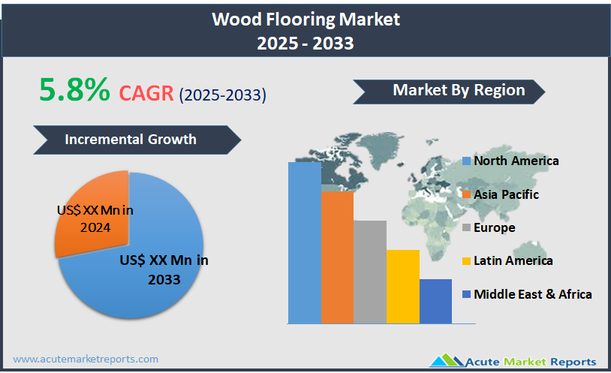

Wood flooring encompasses a variety of floor coverings made from timber, designed to provide an aesthetically pleasing and durable surface option for residential and commercial properties. This category includes solid hardwood, engineered wood, and bamboo flooring, among others. Each type offers unique characteristics in terms of grain, color, durability, and environmental impact, making wood flooring a popular choice for its natural appearance, longevity, and the warmth it adds to interior spaces. The wood flooring market is projected to grow at a compound annual growth rate (CAGR) of 5.8% over the forecast period.

Sustainable Building Practices Driving Demand

The escalating commitment to sustainable building practices serves as a significant driver in the wood flooring market. As environmental concerns gain prominence among consumers and policymakers, there is a growing preference for building materials that are renewable and have a lower carbon footprint. Wood, being a natural and sustainable resource, especially when sourced from certified sustainably managed forests, meets these criteria. This shift is evident in the increased adoption of green building standards like LEED and BREEAM, which reward the use of sustainable materials. Additionally, wood floors are known for their durability and longevity, which aligns with the principles of sustainable living by reducing the frequency of replacements. The aesthetic value and timeless appeal of wood flooring also contribute to its popularity, ensuring that it remains a favored choice in both residential and commercial construction projects.

Opportunity in Technological Advancements in Wood Processing

Technological advancements in wood processing present a significant opportunity for growth in the wood flooring market. Innovations such as water-resistant coatings and improved adhesives have expanded the applications of wood flooring into areas previously unsuitable for wood, such as kitchens and bathrooms. These technological enhancements not only improve the functional attributes of wood flooring, such as durability and maintenance ease but also cater to evolving consumer preferences for more versatile wood flooring solutions. Furthermore, the development of sustainable wood treatment methods that minimize environmental impact broadens the market's appeal to environmentally conscious consumers, potentially increasing market penetration in both new builds and renovation sectors.

High Cost and Maintenance as a Restraint

Despite its benefits, the high cost and maintenance requirements of wood flooring pose significant restraints to its broader adoption. Wood floors generally require a larger initial investment compared to other flooring options like laminate or vinyl, making them less accessible to budget-conscious consumers. In addition, wood flooring demands regular maintenance to retain its appearance and durability, including sanding, finishing, and protection from moisture and scratches. These ongoing care requirements can be a deterrent for those looking for more low-maintenance flooring solutions, particularly in high-traffic commercial environments or rental properties where durability and ease of maintenance are priorities.

Challenge of Market Saturation and Competition

A major challenge facing the wood flooring market is the intense competition and market saturation in developed economies. With numerous players ranging from large corporations to small local businesses, differentiating products in the market becomes increasingly difficult. Additionally, the rise of alternative flooring materials such as luxury vinyl tile (LVT) that mimic the aesthetics of wood without the associated costs and maintenance issues further intensifies the competitive landscape. These alternatives are gaining traction among consumers, particularly those in commercial settings, due to their cost-effectiveness and lower maintenance needs. For wood flooring manufacturers, innovating in ways that enhance the intrinsic value of real wood-such as through unique finishes or eco-friendly manufacturing processes-remains critical to maintaining market share in an increasingly crowded market.

Market Segmentation by Product

In the wood flooring market, products are segmented into Solid Wood, Laminated Wood, and Engineered Wood. Solid Wood flooring holds the highest revenue share due to its traditional appeal and the high value it adds to properties, being favored for its authenticity, longevity, and the ability to be refinished multiple times over its lifespan. However, Engineered Wood is projected to exhibit the highest CAGR from 2025 to 2033. This growth is attributed to the product’s structural stability, which allows it to withstand variations in temperature and humidity better than solid wood. Engineered Wood flooring is also easier to install and generally comes at a lower cost than solid wood, making it an increasingly popular choice among both residential and commercial users seeking durability along with aesthetic appeal.

Market Segmentation by Application

Regarding application, the wood flooring market is segmented into Residential and Commercial use. The Residential segment accounts for the highest revenue, driven by homeowners’ preferences for durability, aesthetic appeal, and the long-term value wood flooring adds to homes. As residential construction continues to recover and grow, particularly in suburban and rural areas, the demand for high-quality wood flooring is expected to remain robust. Conversely, the Commercial segment is anticipated to register the highest CAGR over the forecast period, fueled by increasing investments in commercial real estate and the hospitality industry, where the luxury aesthetic of wood flooring is highly valued. Additionally, innovations in wood treatments that enhance durability and reduce maintenance costs are making wood flooring more appealing for commercial applications, where long-lasting and visually appealing materials are crucial.

Geographic Segment

The wood flooring market is differentiated by significant geographic trends. In 2024, North America accounted for the highest revenue percentage, bolstered by a strong preference for wood flooring in both residential and commercial construction and a growing interest in sustainable building materials. The U.S. market, in particular, benefited from the renovation and remodeling trends where wood flooring is a popular choice due to its durability and timeless appeal. However, the Asia Pacific region is expected to witness the highest CAGR from 2025 to 2033. This surge is anticipated due to rapid urbanization, increased disposable incomes, and the expansion of the middle class in countries like China and India, which are adopting Western lifestyle trends, including preferences for luxury interior design materials such as wood flooring.

Competitive Trends and Key Strategies

In 2024, the wood flooring market was highly competitive, featuring key industry players such as Mohawk Industries, Inc., Armstrong Flooring, Inc., Beaulieu International Group, Shaw Industries Group, Boral, Mannington Mills Inc., RIGO, and Somerset Hardwood Flooring Inc. These companies focused on expanding their product portfolios to include both traditional and innovative flooring solutions to cater to a broad range of consumer preferences and emerging market trends. Strategic acquisitions, partnerships, and expansions into new geographic markets were common strategies employed to enhance market presence and penetration. For instance, companies like Mohawk Industries and Armstrong Flooring enhanced their production capacities and invested in new technologies for sustainable flooring solutions. From 2025 to 2033, these players are expected to intensify their focus on sustainability and innovation, particularly in the development and promotion of eco-friendly wood products and processes that meet the evolving environmental standards. The trend towards digitalization and e-commerce is also anticipated to shape competitive strategies, as companies adapt to changing consumer shopping behaviors and seek to improve customer engagement and service through digital platforms.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Wood Flooring market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report