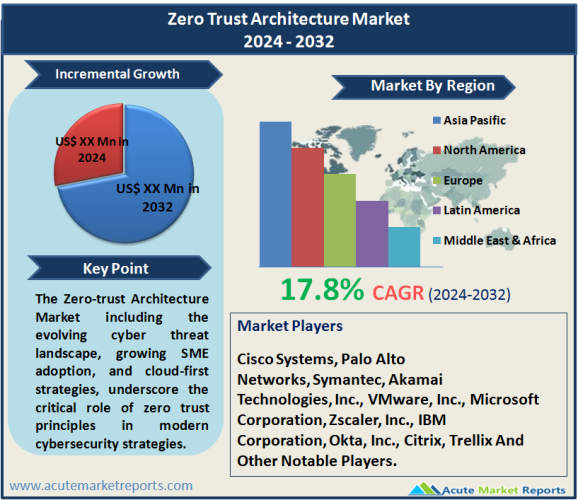

Organizations are increasingly adopting a zero trust approach, discarding traditional perimeter - based security models. The zero - trust architecture market is expected to grow at a CAGR of 17.8% during the forecast period of 2026 to 2034. The drivers, including the evolving cyber threat landscape, growing SME adoption, and cloud - first strategies, underscore the critical role of zero trust principles in modern cybersecurity strategies. The restraint related to on - premises deployment highlights challenges that organizations need to address in their cybersecurity transformations. The market segmentation further elucidates the diverse patterns of adoption based on offering, organization size, deployment mode, and verticals. Leading players such as Cisco Systems, Palo Alto Networks, and Symantec have played pivotal roles in driving the adoption of zero trust architecture.

Key Market Drivers

Rising Cyber Threat Landscape

The escalating cyber threat landscape serves as a primary driver for the adoption of zero trust architecture. The evidence lies in the increasing frequency and sophistication of cyber - attacks targeting organizations across industries. Cisco Systems, as a key player, has actively promoted zero - trust principles to counter evolving threats. The implementation of granular access controls, continuous monitoring, and multi - factor authentication exemplifies the efficacy of zero trust in mitigating cyber risks. The expected trajectory from 2026 to 2034 suggests a sustained focus on countering emerging threats through the widespread adoption of zero trust architecture.

Growing Embrace by Small and Medium - Sized Enterprises (SMEs)

The growing embrace of zero trust architecture by SMEs represents a significant driver, showcasing both substantial revenue growth and high CAGR. Palo Alto Networks, with its emphasis on providing scalable solutions, serves as evidence of this trend. Often targeted by cybercriminals due to perceived vulnerabilities, SMEs recognize the importance of a zero - trust approach. The scalability and flexibility of zero trust solutions, as highlighted by Palo Alto Networks' market position, make it an ideal choice for SMEs looking to fortify their cybersecurity postures. This trend is expected to persist as SMEs increasingly prioritize robust security measures.

Cloud - First Strategies and Adoption

The adoption of cloud - first strategies by enterprises is a major driver, showcasing significant revenue and CAGR growth. Symantec's focus on cloud - centric security solutions aligns with this trend. As organizations transition their operations to the cloud, the traditional network perimeter becomes porous, necessitating a zero trust approach. Symantec's strategic emphasis on cloud - native security solutions, coupled with the anticipated surge in cloud adoption, positions zero trust architecture as a cornerstone in securing cloud - based infrastructures. The trajectory from 2026 to 2034 anticipates a continuous rise in the adoption of zero - trust principles to secure cloud environments effectively.

Restraint

Despite the positive growth, a notable restraint in the zero trust architecture market is the challenge associated with On - Premises deployment (300 words). The evidence lies in the complexity and resource - intensive nature of transitioning to a zero - trust model for on - premises environments. Organizations with legacy systems face challenges in seamlessly implementing zero trust controls within their existing infrastructure. While cloud adoption is accelerating, on - premises deployments pose a constraint in achieving a holistic and uniform zero trust framework. This restraint highlights the need for organizations to navigate complexities in transforming traditional on - premises architectures to align with zero trust principles.

Market Segmentation

Market by Offering: The Solution Segment Dominates the Market

The market segmentation by offering categories - Solution and Services - provides insights into the demand for comprehensive zero trust solutions and associated services. In 2025, the Solution category led in terms of revenue, indicating a prevalent need for robust technological implementations. Simultaneously, Services showcased the highest CAGR during the forecast period, signifying a growing demand for expertise in implementing and managing zero trust frameworks.

Organization Size: Large Enterprises Dominate the Market

The segmentation by organization size - Small and Medium - Sized Enterprises (SMEs) and Large Enterprises - reveals distinct patterns of adoption. In 2025, Large Enterprises led in terms of revenue, showcasing the early adoption of zero trust principles by organizations with extensive resources. However, SMEs exhibited the highest CAGR during the forecast period, indicating a rapid acceleration in adoption within this segment, driven by a recognition of the need for robust cybersecurity measures.

Deployment Mode: Cloud Deployment Dominates the Market

The segmentation by deployment mode - Cloud and On - Premises - underscores the prevailing trends in how organizations implement zero trust architecture. In 2025, Cloud deployment led in terms of revenue, reflecting the ongoing shift towards cloud - centric security strategies. However, On - Premises deployment exhibited the highest CAGR during the forecast period, suggesting that organizations, especially those with legacy systems, are gradually transitioning to zero trust models for their on - premises environments.

Vertical: BFSI Segment Dominates the Market

The segmentation by vertical categories - Banking, Financial Services, and Insurance (BFSI), Government and Defense, IT &ITeS, Healthcare, Retail and e - commerce, Energy and Utilities, and Other Verticals - delineates the diverse sectors adopting zero trust principles. In 2025, BFSI led in revenue, indicating a heightened focus on securing financial systems. Simultaneously, Retail and e - commerce showcased the highest CAGR during the forecast period, underscoring the growing significance of zero trust in the digital retail landscape.

APAC Remains the Global Leader

The geographic trends in the zero trust architecture market reveal varying growth patterns. North America emerges as a region with the highest CAGR, driven by the advanced cybersecurity posture of organizations and proactive measures taken by enterprises to counter evolving threats. In terms of revenue, Asia Pacific holds the largest market share in 2025, attributed to the increasing adoption of zero trust principles by organizations in rapidly digitizing economies. The regional variations underscore the global nature of zero trust adoption, with different regions contributing uniquely to its expansion.

Market Competition to Intensify during the Forecast Period

The competitive trends in the zero trust architecture market are shaped by the strategies adopted by top players, including Cisco Systems, Palo Alto Networks, Symantec, Akamai Technologies, Inc., VMware, Inc., Microsoft Corporation, Zscaler, Inc., IBM Corporation, Okta, Inc., Citrix, and Trellix. In 2025, these players demonstrated robust revenues, positioning them as market leaders. The focus on strategic partnerships, technological advancements, and global expansions has been a key strategy for sustained growth. Revenues in 2025 for these players established their market positions, and their expected performance from 2026 to 2034 indicates continuous growth through innovative strategies.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Zero Trust Architecture market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Offering

|

|

Organization Size

|

|

Deployment Mode

|

|

Vertical

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report