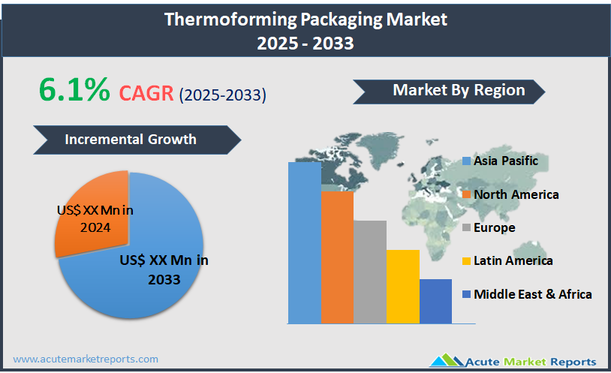

Thermoforming packaging involves a process where plastic sheets are heated to a pliable forming temperature, formed to a specific shape in a mold, and trimmed to create usable products. This type of packaging is widely used across various industries due to its versatility and efficiency in producing lightweight and durable packages. Thermoforming allows for the creation of packages in numerous shapes and sizes, which can be tailored to specific needs of products such as food, pharmaceuticals, and consumer goods. The process is particularly valued for its cost-effectiveness and speed in high-volume manufacturing settings. The global thermoforming packaging market is experiencing robust growth, forecasted to expand at a compound annual growth rate (CAGR) of 6.1% through the upcoming years. This growth is primarily driven by the increasing demand from the food and beverage sector, where thermoforming packaging is favored for its ability to produce visually appealing, protective, and shelf-stable products.

Driver: Demand from Food and Beverage Industry

The significant driver of the thermoforming packaging market is the increasing demand from the food and beverage industry, which relies heavily on this packaging solution for its flexibility, cost-effectiveness, and speed of production. Thermoforming allows for the creation of customized packaging shapes and sizes, catering to the diverse needs of food products ranging from fresh produce to ready-to-eat meals. This method provides protective packaging that maintains food quality and extends shelf life, essential for perishable goods. The visual appeal of thermoformed packages also plays a crucial role in consumer purchasing decisions, as transparent packaging allows for easy inspection of the contents, adding a layer of trust and quality assurance for consumers. Furthermore, the ability to integrate barrier properties that protect against moisture and oxygen enhances the suitability of thermoformed packages for sensitive food products, driving their preference over other packaging types.

Opportunity: Sustainable Packaging Solutions

A significant opportunity within the thermoforming packaging market lies in the development of sustainable packaging solutions. As environmental concerns continue to influence consumer preferences and regulatory policies, the demand for packaging made from recycled, recyclable, or biodegradable materials is on the rise. Thermoforming technology is well-positioned to capitalize on this trend by adapting to use eco-friendly materials such as PLA (Polylactic Acid), which offers a reduced environmental footprint while maintaining the functional benefits of traditional plastics. This shift not only responds to market demands but also opens up new avenues for growth in sectors highly conscious of sustainability, such as organic foods and environmentally friendly products. The ability to offer green packaging solutions can significantly enhance a brand's image and market share in a competitive landscape increasingly driven by eco-awareness.

Restraint: Volatility in Raw Material Prices

A major restraint facing the thermoforming packaging market is the volatility in raw material prices, particularly petroleum-based plastics, which are predominant in the production of thermoformed packages. Fluctuations in oil prices can significantly impact the cost structure of thermoforming operations, affecting profitability and pricing strategies. This volatility forces manufacturers to manage costs and supply chain risks carefully, often resulting in price adjustments passed onto consumers. The dependency on petroleum products also raises concerns over long-term sustainability and susceptibility to global economic factors that affect oil markets, posing continuous challenges to maintaining stable production costs in the thermoforming industry.

Challenge: Recycling and Waste Management

One of the key challenges in the thermoforming packaging market is addressing issues related to recycling and waste management. While thermoformed plastic packages offer numerous benefits, their end-of-life disposal and recyclability remain problematic. Many thermoformed packages are made from multi-layer materials or composites that are difficult to separate and recycle, leading to significant amounts of waste entering landfills. The challenge lies in developing recycling technologies and systems that can efficiently process these materials and reintegrate them into the production cycle. Additionally, the market faces regulatory pressures to reduce plastic waste and improve the environmental footprint of packaging products, requiring ongoing innovation and investment in sustainable material technologies and waste management practices.

Market Segmentation by Material Type

In the thermoforming packaging market, the materials predominantly used include plastic, paper, and aluminum. Plastic, being the most versatile and cost-effective, commands the highest revenue in the market. Its dominance is due to its adaptability in forming various shapes and sizes, excellent barrier properties, and overall durability, making it ideal for a wide range of packaging applications from food to electronics. However, the segment of paper-based thermoforming packaging is expected to witness the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is driven by increasing consumer and regulatory demands for sustainable packaging solutions. Paper offers an eco-friendlier alternative with advantages such as biodegradability and recyclability, which are increasingly valued in the market, particularly in industries focusing on reducing their environmental impact, such as the food and beverage sector.

Market Segmentation by Product Type

The product types within the thermoforming packaging market range from blister packs, clamshells, vacuum & skin packs, containers, trays & lids, to cups & bottles. Clamshells and blister packs are the leaders in terms of revenue generation. These products are highly favored in the retail sector for their ability to provide secure packaging that showcases the product while offering theft protection and tamper evidence. Blister packs are particularly prevalent in pharmaceuticals due to their capability to preserve the integrity of medication and provide dosage precision. On the other hand, vacuum and skin packs are projected to experience the highest CAGR over the forecast period. This growth is attributed to their increasing use in the food industry, where these packaging types are essential for extending the shelf life of perishable goods by protecting them against environmental factors and contamination, thus maintaining product quality and freshness.

Geographic Segment

The thermoforming packaging market displays distinct geographic dynamics, with Asia-Pacific leading in revenue generation in 2024. This region's dominance is underpinned by rapid industrial growth, increasing consumer expenditure, and the expansion of retail and pharmaceutical sectors in major economies such as China, India, and Japan. Asia-Pacific's significant manufacturing base, coupled with high demand for packaged goods, drives the region's market leadership. Looking ahead to the forecast period of 2025 to 2033, Africa is expected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth projection is driven by urbanization, rising middle-class consumer base, and improvements in retail infrastructure, which are anticipated to increase the demand for packaged consumer goods, thereby boosting the market for thermoforming packaging.

Competitive Trends and Top Players

In 2024, the competitive landscape of the thermoforming packaging market was marked by the presence of numerous key players including Agoform GmbH, Amcor Plc, Anchor Packaging Inc., Berry Global Inc., and many others. These companies focused heavily on innovation, sustainability initiatives, and expanding their global footprint. For example, Berry Global and Amcor invested significantly in research and development to introduce more sustainable packaging solutions, responding to global demands for environmental consciousness. Companies like Sealed Air Corporation and Sonoco Products Company expanded their market reach through strategic acquisitions and partnerships, aiming to enhance their product offerings and penetrate new markets. From 2025 to 2033, these companies are expected to continue their focus on innovation, particularly in the development of eco-friendly materials and advanced packaging technologies. Strategic expansions and mergers & acquisitions are anticipated to remain key strategies for these players as they seek to strengthen their positions in the global market. Emphasis is also likely to be placed on adapting to regulatory changes and meeting the evolving preferences of consumers, which will require ongoing adjustments to both product and operational strategies.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Thermoforming Packaging market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Material Type

| |

Product Type

| |

Process Type

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report