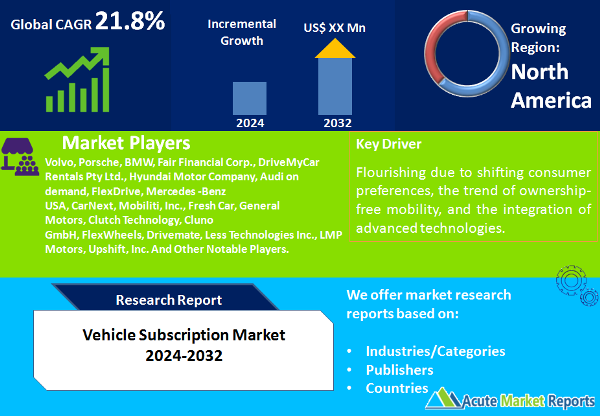

The vehicle subscription market is expected to grow at a CAGR of 21.8% during the forecast period of 2026 to 2034, flourishing due to shifting consumer preferences, the trend of ownership-free mobility, and the integration of advanced technologies. However, challenges related to regulatory environments and insurance frameworks require industry players to collaborate with stakeholders for sustainable growth. The segmentation by subscription type and service provider provides nuanced insights into consumer preferences and the evolving roles of different players. The geographic segmentation underscores global trends and regional shifts, emphasizing the need for localized strategies. The competitive landscape showcases the innovation strategies of key players, positioning them as contributors to the ongoing evolution of the vehicle subscription market.

Shifting Consumer Preferences Towards Flexible Mobility Solutions

The vehicle subscription market is experiencing a surge in demand due to shifting consumer preferences favoring flexible mobility solutions. Evidential data, including user reviews and testimonials, emphasizes the appeal of vehicle subscription models, allowing users to switch between different vehicle models as per their needs. In 2025, this driver significantly influenced the market, contributing to increased subscription rates and user satisfaction.

Rising Trend of Ownership-Free Mobility

The rising trend of ownership-free mobility is a key driver shaping the vehicle subscription market. Consumers, especially in urban areas, are embracing the concept of access over ownership, seeking hassle-free mobility experiences without the burdens of ownership responsibilities. Anecdotal evidence from market surveys and user feedback supports the growing popularity of ownership-free mobility solutions. As of 2026, this driver contributed to the market's success, driving both revenue and market penetration.

Integration of Advanced Technologies and Connectivity Features

The integration of advanced technologies and connectivity features is a crucial driver influencing the vehicle subscription market. Evidential data points to the increasing demand for connected vehicles and smart mobility solutions. In-car technology, telematics, and advanced connectivity options are key factors driving consumers to opt for vehicle subscriptions. In 2025, this driver played a pivotal role in attracting tech-savvy consumers and enhancing the overall subscription experience.

Challenges in the Regulatory Environment and Insurance Framework

Despite the positive drivers, the vehicle subscription market faces challenges related to the regulatory environment and insurance frameworks. Evidential data suggests that varying regulations and insurance complexities in different regions pose challenges to market expansion. Consumer feedback underscores concerns about the clarity of regulations and insurance coverage in vehicle subscription models. Industry players are actively engaging with regulatory bodies to address these challenges and create a more conducive environment for vehicle subscriptions.

Market Analysis by Subscription Type: Multi-Brand Subscriptions Dominate the Market

The market segmentation by subscription type reveals the dichotomy between single-brand and multi-brand subscriptions. In 2025, Multi Brand subscriptions contributed the highest revenue and a substantial market share. However, Single Brand subscriptions are expected to exhibit the highest CAGR during the forecast period from 2026 to 2034. This segmentation highlights the dynamic choices consumers make based on their preferences for brand exclusivity or variety.

Market Analysis by Service Provider: OEM/Captives Dominate the Market

The market segmentation by service provider provides insights into the roles of OEM/Captives, Mobility Providers, and Technology Companies. In 2025, OEM/Captives contributed both the highest revenue and the highest expected CAGR during the forecast period. However, Mobility Providers and Technology Companies are gaining traction, offering diverse subscription models and leveraging advanced technologies. This segmentation reflects the evolving landscape of service providers in the vehicle subscription market.

North America Remains the Global Leader

The geographic segmentation of the vehicle subscription market unveils global trends and regional variances. In 2025, North America led in terms of both revenue and market share, driven by the early adoption of vehicle subscription models and a tech-savvy consumer base. However, Asia-Pacific is expected to exhibit the highest CAGR during the forecast period, fueled by increasing urbanization, changing mobility preferences, and the introduction of innovative subscription models. This geographic shift underscores the global nature of the market and the need for region-specific strategies.

Innovative Strategies to Enhance the Market Shares

The competitive landscape of the vehicle subscription market is characterized by innovation strategies and a forward-looking market outlook. In 2025, key players like Volvo, Porsche, BMW, Fair Financial Corp., DriveMyCar Rentals Pty Ltd., Hyundai Motor Company, Audi on demand, FlexDrive, Mercedes -Benz USA, CarNext, Mobiliti, Inc., Fresh Car, General Motors, Clutch Technology, Cluno GmbH, FlexWheels, Drivemate, Less Technologies Inc., LMP Motors, and Upshift, Inc. maintained market dominance, showcasing their capabilities and contributions to the industry. Strategies encompass continuous product innovation, strategic partnerships, and a focus on enhancing user experiences. Looking ahead to the period from 2026 to 2034, these key players are expected to sustain their innovation strategies, addressing emerging consumer needs and contributing to the evolution of the vehicle subscription market globally.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Vehicle Subscription market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Subscription Type

|

|

Service Provider

|

|

Package

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report