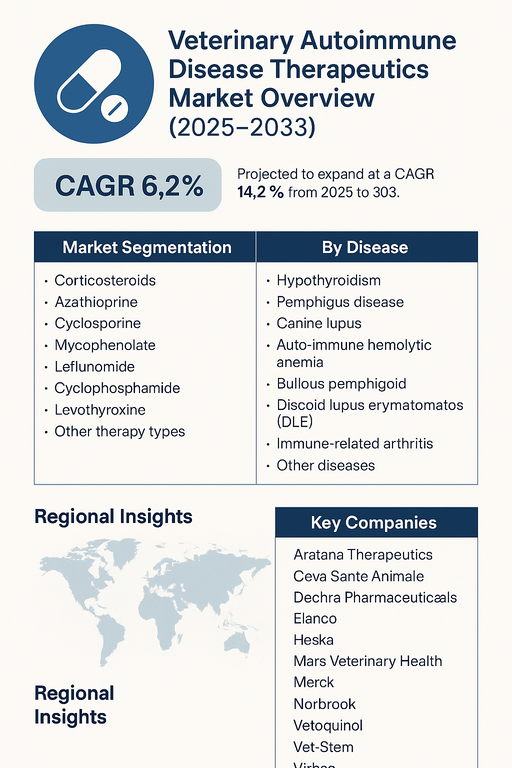

The global veterinary autoimmune disease therapeutics market is projected to grow at a CAGR of 6.2% from 2025 to 2033. Growth is primarily driven by the rising prevalence of autoimmune disorders in companion animals, increasing pet adoption, and heightened awareness among veterinarians and pet owners regarding early diagnosis and treatment. As autoimmune diseases in animals often lead to chronic health issues and reduced quality of life, demand for targeted and effective therapeutics is increasing.

Rising Pet Ownership and Expanding Veterinary Care Fueling Growth

The growing trend of humanization of pets and rising expenditure on veterinary healthcare are supporting the adoption of advanced autoimmune therapeutics. Common diseases such as hypothyroidism, pemphigus, and canine lupus are increasingly diagnosed due to improved diagnostic technologies. Therapeutics including corticosteroids, cyclosporine, and mycophenolate remain first-line treatments, while newer immunosuppressive and targeted therapies are expanding treatment options. Veterinary clinics, specialty hospitals, and research institutions are adopting combination therapies to improve long-term disease management.

Market Challenges: Limited Availability of Specialized Drugs

High treatment costs, limited availability of advanced therapeutics in emerging markets, and the risk of adverse drug reactions pose challenges to market expansion. In addition, autoimmune disease diagnostics in animals are often complex, leading to delayed treatments. However, rising R&D investments in veterinary pharmaceuticals, expansion of tele-veterinary services, and the introduction of biosimilars and generics are expected to reduce these barriers over time.

Market Segmentation by Therapy Type

By therapy type, the market includes corticosteroids, azathioprine, cyclosporine, mycophenolate, leflunomide, cyclophosphamide, levothyroxine, and other therapy types. Corticosteroids remain the most widely prescribed due to cost-effectiveness and efficacy in controlling inflammation. Cyclosporine and mycophenolate are increasingly adopted for long-term management with fewer side effects, while levothyroxine dominates hypothyroidism treatment. Azathioprine, leflunomide, and cyclophosphamide support niche applications in severe or resistant cases.

Market Segmentation by Disease

By disease, the market is segmented into hypothyroidism, pemphigus disease, canine lupus, autoimmune hemolytic anemia, bullous pemphigoid, discoid lupus erythematosus (DLE), immune-related arthritis, and other diseases. Hypothyroidism holds the largest share due to its high prevalence in dogs, particularly in middle-aged breeds. Pemphigus and canine lupus are steadily treated with immunosuppressive drugs, while autoimmune hemolytic anemia and DLE require aggressive therapeutic approaches. Immune-related arthritis is an emerging focus, reflecting the aging pet population and growing demand for chronic care management.

Regional Insights

In 2024, North America led the market due to high pet ownership, advanced veterinary care infrastructure, and strong presence of leading pharmaceutical companies. Europe followed, supported by comprehensive veterinary healthcare frameworks and insurance coverage for companion animals. Asia Pacific is the fastest-growing region, with rising disposable incomes, increasing pet adoption in urban centers, and expanding veterinary hospitals in China, India, and Japan. Latin America and Middle East & Africa (MEA) are emerging regions, where growing awareness and expanding private veterinary services are creating new opportunities despite affordability constraints.

Competitive Landscape

The 2024 market featured a mix of global veterinary pharmaceutical leaders and specialized biotech firms. Zoetis, Elanco, and Merck led with broad therapeutic portfolios and global distribution. Virbac, Ceva Santé Animale, Dechra Pharmaceuticals, and Vetoquinol strengthened positions in Europe and emerging markets with diversified autoimmune therapeutics. Aratana Therapeutics and Vet-Stem contributed niche biologic and regenerative solutions. Heska and Norbrook expanded through partnerships and cost-effective product lines, while Mars Veterinary Health leveraged its veterinary clinic network for broad therapeutic adoption. Competitive strategies center on expanding product pipelines, improving safety profiles, regional expansion, and strategic collaborations.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Veterinary Autoimmune Disease Therapeutics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Therapy Type

| |

Disease

| |

Animal Type

| |

Route of Administration

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report