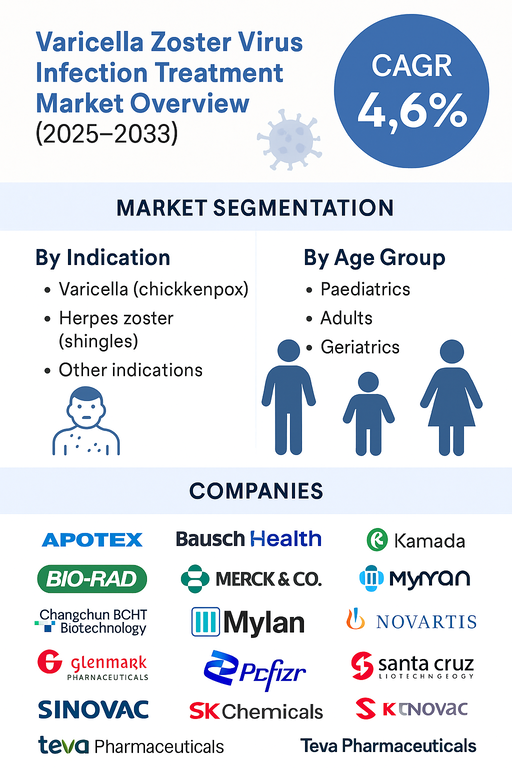

The global varicella zoster virus (VZV) infection treatment market is projected to expand at a CAGR of 4.6% from 2025 to 2033, driven by rising vaccination programs, increasing awareness of viral infections, and growing elderly populations vulnerable to shingles. VZV, the causative agent of varicella (chickenpox) and herpes zoster (shingles), continues to present significant public health challenges, particularly in developing countries with limited vaccine penetration. Growing investments in antiviral therapies and immunization campaigns are shaping the market outlook.

Increasing Vaccination Coverage and Antiviral Use Driving Growth

The adoption of varicella and zoster vaccines is expanding globally, driven by government immunization programs and the rising demand for preventive healthcare. Advanced antiviral medications are also playing a crucial role in managing VZV infections, reducing symptom severity, and preventing complications such as post-herpetic neuralgia. Rising geriatric populations in North America, Europe, and Asia Pacific are fueling demand for shingles vaccines, with ongoing clinical research focusing on improving vaccine efficacy and extending immunity duration.

Limited Access and Safety Concerns as Challenges

Despite positive growth prospects, challenges persist due to limited vaccine access in low-income countries, high costs of advanced treatments, and safety concerns regarding immunocompromised patients. Vaccination hesitancy in certain regions further restricts coverage. Additionally, patent expirations of branded antivirals and vaccines may increase competition from generics, pressuring pricing strategies. However, increasing R&D in novel vaccine technologies, such as recombinant subunit and mRNA vaccines, is expected to provide long-term opportunities.

Market Segmentation by Indication

The market is segmented into varicella (chickenpox), herpes zoster (shingles), and other indications. In 2024, herpes zoster (shingles) accounted for the largest share, driven by rising cases among the aging population. Varicella remained significant in pediatric populations, particularly in countries where vaccination programs are still expanding. The others category includes complications such as post-herpetic neuralgia and ophthalmic zoster, which are gaining attention due to their impact on quality of life.

Market Segmentation by Age Group

By age group, the market is divided into paediatrics, adults, and geriatrics. In 2024, geriatrics held the largest share, driven by higher susceptibility to shingles and vaccine recommendations for elderly populations. Paediatrics remained a major segment due to ongoing chickenpox vaccination programs. Adults accounted for steady demand, especially in cases requiring shingles vaccination in middle-aged populations.

Regional Insights

In 2024, North America dominated the VZV treatment market, with strong vaccination programs in the U.S. and Canada, alongside high healthcare spending. Europe followed, with increasing adoption of shingles vaccines in countries such as Germany, France, and the UK. Asia Pacific is emerging as the fastest-growing market, with China, India, and Japan expanding immunization programs and pharmaceutical investments. Latin America and Middle East & Africa remain underpenetrated but represent growth potential with government-backed healthcare initiatives.

Competitive Landscape

The 2024 market featured both multinational pharmaceutical giants and regional biotech players. Merck & Co., GlaxoSmithKline, Pfizer, and Novartis led the global market with strong vaccine and antiviral portfolios. Sinovac, SK Chemicals, and Changchun BCHT Biotechnology played critical roles in regional vaccine production, particularly in Asia. Bausch Health, Glenmark Pharmaceuticals, Teva Pharmaceuticals, and Apotex supported antiviral drug offerings and generics. Sandoz, Kamada, and Mylan contributed to affordable treatment options across emerging markets. Bio-Rad Laboratories and Santa Cruz Biotechnology provided diagnostic and research solutions supporting clinical management and drug discovery. Competitive strategies are shaped by vaccine innovation, affordability, and global immunization partnerships.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Varicella Zoster Virus Infection Treatment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Treatment Type

| |

Indication

| |

Age Group

| |

Product Type

| |

Route of Administration

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report