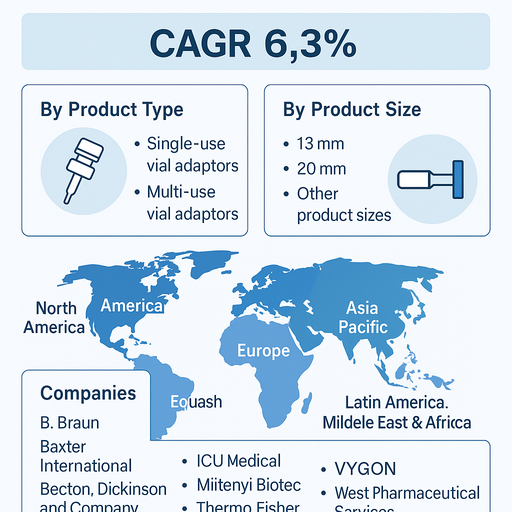

The global vial adaptors market is projected to grow at a CAGR of 6.3% from 2025 to 2033, driven by rising demand for safe and efficient drug reconstitution methods, increasing prevalence of chronic diseases, and the growing use of biologics and injectable therapies. Vial adaptors provide a closed, sterile system for accessing drug vials, reducing contamination risks and improving accuracy in drug delivery. They are increasingly used across hospitals, clinics, and home healthcare settings to streamline workflows, enhance patient safety, and comply with regulatory requirements for medication handling.

Rising Demand for Safety and Efficiency in Drug Preparation

The adoption of vial adaptors is growing as healthcare systems seek solutions that reduce needle-stick injuries, minimize contamination, and improve drug handling efficiency. The rise in biologics and cytotoxic drugs, which require precise and sterile reconstitution, is fueling demand. Single-use adaptors are especially popular due to their ability to prevent cross-contamination and simplify hospital workflows. Additionally, the global trend toward home-based treatments is creating opportunities for user-friendly vial adaptor solutions.

Challenges: Cost Constraints and Regulatory Barriers

Despite growth, the market faces challenges including cost sensitivity in price-conscious healthcare systems and limited awareness in emerging markets. Regulatory requirements for drug-device combination products add complexity for manufacturers, increasing approval timelines. Supply chain disruptions and raw material shortages also affect market stability. However, rising healthcare investments, expanded use of closed-system transfer devices (CSTDs), and ongoing product innovation are expected to offset these constraints.

Market Segmentation by Product Type

By product type, the market is divided into single-use and multi-use vial adaptors. Single-use adaptors dominate due to their widespread use in hospital and clinical settings, where sterility and contamination prevention are critical. Multi-use adaptors, though smaller in market share, are gaining traction in cost-sensitive regions and for specific use cases where multiple withdrawals from a vial are necessary.

Market Segmentation by Product Size

By product size, the market is segmented into 13 mm, 20 mm, and other product sizes. The 20 mm adaptors account for the largest share, as most drug vials used in hospitals and clinics follow this standard size. The 13 mm segment also holds significant demand, particularly in specialized therapies and smaller vial formats. Other product sizes cater to niche applications, ensuring compatibility across a wide range of vials.

Regional Insights

In 2024, North America led the vial adaptors market, supported by strong adoption of safety-engineered devices, advanced healthcare infrastructure, and regulatory emphasis on safe drug handling. Europe followed, with high uptake in countries such as Germany, France, and the UK, where healthcare systems prioritize patient safety. Asia Pacific is expected to grow the fastest, driven by increasing investments in healthcare infrastructure, rising prevalence of chronic diseases, and expanding access to advanced therapies in China, India, and Japan. Latin America and Middle East & Africa (MEA) are emerging markets with gradual adoption, supported by improving healthcare systems and rising awareness of safe drug administration practices.

Competitive Landscape

The 2024 market was characterized by a mix of global medtech leaders and specialized device manufacturers. Becton, Dickinson and Company (BD), West Pharmaceutical Services, and ICU Medical lead with comprehensive portfolios of vial access and closed-system solutions. Baxter International and B. Braun strengthen their presence with hospital-focused adaptor offerings integrated into broader drug delivery portfolios. EQUASHIELD and Yukon Medical specialize in closed-system transfer devices (CSTDs), addressing oncology and hazardous drug handling. Helapet, CODAN Medizinische Gerate, and VYGON serve regional markets with customized solutions. Miltenyi Biotec and Thermo Fisher Scientific target niche applications in life sciences and research laboratories. Competitive strategies emphasize product safety, compatibility with biologics, and compliance with stringent healthcare regulations.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Vial Adaptors market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Product Size

| |

Material

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report