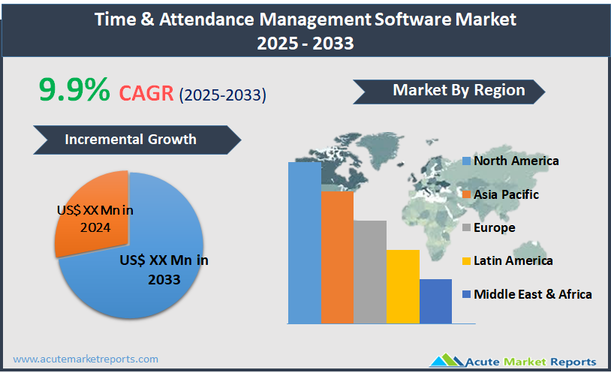

The time & attendance management software market encompasses solutions designed to track and optimize the hours that employees spend on the job and keep records of wages and salaries paid. This software automates the process of recording when employees start and stop work, along with the breaks they take. It is a critical component in workforce management, enabling businesses to ensure compliance with labor regulations, improve workforce productivity, and reduce administrative costs associated with manual timekeeping methods. These systems are often integrated with payroll services, human resources management systems, and job scheduling software. The time & attendance management software market is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 9.9%.

Increasing Adoption of Flexible Work Arrangements

A significant driver for the time & attendance management software market is the increasing adoption of flexible work arrangements, including remote work and flexible scheduling. As businesses adapt to global trends and employee preferences for work-life balance, there is a greater need for sophisticated time & attendance systems that can accurately track and manage employee hours across different locations and time zones. This software enables employers to ensure compliance with labor laws and internal policies while facilitating a more adaptable work environment. The shift toward remote work, accelerated by the COVID-19 pandemic, has underscored the importance of reliable systems that support asynchronous work patterns and provide transparency and fairness in how work hours and outputs are recorded and evaluated.

Integration with Advanced HR Technologies

An emerging opportunity within the time & attendance management software market is its integration with advanced HR technologies, such as HR analytics and employee engagement tools. As organizations become more data-driven, the ability to integrate time & attendance data with other HR systems allows for comprehensive analyses of workforce efficiency, productivity, and patterns. This integration helps HR professionals and managers make informed decisions about staffing, overtime, and workplace policies. It also supports initiatives around employee well-being by identifying trends that could indicate burnout or disengagement, thus fostering a healthier workplace culture and improving overall organizational performance.

High Implementation Costs

A primary restraint in the time & attendance management software market is the high implementation costs associated with these systems. For many small to medium-sized enterprises (SMEs), the initial investment in software, including hardware like biometric scanners if applicable, and the cost of integrating it with existing payroll and HR systems can be prohibitively expensive. Additionally, the ongoing maintenance and need for occasional updates or upgrades add to the total cost of ownership, making it challenging for smaller companies to justify the expense despite the potential long-term benefits of such systems.

User Adoption and Adaptability Issues

A significant challenge facing the time & attendance management software market is user adoption and adaptability issues. Employees and managers may resist transitioning from familiar manual processes to a new, automated system due to discomfort with technology or skepticism about its benefits. Training staff to use new software effectively can require substantial time and resources, and the failure to achieve widespread user adoption can undermine the advantages of the system. Furthermore, in organizations with a diverse or technologically unsophisticated workforce, encouraging consistent use of the new system and ensuring it meets various user needs without complicating the existing workflow can be particularly daunting.

Market Segmentation by Component

In the time & attendance management software market, the segmentation by component includes Software and Services. The Software segment holds the highest revenue and is projected to witness the highest CAGR. This trend is driven by the core necessity of time & attendance software in automating the tracking of employee hours and integrating these data with payroll and HR systems. As businesses increasingly recognize the efficiency gains from automating time tracking, the demand for reliable and scalable software solutions continues to grow. Additionally, software solutions are evolving to include more features such as mobile applications, real-time analytics, and customized reporting, enhancing their value proposition and driving further adoption. The Services segment, which includes installation, training, and support services, also plays a crucial role in the market. However, as software becomes more user-friendly and companies become more accustomed to implementing IT solutions independently, the relative growth in services may moderate compared to the software segment.

Market Segmentation by Deployment

Regarding deployment, the time & attendance management software market is segmented into On-premise and Cloud-based solutions. The Cloud segment is experiencing the highest revenue and is expected to grow at the highest CAGR. This surge is attributed to the cloud’s scalability, cost-effectiveness, and flexibility, which are particularly appealing to small and medium-sized enterprises (SMEs). Cloud deployment allows businesses to avoid the high upfront costs associated with on-premise software and reduces the need for in-house IT maintenance and support. Additionally, cloud-based solutions offer remote accessibility, an essential feature for companies supporting hybrid and remote work models, making it easier to manage a geographically dispersed workforce. In contrast, the On-premise segment is growing at a slower pace as it typically requires more significant initial investments and ongoing maintenance, making it less attractive to businesses seeking agility and minimal operational disruption.

Geographic Segment

The time & attendance management software market has exhibited notable geographic trends, with North America leading in both highest revenue and highest CAGR as of 2025. This dominance is largely attributed to the advanced IT infrastructure, widespread adoption of modern work practices, and the presence of major technology players in the region. Companies in North America have been quick to adopt new technologies to enhance operational efficiency and comply with complex labor laws, driving the demand for sophisticated time & attendance solutions. Europe follows closely, driven by similar factors, including stringent labor regulations and a strong focus on enhancing workforce management. Asia Pacific is also experiencing rapid growth, fueled by increasing industrialization, the expansion of multinational companies into the region, and growing awareness about the benefits of workforce automation in emerging economies like China and India.

Competitive Trends

In 2025, the competitive landscape of the time & attendance management software market was shaped by the activities of key players such as SAP SE, FingerCheck, NETtime Solutions, ADP, Inc., Oracle Corporation, Reflexis Systems Inc., Replicon, Ultimate Kronos Group (UKG), Paycor, Paycom Software, Inc., Rippling, Civica, Ramco Systems, Workday, Inc., Ceridian HCM, and ATOSS. These companies focused on leveraging advanced technologies such as cloud computing, artificial intelligence, and machine learning to enhance the functionality and user experience of their solutions. They aimed to provide more integrated and intuitive systems that could handle complex timekeeping needs across various industries and regions. Strategic partnerships, mergers, and acquisitions were common as companies sought to expand their market reach and enhance their technological capabilities. From 2026 to 2034, these companies are expected to continue innovating and expanding their global footprints. There will likely be an increased emphasis on creating more flexible and scalable solutions that can easily adapt to changing work environments, such as the growing trend of remote and hybrid work models. Additionally, as data privacy and security become more crucial, these companies will invest more in securing their systems and ensuring compliance with global data protection regulations, thereby reinforcing their commitment to safeguarding user data.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Time & Attendance Management Software market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Deployment

|

|

End-user

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report