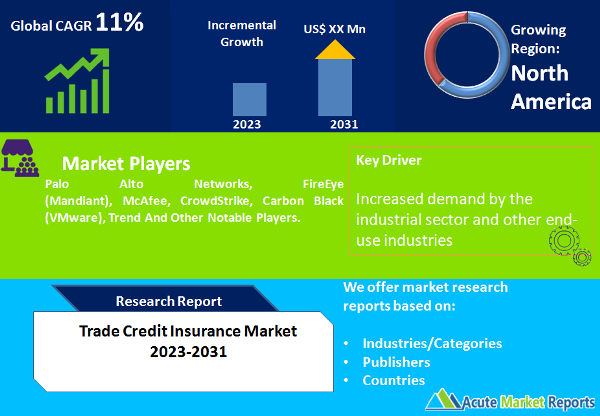

The trade credit insurance market is an essential component of the global trade ecosystem, providing financial protection to businesses against the risk of non-payment by their customers. This market offers coverage to companies engaged in domestic and international trade, safeguarding them from potential losses due to customer insolvency, bankruptcy, or protracted default. The market revenue of trade credit insurance has been steadily growing over the years, driven by increasing trade volumes, globalization, and the need for risk mitigation in uncertain economic conditions. While specific revenue figures may vary, the trade credit insurance market has demonstrated a positive growth trajectory. The CAGR of the trade credit insurance market is expected to grow at a CAGR of 11% during the forecast period of 2026 to 2034, reflecting the growing demand for risk management solutions in the business landscape. The CAGR indicates the average annual growth rate of market revenue over a specified period. Factors contributing to the robust CAGR of the trade credit insurance market include the expanding global trade network, the emergence of new markets and industries, and the recognition of the importance of protecting cash flows and minimizing credit risks. As businesses increasingly recognize the value of trade credit insurance in managing financial uncertainties, the demand for such insurance solutions continues to rise. In a highly interconnected global economy, the trade credit insurance market plays a crucial role in facilitating trade by providing reassurance to businesses and encouraging them to engage in commercial activities with confidence. It offers a range of services, including credit assessment, risk monitoring, debt collection, and indemnification against non-payment. By mitigating the risks associated with trade transactions, trade credit insurance enables businesses to expand their market reach, improve liquidity, and secure financing from lenders. It also helps businesses build stronger relationships with their customers by offering them credit terms while minimizing the potential impact of payment defaults.

Increasing Global Trade Volume

The trade credit insurance market is driven by the expansion of global trade volume. As international trade continues to grow, businesses face higher exposure to credit risks and non-payment from their customers. Trade credit insurance acts as a vital risk management tool, providing coverage against such risks and facilitating trade transactions. According to the World Trade Organization (WTO), global merchandise trade volume is projected to grow by around 8% in 2022 after a decline in 2021 due to the COVID-19 pandemic. This rebound in trade activity indicates the potential for increased demand for trade credit insurance as businesses seek to protect their receivables and mitigate credit risks.

Economic Uncertainty and Financial Instability

Economic uncertainties and financial instability are key drivers of the trade credit insurance market. In times of economic downturns, businesses face higher risks of customer insolvency, bankruptcy, and payment defaults. Trade credit insurance provides a safety net by indemnifying businesses against losses arising from such events. For instance, during the global financial crisis in 2008-2009, there was a surge in demand for trade credit insurance as businesses sought to safeguard their trade receivables amid a challenging economic environment. This trend highlights the crucial role of trade credit insurance in mitigating the impact of economic uncertainties and financial instability.

Focus on Risk Mitigation and Cash Flow Management

Businesses are increasingly recognizing the importance of risk mitigation and effective cash flow management. Trade credit insurance offers an effective solution for managing credit risks and ensuring a steady cash flow. By providing coverage against non-payment and supporting debt collection efforts, trade credit insurance helps businesses protect their financial stability and liquidity. This driver is particularly relevant for small and medium-sized enterprises (SMEs) that may have limited resources to absorb losses from unpaid invoices. According to a study by the International Trade Finance Survey, 62% of SMEs consider managing credit risk and cash flow as the primary benefit of trade credit insurance. The emphasis on risk mitigation and cash flow management positions trade credit insurance as a critical tool for businesses navigating the complexities of trade transactions and financial uncertainties.

Economic Volatility and Default Risks

One significant restraint affecting the trade credit insurance market is economic volatility and the associated default risks. Economic downturns, recessions, and financial crises can lead to increased business insolvencies and defaults on trade payments. Such challenging economic conditions make it more difficult for insurance providers to assess risks accurately and determine appropriate premium rates. Additionally, during periods of economic uncertainty, businesses may face difficulties in securing trade credit insurance coverage due to heightened risks and potential limitations imposed by insurance providers. For example, during the global financial crisis in 2008-2009, many insurance companies tightened their underwriting standards, resulting in reduced availability and increased premiums for trade credit insurance. This restraint is further exemplified by the impact of the COVID-19 pandemic on the trade credit insurance market, where insurers faced uncertainties in assessing risks due to widespread business disruptions and financial strains. The economic volatility and default risks associated with challenging economic conditions present a restraint to the trade credit insurance market, as insurers and businesses navigate the uncertainties and assess the potential impact on creditworthiness and payment capabilities.

Large Enterprises Dominate the Market by Enterprise Size

The trade credit insurance market can be segmented based on enterprise size, with a focus on large enterprises and small to medium enterprises (SMEs). Large enterprises, with their substantial trade volumes and global presence, contribute significantly to the revenue of the trade credit insurance market. These enterprises often engage in high-value transactions and have extensive supply chains, which increases their exposure to credit risks. By leveraging trade credit insurance, large enterprises can effectively manage these risks and protect their financial interests. Their ability to negotiate favorable terms and access comprehensive coverage options enables them to make the most of trade credit insurance offerings. With their higher revenue and greater risk exposure, large enterprises contributed significantly to the overall market revenue in 2025. On the other hand, SMEs represent a dynamic and diverse segment in the trade credit insurance market. Although their individual trade volumes may be smaller compared to large enterprises, the collective contribution of SMEs is substantial. SMEs often face resource constraints, limited access to financing, and higher vulnerability to customer defaults. Trade credit insurance plays a crucial role in enabling SMEs to participate in domestic and international trade by mitigating credit risks and providing financial protection. As a result, the SME segment is expected to exhibit a higher CAGR in the trade credit insurance market during the forecast period of 2026 to 2034. SMEs are increasingly recognizing the importance of protecting their cash flows and minimizing credit risks to ensure business continuity and growth.

Whole Turnover Coverage Dominates the Market by Coverage

The trade credit insurance market can be segmented based on coverage types, namely whole turnover coverage and single buyer coverage. Whole turnover coverage refers to insurance policies that provide comprehensive protection for an enterprise's entire portfolio of trade receivables. This type of coverage offers a broader scope and is suitable for businesses with multiple customers and a diverse range of transactions. Whole turnover coverage provides a holistic approach to managing credit risks, ensuring that businesses are safeguarded against the potential non-payment or insolvency of any customer within their portfolio. As a result, it contributes to the overall market revenue due to its broader coverage and appeal to enterprises of various sizes. Single buyer coverage, as the name suggests, focuses on insuring specific buyer accounts or transactions. This coverage type is particularly relevant for businesses that have a significant concentration of sales to a specific buyer or a limited number of key customers. By insuring individual buyer accounts, companies can mitigate the risk associated with default or non-payment from those specific customers. Single buyer coverage allows businesses to tailor their risk management strategy according to the unique characteristics of their customer base, offering targeted protection where it is most needed. Although the revenue contribution of single buyer coverage may be lower compared to whole turnover coverage, it is expected to exhibit a higher CAGR during the forecast period of 2026 to 2034, as more businesses recognize the importance of protecting key accounts and managing customer-specific risks.

North America remains the Global Leader

North America remained the dominant market in 2025, driven by the presence of a strong and developed economy. The region's focus on international trade, particularly in sectors such as manufacturing, technology, and services, contributes to the high revenue percentage in North America. Additionally, the region has a well-established insurance infrastructure and a mature credit market, which fosters the adoption of trade credit insurance. While North America demonstrates a steady growth rate, the highest CAGR is observed in emerging economies of the Asia-Pacific region. The Asia-Pacific region, with its growing economies and expanding trade activities, presents significant opportunities for the trade credit insurance market. Countries such as China, India, and Japan are witnessing increased industrialization, rapid urbanization, and growing exports, which drive the demand for trade credit insurance. The region's high CAGR during the forecast period of 2026 to 2034, can be attributed to the rising awareness of credit risks, the need for financial protection, and the emergence of small and medium-sized enterprises (SMEs) actively participating in international trade. As businesses in the Asia-Pacific region become more aware of the benefits of trade credit insurance, the market is expected to experience substantial growth.

Market Competition to Intensify During the Forecast Period

The trade credit insurance market is highly competitive, with several key players operating globally and striving to capture a significant market share. These players employ various strategies to strengthen their market position and meet the evolving needs of businesses. Overall, the market outlook is characterized by intense competition, technological advancements, strategic partnerships, and a focus on offering comprehensive and tailored trade credit insurance solutions. Some of the top players in the trade credit insurance market include Euler Hermes, Coface, Atradius, and Zurich Insurance Group. These companies have established themselves as market leaders through their extensive experience, global presence, and strong customer base. They offer a wide range of trade credit insurance products and services to cater to the diverse needs of businesses across different industries. Furthermore, players in the trade credit insurance market focus on offering customized solutions to address the evolving needs of businesses. They provide flexible coverage options, such as whole turnover and single buyer coverage, to cater to different trade volumes and customer profiles. Tailored risk management solutions, including credit limit monitoring, debt collection services, and trade intelligence, further enhance the value proposition for businesses seeking trade credit insurance.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Trade Credit Insurance market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Enterprise Size

|

|

Coverage

|

|

Application

|

|

End-use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report