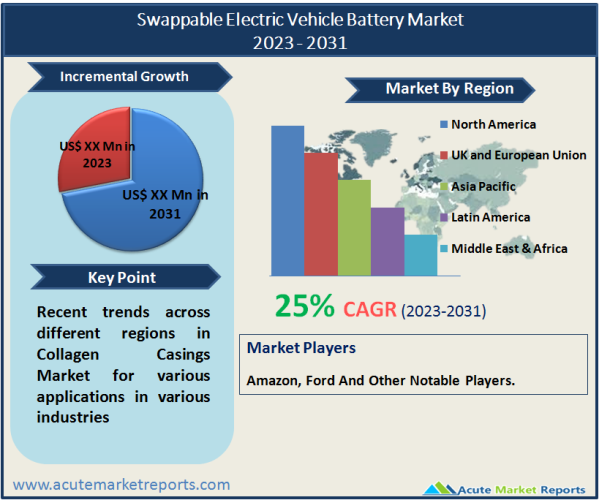

The swappable electric vehicle battery market is expected to grow at a CAGR of 25% during the forecast period of 2026 to 2034. The market has emerged as a promising segment within the broader electric vehicle industry. This market focuses on developing and implementing battery swapping infrastructure that enables electric vehicle owners to quickly exchange their depleted batteries for fully charged ones at designated stations. The market revenue for swappable electric vehicle batteries has been steadily growing, driven by factors such as the increasing adoption of electric vehicles, the need for efficient charging solutions, and the growing demand for convenient and time-saving alternatives to traditional charging methods. The market revenue for swappable electric vehicle batteries is expected to witness significant growth in the coming years. As more countries and regions commit to reducing carbon emissions and promoting sustainable transportation, the adoption of electric vehicles is on the rise. Swappable battery technology offers a compelling solution to address one of the main challenges associated with electric vehicles - charging time. Instead of waiting for hours to charge their vehicles, users can simply swap their depleted batteries with fully charged ones, significantly reducing the time spent on charging. Moreover, the market is expected to benefit from government initiatives and incentives aimed at promoting the adoption of electric vehicles and supporting the development of charging infrastructure. Governments around the world are investing in the establishment of battery swapping networks, providing financial incentives to companies involved in battery swapping technology, and facilitating partnerships to expand the reach of swappable battery infrastructure. These initiatives are expected to drive market growth and create opportunities for businesses operating in the swappable electric vehicle battery segment.

Charging Time Efficiency

One of the key drivers for the swappable electric vehicle battery market is the need for improved charging time efficiency. Electric vehicles have gained popularity as a sustainable transportation option, but one of the main challenges is the time required for charging the batteries. Traditional charging methods can take several hours to fully charge an electric vehicle, leading to range anxiety and inconvenience for users. Swappable battery technology addresses this challenge by allowing users to quickly exchange their depleted batteries with fully charged ones at dedicated battery swapping stations. This significantly reduces the charging time and provides a seamless and convenient experience for electric vehicle owners. The success of companies such as Gogoro in Taiwan, which operates an extensive battery swapping network, demonstrates the demand for faster charging solutions. Gogoro's battery swapping infrastructure has gained popularity among electric scooter users, enabling them to swap batteries in a matter of seconds. The company has reported significant growth in its user base and has expanded its battery swapping network to meet the increasing demand, indicating the positive response to this efficient charging solution.

Scalability and Flexibility of Infrastructure

The scalability and flexibility of the battery swapping infrastructure are another important driver for the swappable electric vehicle battery market. Swappable battery technology allows for the establishment of a network of battery swapping stations that can be strategically placed in various locations, such as parking lots, gas stations, or commercial areas. This flexibility in infrastructure placement enables convenient access to battery swapping services, reducing concerns about range anxiety and expanding the range of electric vehicle adoption. Additionally, the scalability of the infrastructure allows for easy expansion and adaptation to changing demands, accommodating the growing number of electric vehicles on the road. Tesla, a leading electric vehicle manufacturer, has recognized the potential of swappable battery technology. Although the company has primarily focused on fast-charging solutions, it has filed patents related to battery swapping technology. This indicates the acknowledgment of the scalability and flexibility advantages offered by battery swapping infrastructure, even by companies primarily invested in fast-charging solutions.

Supportive Government Initiatives

Supportive government initiatives play a crucial role in driving the adoption of swappable electric vehicle batteries. Many governments are actively promoting the use of electric vehicles as part of their efforts to reduce carbon emissions and combat climate change. In this context, they are incentivizing the development of charging infrastructure, including battery swapping networks. Governments offer financial incentives, tax benefits, and subsidies to companies engaged in battery swapping technology, encouraging the expansion of swappable battery infrastructure and making it an attractive investment opportunity. The Chinese government has been actively supporting the adoption of electric vehicles through its policies and incentives. It has specifically included swappable battery technology as part of its subsidy programs to encourage the development and implementation of battery swapping infrastructure. These initiatives have resulted in the establishment of several battery swapping stations across the country, facilitating the growth of the swappable electric vehicle battery market.

Infrastructure Development Challenges

One of the key restraints affecting the swappable electric vehicle battery market is the challenge of infrastructure development. Implementing a robust and widespread battery swapping network requires significant investments in terms of infrastructure setup, including the establishment of battery swapping stations and the integration of software and communication systems. The need for a standardized infrastructure that supports various electric vehicle models further complicates the development process. Additionally, the availability of suitable locations for battery swapping stations and the logistical challenges associated with battery transportation and maintenance pose further hurdles. These infrastructure development challenges can result in delays in the expansion of battery swapping networks and limit the accessibility of this technology to electric vehicle owners. The limited availability of battery swapping stations in comparison to traditional charging infrastructure is evident in the current market landscape. While traditional charging stations are more prevalent and widely distributed, battery swapping stations are relatively few in number. The need for significant investments in infrastructure development and the complexities involved in setting up a robust battery swapping network contribute to this limited availability. Furthermore, the challenges associated with securing suitable locations and ensuring efficient operations are often cited as barriers to the widespread adoption of battery swapping technology in the electric vehicle market.

Pay-Per-Use Model Dominates in terms of Revenue for Market by Payment Model

The swappable electric vehicle battery market is witnessing significant growth, driven by two prominent payment models: the subscription model and the pay-per-use model. With the subscription model, users pay a fixed amount on a regular basis, gaining access to a designated number of battery swaps per month. This model offers convenience and flexibility, particularly for individuals who frequently require battery replacements, such as ride-hailing drivers or long-distance commuters. On the other hand, the pay-per-use model enables users to pay only when they need a battery swap, eliminating the need for a regular subscription fee. This approach appeals to occasional users or those who prefer a more on-demand payment structure. In terms of market performance, the subscription model is expected to exhibit the highest CAGR during the forecast period of 2026 to 2034, fueled by its ability to cater to the needs of frequent users and build a loyal customer base. However, the pay-per-use model generated the highest revenue in 2025, as it captures a wider consumer segment that includes both regular and occasional users. The swappable electric vehicle battery market's growth is propelled by these diverse payment models, with the subscription model leading in terms of CAGR and the pay-per-use model driving the highest revenue.

Public Charging Stations Dominates in terms of Revenues for Market by Category

The swappable electric vehicle battery market can be categorized into three main segments: private charging, public charging, and long-distance fast charging. Private charging involves individuals installing charging stations at their residences or workplaces, providing convenient and accessible charging options for personal electric vehicles. Public charging stations, on the other hand, are available in various locations such as shopping centers, parking lots, and city streets, allowing EV owners to charge their vehicles while running errands or during longer stops. Lastly, long-distance fast charging stations are strategically positioned along highways and major routes, providing quick and efficient charging for electric vehicles during long journeys. Among these categories, long-distance fast charging is expected to exhibitthe highest CAGR during the forecast period of 2026 to 2034, due to the increasing adoption of electric vehicles for long-distance travel, as it offers the most practical and time-efficient charging solution. In terms of revenue, public charging stations generated the highest revenue in 2025, as they cater to a broader consumer base, including regular commuters, urban dwellers, and those without access to private charging facilities. While private charging serves as a convenient option for EV owners, its revenue potential is limited to the number of individuals who invest in home charging infrastructure. In summary, the swappable electric vehicle battery market can be classified into private charging, public charging, and long-distance fast charging, with long-distance fast charging experiencing the highest CAGR and public charging generating the highest revenue.

North America Remains as the Global Leader

In terms of geographic trends, North America has emerged as a key market for swappable electric vehicle batteries in 2025, driven by the increasing adoption of electric vehicles and supportive government policies promoting sustainable transportation. Europe follows closely, with countries like Norway, the Netherlands, and Germany leading the way in electric vehicle penetration and the establishment of charging infrastructure. Asia Pacific also showcases significant growth potential, fuelled by the rising demand for electric vehicles in countries like China, Japan, and South Korea. Among these regions, Asia Pacific demonstrates the highest CAGR during the forecast period of 2026 to 2034, driven by a combination of government incentives, growing urbanization, and a shift towards clean energy solutions. In terms of revenue percentage, Europe takes the lead, primarily due to its well-established charging infrastructure and the presence of premium electric vehicle brands. The region boasts a strong consumer base and a high level of consumer acceptance for electric vehicles, leading to a substantial revenue contribution. While North America is witnessing impressive growth, its revenue percentage is slightly lower due to the challenges associated with infrastructure development in certain areas.

Market Competition to Intensify During Forecast Period

The swappable electric vehicle battery market is witnessing intense competition among various players vying for market share and technological advancements. Several top players dominate the market and employ key strategies to maintain their competitive edge. One of the prominent players in the market is Tesla, which has been at the forefront of electric vehicle technology. Tesla has focused on developing its proprietary battery technology, enabling longer driving ranges and faster charging times. The company has also strategically positioned its Supercharger network globally, providing seamless charging options for Tesla owners. Another major player is NIO, a Chinese electric vehicle manufacturer that offers a unique battery swap service called "Battery as a Service" (BaaS). NIO's BaaS model allows users to purchase electric vehicles at a lower price point while leasing the battery separately, reducing upfront costs and providing the convenience of battery swapping. Additionally, NIO has been expanding its battery swapping network across China, enhancing the accessibility and availability of this service. Another key player in the market is Rivian, known for its electric adventure vehicles. Rivian has adopted a customer-centric approach by focusing on vehicle performance, off-road capabilities, and innovative battery solutions. The company aims to establish a network of charging and battery swap stations, particularly in remote and adventure-focused locations, catering to the needs of their target market. Furthermore, Rivian has secured partnerships with major companies such as Amazon and Ford, strengthening its position in the market. Additionally, there are players like Xpeng Motors, which utilizes battery swap technology in its electric vehicles. Xpeng has integrated swappable battery systems into its vehicles, offering users the option to either charge or swap their batteries as per their convenience. This strategy provides flexibility for customers and addresses concerns related to charging infrastructure availability.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Swappable Electric Vehicle Battery market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Payment Model

|

|

Category

|

|

Battery Capacity

|

|

Vehicle

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report