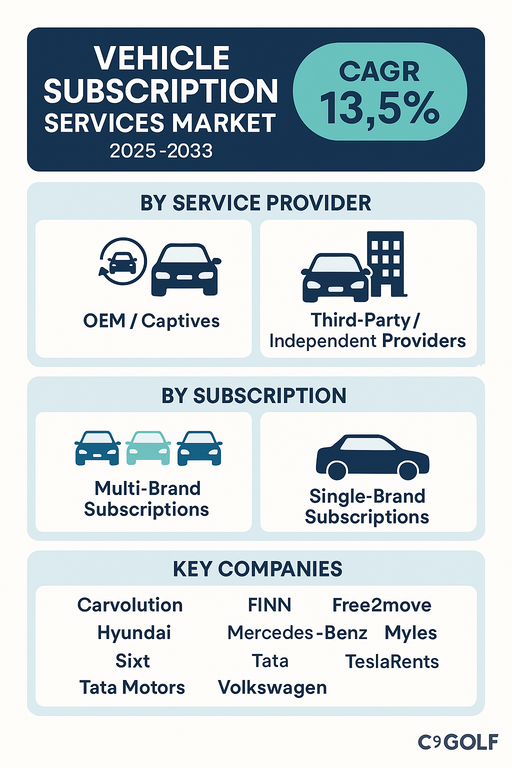

The global vehicle subscription services market is projected to grow at a CAGR of 13.5% from 2025 to 2033, fueled by shifting consumer preferences toward flexible mobility solutions, growing digital platforms for car access, and increasing urban adoption of shared and subscription-based models. Vehicle subscription services allow customers to pay a recurring fee to access a car without the long-term financial commitment of ownership or leasing. This model offers bundled benefits such as insurance, maintenance, and roadside assistance, appealing to urban consumers, younger demographics, and businesses seeking cost-efficient fleet solutions.

Rising Demand for Flexibility and Mobility-as-a-Service

The adoption of vehicle subscription services is increasing due to the growing demand for flexibility and convenience in mobility. Unlike traditional ownership or leasing, subscription models allow customers to switch vehicles, adjust subscription terms, and avoid large upfront costs. Urbanization, rising disposable incomes, and growing digital literacy are accelerating uptake globally. OEMs are increasingly entering the subscription space to strengthen customer retention, while independent providers focus on multi-brand offerings to attract diverse consumer groups.

Challenges: Profitability and Market Awareness

Despite strong growth potential, the market faces challenges in achieving sustainable profitability due to high operational costs, depreciation risks, and complex logistics of fleet management. Limited awareness of subscription benefits, particularly in emerging markets, also slows adoption. Furthermore, regulatory complexities and competition from leasing and car-sharing models add to market pressures. However, increasing investments by OEMs, expansion of digital platforms, and integration with broader mobility-as-a-service (MaaS) ecosystems are expected to address these barriers.

Market Segmentation by Service Provider

By service provider, the market is segmented into OEM/captives and third-party/independent providers. OEMs and captives, such as Hyundai, Mercedes-Benz, Tata Motors, and Volkswagen, are leveraging subscriptions to build long-term relationships with customers and promote brand loyalty. Third-party providers like Carvolution, FINN, Sixt, and Myles dominate multi-brand offerings, providing consumers with more choice and flexibility. TeslaRents and Free2move are examples of niche providers targeting specific customer groups and markets.

Market Segmentation by Subscription

By subscription type, the market is divided into multi-brand subscriptions and single-brand subscriptions. Multi-brand subscriptions are growing rapidly due to their ability to cater to diverse customer needs, enabling users to switch between different models and brands. Single-brand subscriptions remain significant, particularly for OEMs using them as a brand loyalty and customer acquisition tool. Premium automakers like Mercedes-Benz and Tesla are advancing single-brand subscription models with tech-driven personalization.

Regional Insights

In 2024, Europe led the vehicle subscription services market, with countries like Germany, France, and the UK adopting subscription models at scale due to digital mobility initiatives and strong OEM presence. North America followed, driven by high urban adoption and subscription programs launched by both OEMs and startups. Asia Pacific is expected to grow at the fastest pace, led by India, China, and Southeast Asia, where urban millennials and Gen Z consumers are embracing mobility-as-a-service. Latin America and Middle East & Africa (MEA) remain emerging markets, with gradual adoption supported by growing internet penetration and evolving mobility infrastructure.

Competitive Landscape

The 2024 market included a mix of OEM-led initiatives and independent subscription platforms. Carvolution and FINN are key European players offering multi-brand subscription services with strong customer bases. Free2move, backed by Stellantis, expands its presence with integrated mobility offerings. Hyundai, Mercedes-Benz, Tata Motors, and Volkswagen leverage subscriptions to enhance customer engagement and promote their fleets. TeslaRents focuses on electric vehicle subscription solutions, aligning with the EV adoption trend. Sixt and Myles maintain strong independent presence, offering flexible terms across regions. Competitive differentiation is being driven by pricing strategies, digital platform efficiency, vehicle variety, and integration with broader mobility ecosystems.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Vehicle Subscription Services market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Service Provider

| |

Subscription

| |

Subscription Period

| |

Vehicle

| |

End Use

| |

Fuel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report