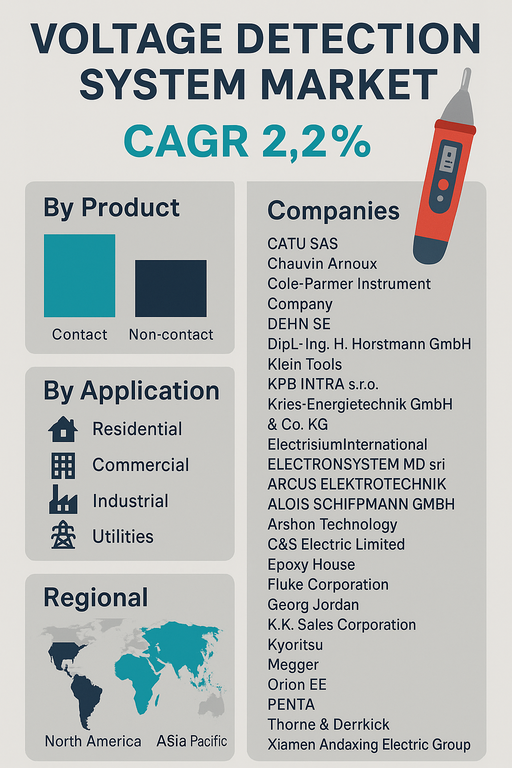

The global voltage detection system market is projected to grow at a CAGR of 2.2% from 2025 to 2033. These systems are widely used across residential, commercial, industrial, and utility sectors to enhance electrical safety and prevent accidents related to live wires or faulty circuits. The market is supported by increasing emphasis on workplace safety regulations, infrastructure modernization, and continuous demand for reliable testing and measuring instruments. Advancements in compact, digital, and non-contact voltage detection devices are further reshaping adoption across diverse applications.

Rising Demand for Safety and Reliable Electrical Infrastructure

Growing awareness of electrical hazards and stringent occupational safety standards are fueling demand for voltage detection systems. Non-contact detectors are increasingly preferred due to their ease of use, portability, and ability to detect voltage without physical contact, ensuring enhanced operator safety. Residential and commercial applications are expanding with greater awareness of household electrical safety. In industrial and utility sectors, voltage detection systems are critical in maintenance, fault detection, and operational reliability of power distribution networks. Integration of digital indicators, LED signals, and wireless monitoring is further strengthening product usability.

Challenges: Low Market Growth and Counterfeit Products

Despite being essential safety tools, the voltage detection system market faces modest growth, primarily due to product commoditization and availability of low-cost alternatives. Counterfeit and poor-quality products undermine consumer trust and limit revenue opportunities for established brands. Price sensitivity in emerging markets further constrains adoption of advanced devices. However, ongoing technological improvements, rising safety training initiatives, and government-backed electrical safety campaigns are expected to offset these challenges and maintain steady demand.

Market Segmentation by Product

By product, the market is divided into contact and non-contact detectors. In 2024, non-contact detectors held the larger share, driven by strong adoption across residential and commercial sectors due to their convenience and enhanced safety. Contact-type detectors remain relevant in industrial and utility applications where precise measurement and direct verification of voltage are required.

Market Segmentation by Application

By application, the market is segmented into residential, commercial, industrial, and utilities. The industrial and utility sectors account for the largest share, where voltage detection systems are vital for ensuring maintenance efficiency and minimizing downtime. The residential segment is expanding with growing consumer emphasis on home safety and availability of low-cost devices. The commercial segment, including offices and retail establishments, demonstrates steady adoption in preventive electrical maintenance.

Regional Insights

In 2024, North America led the voltage detection system market, supported by strict safety regulations, widespread adoption of advanced testing equipment, and strong presence of global manufacturers. Europe followed closely, with Germany, the UK, and France driving demand through occupational safety standards and industrial modernization. Asia Pacific is the fastest-growing region, led by China, India, and Southeast Asia, where rapid urbanization and infrastructure investments are boosting demand for electrical safety devices. Latin America and the Middle East & Africa (MEA) are emerging markets with growing adoption as awareness and regulatory frameworks expand.

Competitive Landscape

The 2024 voltage detection system market featured a mix of established multinational players and regional manufacturers. Fluke Corporation, Megger, and Kyoritsu are global leaders offering advanced detection systems with strong brand recognition. CATU SAS, Chauvin Arnoux, and DEHN SE remain key European players with a strong focus on safety products for utilities and industrial customers. Dipl.-Ing. H. Horstmann GmbH, Kries-Energietechnik, and Georg Jordan are active in specialized voltage detection solutions. Klein Tools and C&S Electric Limited cater to broader markets, including North America and Asia. Emerging players such as Electrisium International, Epoxy House, Arshon Technology, Orion EE, and Xiamen Andaxing Electric Group are strengthening their positions with cost-effective solutions. Competitive strategies are increasingly focused on innovation in non-contact technologies, digital integration, and global distribution networks.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Voltage Detection System market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report