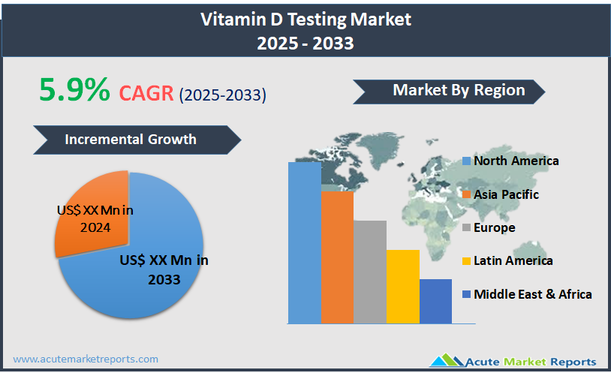

Vitamin D testing refers to the clinical assessment used to determine the level of vitamin D in the blood, an essential nutrient that plays a crucial role in bone health, immune function, and overall well-being. These tests typically measure the level of 25-hydroxyvitamin D, considered the best indicator of vitamin D stores in the body. The results help to diagnose vitamin D deficiencies or surpluses, guide supplementation recommendations, and can assist in the diagnosis of bone disorders, among other health issues. The vitamin D testing market is projected to grow at a compound annual growth rate (CAGR) of 5.9% over the forecast period. This growth is largely attributed to the increased knowledge and education regarding the importance of vitamin D for various bodily functions and the potential health consequences of deficiencies.

Increased Awareness of Vitamin D's Health Benefits as a Driver

The growing awareness of vitamin D's critical role in maintaining overall health significantly drives the market for vitamin D testing. Vitamin D is not only essential for bone health, preventing conditions like osteoporosis and rickets, but also plays a crucial role in immune function, muscle health, and the reduction of inflammation. Public health campaigns and medical research have highlighted the risks associated with vitamin D deficiency, which include an increased risk of serious diseases such as cardiovascular illnesses and certain cancers. The widespread public and clinical recognition of these health implications has led to an increase in vitamin D testing as part of routine health screenings, particularly in populations at higher risk of deficiency due to limited sun exposure or older age. This heightened awareness is prompting more individuals to monitor their vitamin D levels more diligently, further propelling the demand for testing services.

Opportunity in Technological Advancements in Testing

Technological advancements in diagnostic testing present a significant opportunity in the vitamin D testing market. Innovations in testing technologies have led to the development of faster, more accurate, and less invasive testing methods. For instance, the emergence of point-of-care tests and improvements in liquid chromatography-mass spectrometry (LC-MS) techniques have made vitamin D testing more accessible and reliable. These advancements not only improve patient comfort and convenience but also provide quicker results, enhancing the ability of healthcare providers to diagnose and treat vitamin D deficiency more effectively. As diagnostic technology continues to evolve, the capability to integrate vitamin D testing into broader metabolic panels is expected, which could simplify processes for both patients and labs, potentially increasing the frequency and volume of vitamin D testing.

High Cost of Testing as a Restraint

The high cost associated with vitamin D testing remains a significant restraint in the market. Although the importance of monitoring vitamin D levels is well recognized, the expense related to the testing process can be prohibitive for many patients, especially in regions without adequate health insurance coverage or in lower-income countries. The cost barrier is exacerbated by the need for repeated testing to monitor levels over time, which is necessary for the effective management of patients with chronic deficiencies or those undergoing treatment for related conditions. This financial burden can discourage routine vitamin D screening, limit the frequency of tests among those already diagnosed with deficiency, and reduce market penetration in economically disadvantaged regions.

Challenge of Standardization and Accuracy in Testing

One of the principal challenges in the vitamin D testing market is ensuring standardization and accuracy across different testing methods and laboratories. Vitamin D tests must be precise and reliable, as the results directly influence treatment decisions. However, discrepancies in test results between different types of assays and among laboratories can lead to confusion and misdiagnosis. For example, variability in assay sensitivity and specificity can result in significantly different vitamin D level readings, which may affect clinical decisions regarding supplementation or further interventions. Addressing these inconsistencies requires ongoing calibration and standardization efforts, as well as training for laboratory personnel to ensure that all testing procedures adhere to high-quality standards. This challenge is critical to maintaining trust in vitamin D testing and ensuring that patients receive appropriate care based on accurate diagnostics.

Market Segmentation by Test Type

In the vitamin D testing market, segmentation by test type includes 25-Hydroxy D Vitamin and 1,25-Dihydroxy D Vitamin tests. The 25-Hydroxy D Vitamin test dominates in terms of revenue, as it is the most commonly used test to assess vitamin D status in individuals. This test measures the main circulating form of vitamin D in the blood, which is considered the best indicator of vitamin D supply to the body from both sunlight exposure and dietary intake. Its widespread use in clinical settings due to its effectiveness in reflecting long-term vitamin D status attributes to its market dominance. Meanwhile, the 1,25-Dihydroxy D Vitamin test, which measures the active form of vitamin D, is projected to exhibit the highest CAGR from 2025 to 2033. This anticipated growth is driven by its critical application in diagnosing and managing diseases related to calcium metabolism, including kidney disease and hyperparathyroidism, where this active form provides essential diagnostic information.

Market Segmentation by Technique

Regarding the technique, the vitamin D testing market is segmented into Radioimmunoassay, ELISA, HPLC, LC-MS, and Others. ELISA (Enzyme-Linked Immunosorbent Assay) holds the highest revenue share due to its widespread adoption in clinical laboratories for its cost-effectiveness, simplicity, and ability to handle large sample volumes efficiently. However, LC-MS (Liquid Chromatography-Mass Spectrometry) is expected to register the highest CAGR through 2025 to 2033. The growth in LC-MS is attributed to its superior accuracy, specificity, and sensitivity in detecting both forms of vitamin D at very low concentrations, making it increasingly preferred in clinical settings where precise measurements are crucial for diagnosis and treatment decisions. This technique's ability to provide detailed profiles of vitamin D metabolites further enhances its application in advanced diagnostic procedures.

Geographic Segment

In 2024, North America dominated the vitamin D testing market in terms of revenue, driven by a well-established healthcare infrastructure, high awareness about preventive healthcare practices, and widespread adoption of advanced diagnostic techniques. This region's market leadership was also supported by the presence of key industry players and their active engagement in launching innovative products and services tailored to the needs of a growing patient population concerned with vitamin D deficiency and its impact on health. Looking ahead, Asia Pacific is expected to register the highest CAGR from 2025 to 2033. This growth is anticipated due to increasing health awareness, rising healthcare expenditures, and improvements in healthcare infrastructure across major economies such as China, India, and Japan. The expansion in this region is further fueled by governmental initiatives aimed at improving vitamin D deficiency screening and management, along with the increasing prevalence of conditions associated with low vitamin D levels in the population.

Competitive Trends and Key Strategies

In 2024, the competitive landscape of the vitamin D testing market was shaped by activities from major players such as Teleflex Incorporated, Vyaire Medical, Dragerwerk AG & Co. KGaA, GE Healthcare, Medtronic plc, Koninklijke Philips N.V., Smiths Medical, ResMed, Inc., O-Two Medical Technologies Inc., Dimar s.r.l., Intersurgical Ltd., HAROL S.r.l., Vygon SA, Getinge AB, Vapotherm, Inc., and Fisher & Paykel Healthcare Limited. These companies focused on strategic innovations, mergers, and acquisitions to enhance their market positions and expand their product portfolios. For example, companies like GE Healthcare and Philips N.V. leveraged their robust R&D capabilities to introduce more accurate and user-friendly vitamin D testing technologies that meet the increasing demands of both healthcare providers and patients. From 2025 to 2033, these players are expected to continue their focus on technological advancements, particularly in developing regions where there is a growing demand for cost-effective and easily accessible vitamin D testing solutions. Additionally, strategic partnerships with healthcare providers and adherence to evolving regulatory standards are likely to be key strategies for maintaining and enhancing their market presence. The companies will also likely increase their investments in marketing and customer education to raise awareness about the importance of vitamin D testing in preventing and managing health issues associated with vitamin D deficiency.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Vitamin D Testing market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Test Type

| |

Technique

| |

Patient Type

| |

Indication

| |

End-user

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report