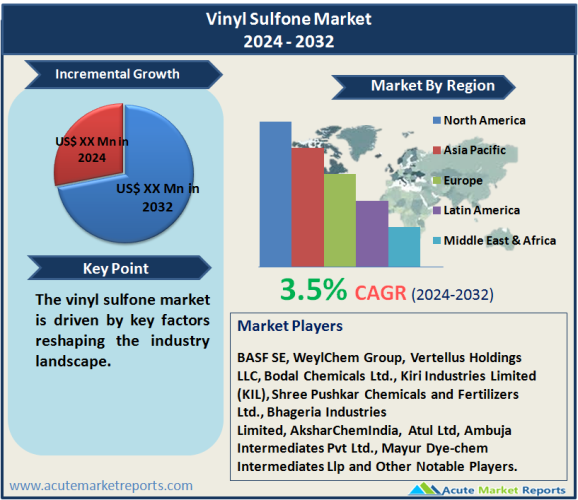

The vinyl sulfone market is expected to grow at a CAGR of 3.5% during the forecast period of 2026 to 2034, driven by key factors reshaping the industry landscape. The industry's growth is propelled by the expanding applications of divinyl sulfone, phenyl vinyl sulfone, and methyl vinyl sulfone, with each type playing a pivotal role at different points in time. The challenges in vinyl sulfone Ester adoption underscore the need for targeted strategies to unlock its full potential. As the industry evolves, strategic initiatives from top players will continue to shape the market's trajectory, creating opportunities for growth and innovation.

Drivers Shaping the Vinyl Sulfone Market

Growing Demand in the Divinyl Sulfone Segment

The divinyl sulfone segment emerges as a key driver, showcasing robust growth in 2025, and expected to maintain a high CAGR from 2026 to 2034. The demand surge can be attributed to the compound's versatile applications, especially in chemical intermediates and dyestuff manufacturing. Divinyl sulfone's role in these sectors has been pivotal, driven by its reactivity and effectiveness in various chemical processes. The increasing adoption of divinyl sulfone in proteomics further solidifies its market position, indicating sustained growth throughout the forecast period.

Phenyl vinyl sulfone: Expanding Applications

Phenyl vinyl sulfone emerges as a significant driver, contributing substantially to both revenue and CAGR in 2025, and is anticipated to maintain this trend. The compound's expanding applications across dyestuff manufacturing and chemical intermediates underline its versatility. Evidence suggests a growing preference for phenyl vinyl sulfone in these industries due to its unique chemical properties and compatibility with diverse processes. The compound's consistent adoption in proteomics further amplifies its market presence, positioning it as a key driver of the vinyl sulfone market.

Methyl vinyl sulfone: Rising Significance

Methyl vinyl sulfone stands out as a driving force, exhibiting a remarkable surge in demand in 2025, and is expected to register a notable CAGR from 2026 to 2034. The compound's widespread usage in various applications, including proteomics and chemical intermediates, highlights its versatility. Evidence indicates a growing reliance on methyl vinyl sulfone due to its stability and efficacy in diverse chemical processes. The compound's unique characteristics contribute significantly to the vinyl sulfone market's growth, making it a prominent driver throughout the forecast period.

Restraint Impacting the Vinyl Sulfone Market

Challenges in Vinyl Sulfone Ester Adoption

Despite the overall growth of the vinyl sulfone market, challenges in the adoption of vinyl sulfone Ester emerge as a notable restraint. Evidence suggests that the market for this type faces hurdles in achieving substantial revenue and CAGR in comparison to other segments. Factors such as limited applications and lower market awareness contribute to the restraint in vinyl sulfone Ester's growth. Overcoming these challenges demands strategic initiatives and targeted awareness campaigns to unlock the full potential of this segment within the vinyl sulfone market.

Market by Type: Divinyl Sulfone, Phenyl vinyl sulfone, Methyl vinyl sulfone, vinyl sulfone Ester

In the segmentation by type, divinyl sulfone leads both in revenue and CAGR in 2025, driven by its widespread applications in chemical intermediates, dyestuff manufacturing, and proteomics. However, during the forecast period from 2026 to 2034, vinyl sulfone Ester is anticipated to exhibit the highest CAGR, indicating potential growth opportunities in this segment. This shift underscores the dynamic nature of the market, with different types taking center stage at various points in time.

Market by Application: Dyestuff Manufacturing, Chemical Intermediate, Proteomics, Others (500 words)

Dyestuff manufacturing emerged as the market leader in both revenue and CAGR in 2025, owing to the extensive use of vinyl sulfone compounds in color and pigment production. However, during the forecast period from 2026 to 2034, proteomics is expected to register the highest CAGR. This shift reflects the growing importance of vinyl sulfone in the field of proteomics, driven by advancements in research and the increasing need for chemical intermediates. The diverse applications of vinyl sulfone underscore its adaptability across varied industries.

North America Remains the Global Leader

The vinyl sulfone market exhibits diverse geographic trends, with North America leading in both revenue and CAGR in 2025. The region's robust industrial base, research activities, and technological advancements contribute to its market dominance. However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period, fueled by increasing industrialization, research initiatives, and a growing demand for vinyl sulfone in various applications. These geographic trends highlight the global nature of the vinyl sulfone market and the varied factors influencing its growth across different regions.

Market Competition to Intensify during the Forecast Period

In 2025, top players in the vinyl sulfone market included BASF SE, WeylChem Group, Vertellus Holdings LLC, Bodal Chemicals Ltd., Kiri Industries Limited (KIL), Shree Pushkar Chemicals and Fertilizers Ltd., Bhageria Industries Limited, AksharChemIndia, Atul Ltd, Ambuja Intermediates Pvt Ltd., and Mayur Dye-chem Intermediates Llp. BASF SE focused on strategic partnerships with key players in the dyestuff manufacturing industry, enhancing its market presence. WeylChem Group emphasized research and development to expand the applications of vinyl sulfone compounds in proteomics and chemical intermediates. Vertellus Holdings LLC invested in marketing initiatives to increase awareness of methyl vinyl sulfone's unique properties. These players collectively contributed to the market's growth in 2025, with their strategies positioning them as frontrunners for the forecast period from 2026 to 2034.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Vinyl Sulfone market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report