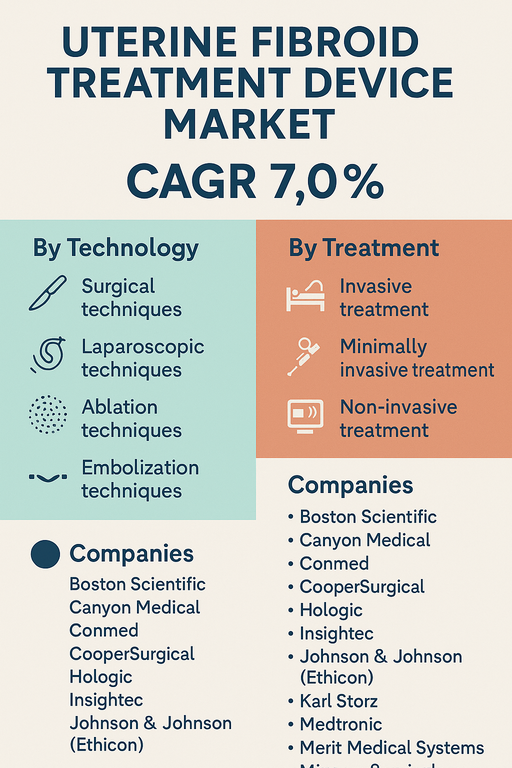

The global uterine fibroid treatment device market is projected to grow at a CAGR of 7.0% from 2025 to 2033. Growth is primarily driven by rising incidence of uterine fibroids among women of reproductive age, increasing demand for minimally invasive and non-invasive treatment options, and greater awareness regarding fibroid-related complications such as infertility, heavy bleeding, and pelvic pain. As healthcare providers aim to improve patient outcomes and reduce hospital stays, demand for innovative fibroid management technologies continues to rise across global healthcare systems.

Market Drivers

Increasing Preference for Minimally and Non-Invasive Treatment Options

Globally, there is a significant shift toward uterine fibroid treatment options that offer reduced recovery times, lower complication rates, and preservation of fertility. Techniques such as laparoscopic myomectomy, MR-guided focused ultrasound (MRgFUS), and uterine artery embolization (UAE) are gaining popularity over traditional hysterectomy. As awareness increases and reimbursement frameworks improve, adoption of less-invasive devices is expected to accelerate, particularly in outpatient and ambulatory surgical settings.

Rising Prevalence and Awareness of Uterine Fibroids

Up to 70–80% of women develop fibroids by the age of 50, though only a subset require treatment. Rising diagnosis rates enabled by increased use of pelvic imaging and proactive gynecological consultations are expanding the patient pool eligible for device-based treatments. In addition, awareness campaigns by medical organizations and patient advocacy groups are encouraging earlier intervention, particularly among women prioritizing uterine preservation and fertility outcomes.

Market Restraint

High Cost of Advanced Treatment Devices and Limited Access in Low-Income Regions

Despite clinical benefits, the high upfront cost of advanced treatment systems (e.g., laparoscopic tools, robotic platforms, or MRgFUS devices) poses a barrier, particularly in developing markets. Additionally, limited access to trained specialists, inadequate reimbursement in certain healthcare systems, and infrastructural limitations restrict wider adoption of device-based uterine fibroid therapies in underserved regions.

Market Segmentation by Technology

By technology, the market is segmented into Surgical Techniques, Laparoscopic Techniques, Ablation Techniques, and Embolization Techniques. In 2024, surgical techniques, including myomectomy and hysterectomy, remained dominant due to their definitive nature and broad availability. However, laparoscopic and ablation techniques are projected to witness faster growth through 2033, supported by advancements in minimally invasive devices, real-time imaging, and robotics. Embolization techniques, such as uterine artery embolization (UAE), continue to gain clinical acceptance for fibroid volume reduction without surgical intervention.

Market Segmentation by Treatment Type

By treatment, the market includes Invasive, Minimally Invasive, and Non-Invasive Treatments. In 2024, minimally invasive treatment dominated the market, driven by patient preference for uterus-sparing procedures with faster recovery. Non-invasive treatments, such as high-intensity focused ultrasound (HIFU), are expected to grow at the fastest pace, though their adoption is currently limited to specialized centers. Invasive treatments, such as hysterectomy, still account for a significant share in regions where other modalities are less accessible or not reimbursed.

Geographic Trends

In 2024, North America led the uterine fibroid treatment device market due to well-established healthcare infrastructure, high diagnostic rates, and strong presence of key device manufacturers. Europe followed, particularly in countries like Germany, the UK, and France, where access to minimally invasive gynecologic procedures is expanding. The Asia Pacific region is expected to witness the highest CAGR from 2025 to 2033, with rising women’s health awareness, expanding hospital infrastructure, and increasing disposable income in markets such as China, India, and South Korea. Latin America and MEA show growing potential through public-private healthcare partnerships and mobile health clinics focused on women’s health screening and care.

Competitive Trends

The uterine fibroid treatment device market is moderately consolidated, with companies focusing on innovation, clinical validation, and expanding global reach. In 2024, Hologic, Boston Scientific, and Johnson & Johnson (Ethicon) led the market with strong portfolios in surgical and minimally invasive gynecology. Medtronic, Conmed, and Karl Storz provided laparoscopic tools and advanced visualization systems. Insightec and Nesa Medtech stood out for non-invasive focused ultrasound technologies. Minerva Surgical and CooperSurgical focused on endometrial ablation and intrauterine treatment systems. Olympus, Mindray, and Terumo Corporation enhanced market coverage with diagnostic and interventional solutions tailored to emerging markets. Key strategies include product miniaturization, fertility-preserving technologies, and AI-enabled procedural guidance for enhanced precision and patient outcomes.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Uterine Fibroid Treatment Device market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Technology

| |

Treatment

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report