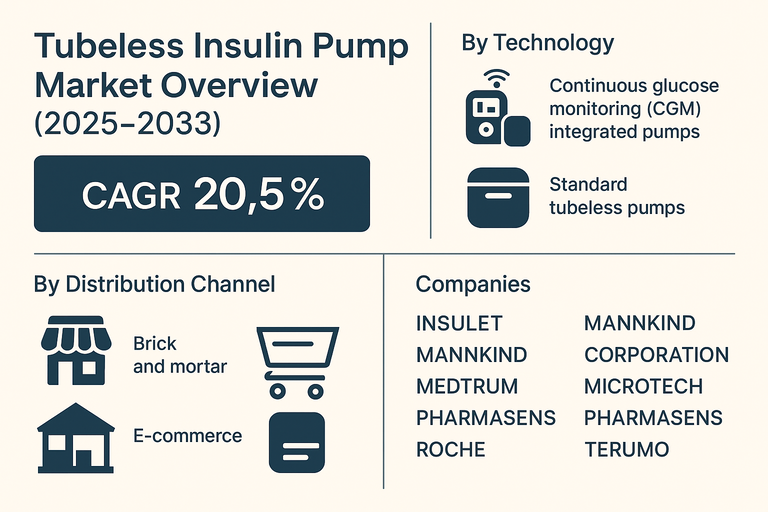

The global tubeless insulin pump market is projected to grow at a CAGR of 20.5% from 2025 to 2033, driven by rising prevalence of diabetes, patient demand for more comfortable and discreet insulin delivery solutions, and continuous advancements in wearable healthcare technologies. Tubeless insulin pumps, also known as patch pumps, eliminate the need for traditional tubing by adhering directly to the skin and providing continuous subcutaneous insulin infusion. Their ease of use, reduced visibility, and integration with digital monitoring platforms are significantly improving patient adherence and outcomes compared to conventional insulin delivery systems.

Rising Demand for Convenience and Integration

Growing global diabetes incidence, coupled with increased focus on lifestyle-friendly treatment options, is fueling the adoption of tubeless insulin pumps. Patients are increasingly preferring compact, wearable devices that minimize inconvenience while offering precise insulin delivery. Continuous glucose monitoring (CGM) integration with tubeless pumps is revolutionizing diabetes management by enabling real-time insulin adjustments and reducing dependence on manual intervention. Increasing smartphone connectivity, cloud-based monitoring, and AI-driven dose adjustment algorithms are further strengthening adoption across both developed and emerging markets.

Challenges: High Costs and Limited Awareness

Despite strong growth, adoption is challenged by the high costs of tubeless pumps, which limit penetration in price-sensitive regions. Reimbursement barriers in several healthcare systems restrict patient accessibility, particularly for advanced CGM-integrated pumps. Technical limitations such as adhesive durability, shorter wear time, and insulin capacity constraints also impact patient experience. Limited awareness among healthcare professionals and patients in certain regions further slows uptake. However, ongoing technological improvements, broader reimbursement coverage, and increased patient education campaigns are expected to overcome these challenges and sustain long-term growth.

Market Segmentation by Technology

By technology, the market is divided into continuous glucose monitoring (CGM) integrated pumps and standard tubeless pumps. In 2024, CGM-integrated pumps held the largest share due to their ability to provide real-time glucose data and support automated insulin adjustments. These systems improve glycemic control and reduce the risk of hypoglycemia, making them highly attractive for Type 1 diabetes patients. Standard tubeless pumps remain relevant for patients seeking simpler and more cost-effective solutions, particularly in regions with lower reimbursement penetration.

Market Segmentation by Distribution Channel

By distribution channel, the market is segmented into brick and mortar and e-commerce. Brick-and-mortar channels, including hospitals, clinics, and pharmacies, currently dominate due to the need for physician guidance and training during device adoption. However, e-commerce platforms are growing rapidly, supported by rising digital health adoption, direct-to-consumer sales strategies, and subscription-based supply models for consumables. The shift toward online channels is expected to accelerate as awareness of tubeless insulin pumps spreads globally.

Regional Insights

In 2024, North America led the tubeless insulin pump market, supported by strong adoption of wearable technologies, favorable reimbursement policies, and high prevalence of Type 1 diabetes. Europe followed, with Germany, the UK, and France driving uptake through healthcare innovation and patient-centric diabetes management programs. Asia Pacific is the fastest-growing region, led by China, India, and Japan, where rising diabetes incidence and growing investments in digital healthcare solutions are creating strong adoption potential. Latin America and Middle East & Africa (MEA) are emerging markets where rising urbanization, increasing healthcare expenditure, and growing access to advanced diabetes technologies are gradually expanding opportunities.

Competitive Landscape

The 2024 market was dominated by specialized medtech companies focused on innovation and integration. Insulet remains the leader with its Omnipod system, widely adopted across global markets for its ease of use and CGM compatibility. MannKind Corporation and Medtrum are strengthening their positions with next-generation patch pumps and hybrid solutions. MicroTech and Pharmasens are emerging players innovating in affordable tubeless solutions and patient-centric design. Roche and TERUMO leverage their strong healthcare portfolios and global distribution networks to expand presence in insulin delivery. Competitive differentiation is being driven by device miniaturization, CGM integration, AI-powered automation, affordability, and patient adherence support, ensuring rapid evolution of the competitive landscape.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Tubeless Insulin Pump market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Technology

| |

Distribution Channel

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report