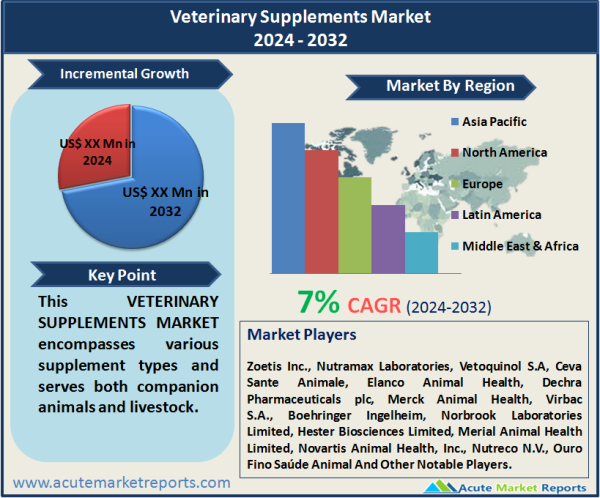

The veterinary supplements market, a critical component of animal healthcare, is poised for a CAGR of 7% during the forecast period of 2026 to 2034. This market encompasses various supplement types and serves both companion animals and livestock. It is influenced by several driving factors and one significant restraint. The veterinary supplements market is set for steady growth from 2026 to 2034, driven by various supplement types, animal types, and geographic trends. Regulatory challenges pose a significant restraint, emphasizing the need for compliance and safety measures. Competitive trends suggest that key players will continue to focus on innovation, partnerships, and global expansion in this dynamic and evolving industry.

Antioxidants Boost Animal Wellness

Antioxidants emerged as a prominent driver in the veterinary supplements market in 2025 and are expected to maintain their significance from 2026 to 2034. Antioxidant supplements, including vitamins C and E, selenium, and coenzyme Q10, play a crucial role in supporting animal wellness. They help combat oxidative stress and reduce the risk of chronic diseases in both companion animals and livestock. The segment's substantial revenue in 2025 reflects the growing awareness among pet owners and livestock producers about the benefits of antioxidants in enhancing animal health. Moreover, the antioxidant segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period, driven by the increasing adoption of preventive healthcare measures for animals.

Growing Emphasis on Livestock Nutrition

In 2025, the Livestock segment garnered the highest revenue in the veterinary supplements market, a trend expected to persist through 2034. This growth is primarily attributed to the rising global demand for high-quality meat and dairy products. To meet this demand, livestock producers are increasingly focusing on improving the nutrition and health of their animals. Livestock supplements, including vitamins, proteins, and amino acids, are integral to achieving these goals. The Livestock segment is projected to maintain a substantial CAGR during the forecast period, driven by the continuous efforts of farmers and ranchers to optimize animal nutrition and production efficiency.

Companion Animal Wellness and the Role of Probiotics

Probiotics gained prominence as drivers in the veterinary supplements market in 2025, primarily due to their role in enhancing the wellness of companion animals. Probiotic supplements are recognized for their positive effects on the digestive health of pets, helping to maintain a balanced gut microbiome. The rising pet ownership trend, coupled with a growing awareness of the importance of pet nutrition, fueled the demand for probiotics. The segment is anticipated to exhibit a robust CAGR during the forecast period (2026 to 2034) as pet owners continue to prioritize the overall health and well-being of their beloved animals.

Restraint in the veterinary supplements market

Despite the promising growth, one significant restraint in the veterinary supplements market is regulatory challenges and concerns regarding product safety and efficacy. Governments and regulatory bodies worldwide are increasingly scrutinizing the claims made by supplement manufacturers in the animal healthcare industry. Ensuring that supplements meet the required quality standards and that they deliver the expected benefits to animals is a complex and evolving process. The regulatory landscape can be a barrier to market entry for new players and can also lead to product recalls or discontinuations if compliance issues arise. Industry stakeholders need to invest in rigorous research and development, clinical trials, and compliance measures to navigate this restraint effectively and ensure the safety and efficacy of their products.

Market Segmentation by Supplement Type: Antioxidants Segment Dominates the Market

In 2025, within the veterinary supplements market, the highest revenue was generated by the Antioxidants segment, reflecting the growing awareness of their benefits in animal health. Antioxidant supplements, including vitamins C and E, selenium, and coenzyme Q10, play a crucial role in combating oxidative stress and reducing the risk of chronic diseases in both companion animals and livestock. This dominance is expected to continue through 2034, with the Antioxidants segment projected to exhibit the highest Compound Annual Growth Rate (CAGR). The anticipated growth is driven by the increasing adoption of preventive healthcare measures for animals, aligning with the growing trend of pet and livestock wellness.

Market Segmentation by Animal Type: Livestock Segment Dominates the Market

The Livestock segment led the veterinary supplements market in terms of both revenue and growth potential in 2025. This growth is attributed to the rising global demand for high-quality meat and dairy products. To meet this demand, livestock producers are increasingly focusing on improving the nutrition and health of their animals, driving the need for livestock supplements, including vitamins, proteins, and amino acids. This segment is projected to maintain its dominance from 2026 to 2034, supported by continuous efforts to optimize animal nutrition and production efficiency. Additionally, the Livestock segment is expected to have a substantial CAGR during the forecast period.

APAC Remains as the Global Leader

In terms of geographic trends, North America is expected to exhibit the highest CAGR during the forecast period (2026 to 2034). This growth is attributed to the increasing awareness of pet health and wellness and the growing demand for premium pet supplements. The Asia-Pacific region, particularly countries like China and India, is projected to maintain its position as the region with the highest revenue percentage as it was in 2025. The rising disposable income, urbanization, and a burgeoning middle-class population in these countries contribute to the continuous growth of the veterinary supplements market. Additionally, Europe is likely to show steady growth, reflecting the region's commitment to animal welfare and advanced veterinary healthcare practices.

Market Competition to Intensify During the Forecast Period

In 2025, the veterinary supplements market witnessed intense competition among key players. Companies such as Zoetis Inc., Nutramax Laboratories, Vetoquinol S.A, Ceva Sante Animale, Elanco Animal Health, Dechra Pharmaceuticals plc, Merck Animal Health, Virbac S.A., Boehringer Ingelheim, Norbrook Laboratories Limited, Hester Biosciences Limited, Merial Animal Health Limited, Novartis Animal Health, Inc., Nutreco N.V., and Ouro Fino Saúde Animal. were among the market leaders. These industry giants focused on strategies like product diversification, strategic partnerships with veterinary clinics, and expansion into emerging markets to maintain their market dominance. As we move into the forecast period from 2026 to 2034, it is expected that these players will continue to invest in research and development to introduce innovative and specialized supplements catering to the unique needs of animals. Moreover, digital marketing and e-commerce channels are likely to be leveraged to reach a broader customer base. The focus will remain on ensuring product safety and efficacy while meeting evolving consumer demands for natural and organic supplements.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Veterinary Supplements market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Supplement Type

|

|

Animal Type

|

|

Application / Benefit Area

|

|

Dosage Form

|

|

Distribution Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report