Industry Outlook

Immunization of livestock has been carried out worldwide for centuries and is also accepted as a cost effective measure of controlling infections. Until recently, vaccines were either live attenuated or inactivated organisms formulated with oil-based adjuvant; however these methods and formulations were not very effective. Introduction of gene delivery systems has rendered the development of novel therapeutic and prophylactic vaccines. Identification of vaccine candidates in genomic sequenced turned out to be a revolutionary approach, where it was assumed that antibodies easily access cell surface. Reverse vaccinology makes use of different bioinformatics algorithms for predicting antigen localization and is now successfully applied for immunization against a range of veterinary diseases.

Growing prevalence of animal diseases, increasing demand for companion animals worldwide are the prime drivers of the global veterinary vaccines market. Vaccination protects millions of animals from diseases and fatality. As the field of veterinary medicine is advancing, disease prevention has become a priority. Therefore, one of the best measures for disease prevention is enhancing animal immunity. Vaccination programmes for farm animals depends on management systems, farm location, and nature of herd or flock. Veterinary vaccines continue to play a major role in animal health protection and consequently ensuring public health and reduced use of antibiotics in animals. Some prominent veterinary vaccines include rinderpest and rabies vaccines. Rabies vaccines for domestic and wild animals have nearly eradicated the risk of human rabies. The Global Rinderpest Eradication Program that involved trade restrictiosn, surveillance and vaccination, has rendered significant reduction in incidence making it the second disease after small pox to be eradicated worldwide. Prominent examples of new technologies in animal vaccines which are licensed include DNA vaccines, virus-like particle vaccines, and recombinant modified live virus vaccines. Animal vaccines also make use of novel adjuvants that are not yet incorporated in human use. Furthermore, animal vaccines can also be developed and commercialized more quickly than human vaccines. Furthermore, for animal vaccine in order to effectively safeguard animal health, they should be widely used and therefore need to be affordable. Regulatory processes therefore, need to ensure product safety and efficacy without increasing the licensing and production costs.

"Live-attenuated Vaccines to Dominate the Global Market"

Live-attenuated vaccines based on genetic mutation are the most dominance segment in the global market. Better long-term immunity, inclusion of both cellular and humoral immunity, efficacy and targeting and ease of administration are the key factors that support the dominance of this segment. However, fact that live strains are not very effective, and need for refrigerated storage may restrain the market growth of this segment. Live attenuated vaccines are developed in two ways, either by combining attenuated animal of human virus strains; or by serial passage of initially pathogenic virus or bacteria and selection of less pathogenic strains that may induce protective immunity. These vaccines are believed to augment immunologic response similar to the response resulting from natural infection. Advantage of live-attenuated vaccine is from the replication of organism and antigen processing, mimicking natural infection, both cell-mediated and humoral. Such conferred immunity may also be long lasting or even lifelong.

"High Uptake for Pet/Companion Animals and Increased Healthcare Spending in this Group to Augment Market Growth"

At present, livestock, particularly porcine breeds occupy the largest share in consumption of veterinary vaccines. Increase in global consumption of livestock through meat and dairy products is the prime factor driving the dominance of this segment. As the global population is increasing the world is facing more mouths to feed with nutritional products, this has urged the food industry to enhance the production of farm animals. The purpose of using vaccines for livestock is increasing productivity and profitability of producers. Use of vaccination for zoonotic diseases in livestock is expected to eliminate or reduce the risk of transmission of these diseases to consumers while also protect industry animals. Large-scale use of nontherapeutic antibiotics in livestock has resulted in emergence of antibiotic resistant bacteria. Such issues have promoted increased use of vaccines in livestock animals. On the other hand, the growth rate of pet/companion animal vaccines is expected to be surpassing the overall market benchmark during the forecast period. In companion animal vaccines, canine vaccines hold the most prominent share and will assist in development of the market through the forecast period. Increased adoption of pet animals in the general population, heightened uptake in disabled patients, and increasing spending on scheduled wellbeing measures of such animals are the key factors facilitating the swift growth of this segment.

"Vaccines for Viral and Bacterial Infections Spearhead the Global Market"

At present there are no broad-spectrum antiviral medications available for veterinary purpose. Therefore employment of hygienic environment, limiting exposure, and vaccination are the only methods for prevention of viral infections in animals. RNA viruses are very variable and many of viral infections occur from viruses with different serotypes. Therefore, several of the currently available viral vaccines are not able to combat with infections of the prevailing strains. Several conventional inactivate and live-attenuated vaccines are being produced by veterinary health companies and are in the market for many decades as a part of routine vaccination protocol. Furthermore, many subunit and rationally designed vaccines are being introduced in the market. Several prophylactic live-attenuated or inactivated bacterial vaccines are available in the market. For a majority of attenuated bacterial strains, the form of attenuation is unknown and since there is no proven track record, researchers have done little to characterize the underlying genetics. However in some cases, the old live strains are not very protective and perpetual research is being conducted to develop new and improved vaccines strategies against diseases such as paratuberculosis, brucellosis and bovine tuberculosis.

"United States Leads the Global Veterinary Vaccines Market due to Greater Awareness and Supportive Business Environment"

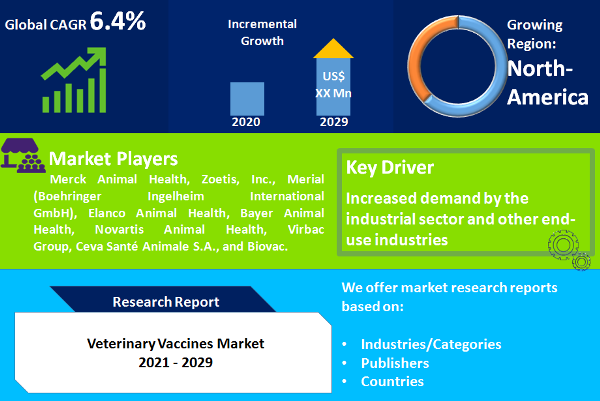

Geographically, North America, particularly the United States holds the largest revenue share in the global veterinary vaccines market. Enhanced and widespread vaccination programmes, increasing adoption of companion animals and greater awareness are the key factors supporting the dominance of this regional market. Furthermore, acceptance of advanced vaccines products such as DNA and recombinant vaccines is also significantly high in North America. Asia Pacific shall advance at the fastest growth rate during the forecast period from 2022 to 2030. The ownership of companion animals is perpetually growing in the region due to increasing disposable incomes. Livestock farming in Asia Pacific is also perpetually advancing in terms of animal healthcare and technologies. Countries such as India, China, Brazil and South Africa will be the fastest progressing country-level markets.

The report also presents insights on the competitive landscape prevalent in the global veterinary vaccines market along with profiling of key companies operating in the industry. Such major market players profiled in this report include Merck Animal Health, Zoetis, Inc., Merial (Boehringer Ingelheim International GmbH), Elanco Animal Health, Bayer Animal Health, Novartis Animal Health, Virbac Group, Ceva Santé Animale S.A., and Biovac.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Veterinary Vaccines market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Vaccine

|

|

Animal

|

|

Disease

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report