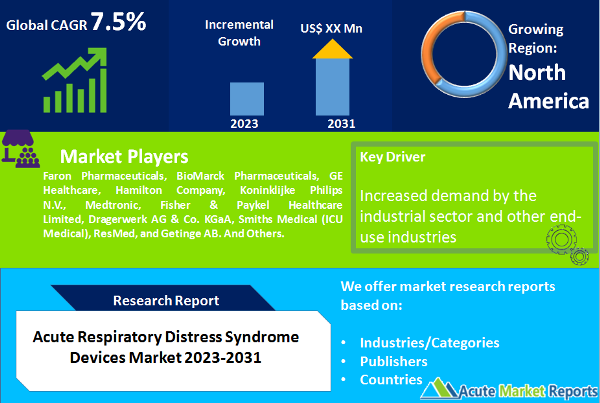

The acute respiratory distress syndrome (ARDS) devices market is expected to grow at a CAGR of 7.5% during the forecast period of 2025 to 2033. Acute respiratory distress syndrome (ARDS) is a severe lung condition that can be caused by a variety of underlying conditions, including sepsis, pneumonia, and trauma. It is marked by inflammation and fluid accumulation in the lungs, which can lead to breathing difficulties and low blood oxygen levels. ARDS can be fatal if not treated immediately and effectively. For the treatment of ARDS, various devices and equipment are utilized, such as mechanical ventilators, oxygen therapy devices, and extracorporeal membrane oxygenation (ECMO) systems. ARDS monitoring equipment is typically utilized in intensive care units (ICUs) and emergency departments.

ARDS incidence increase is anticipated to drive market growth for acute respiratory distress syndrome devices. ARDS is a severe lung condition characterized by the accumulation of fluid in the air sacs of the lungs. The elderly are highly susceptible to developing this condition. Consequently, geriatric population growth is anticipated to stimulate market expansion over the forecast period. It is anticipated that investment in the R&D of new devices will provide lucrative growth opportunities for industry vendors. In the near future, however, high costs and a lack of trained personnel are likely to limit the adoption of ARDS devices. To increase their acute respiratory distress syndrome device market share, vendors are focusing on the introduction of cost-effective products.

Increase in ARDS Incidence Boosting Acute Respiratory Distress Syndrome Devices Market Growth

In the coming years, the demand for ARDS devices is projected to increase due to an aging population and a rise in cases of chronic diseases. People over the age of 60 are at increased risk for ARDS and other chronic diseases. The United Nations projects that the global population aged 60 and older will more than double by 2050. Multiple chronic diseases, including obesity, diabetes, and heart disease, are prevalent in the elderly population. In addition, their immune systems are more likely to be compromised, making them more susceptible to infections such as pneumonia. According to the World Health Organization (WHO), approximately 150 million people worldwide are affected by ARDS annually. Consequently, the high prevalence of ARDS is anticipated to contribute to the growth of the acute respiratory distress syndrome devices market in the near future.

Research and Development of New Devices

Major acute respiratory distress syndrome device manufacturers are heavily investing in new product research and development. Advanced ARDS devices may improve patient outcomes, shorten hospital stays, and reduce healthcare costs. The Hamilton-T1 ventilator with High-Frequency Oscillation Ventilation (HFOV) technology was introduced by Hamilton Medical in June 2020 to provide advanced ventilation support for critically ill patients. HFOV is a type of mechanical ventilation characterized by rapid, small tidal volume, and high-frequency breaths. This reduces lung damage and improves patient outcomes. Therefore, it is anticipated that the development and introduction of new devices will augment the acute respiratory distress syndrome devices market trajectory in the coming years.

Increase in Diagnostic and Monitoring Device Adoption

In accordance with the most recent acute respiratory distress syndrome devices market trends, the diagnostic & monitoring devices segment is anticipated to hold the largest market share over the forecast period. For the treatment and management of ARDS, diagnostic and monitoring devices are utilized. In the near future, the prevalence of ARDS is likely to increase demand for these devices. Oxygen saturation levels, lung function, and other vital signs are measured by diagnostic and monitoring equipment. This allows medical personnel to initiate prompt and effective treatment. Detection and treatment of ARDS as early as possible can improve patient outcomes and shorten hospital stays.

Hospitals/Clinics by End User Segment is Anticipated to Grow Strongly During the Forecast Period

Hospitals/clinics are well-equipped with advanced technological equipment for surgical procedures and improved treatments, and the hospital segment is experiencing rapid growth due to the growing number of hospital admissions with ARDS, the increasing number of patient pools, and the launch of new products by market players, all of which are expected to continue over the forecast period, thereby driving the segment's growth.

The rising number of private hospitals is also anticipated to contribute to market expansion. According to the American Hospital Association Statistics 2025, published in January 2025, there were 2,946 non-profit community hospitals in the United States in 2021, and this number increased to 2,960 in 2024. Consequently, as the number of beds available to treat ARDS patients rises, an increasing number of hospitals will support the growth of the segment over the forecast period.

Increasing hospital admissions and admissions to intensive care units create a demand for ARDS treatment, which drives the market's expansion. According to a study titled "Acute respiratory distress syndrome readmissions: A nationwide cross-sectional analysis of epidemiology and costs of care" published in January 2025 in the PLOS One Journal, 18.4% of patients with acute respiratory distress syndrome were readmitted to the hospital. In addition, according to data published by the Australian Institute of Health and Welfare in May 2025, there will be approximately 11,8 million hospital admissions in 2020-21, which is 6.3% more than in 2019-20. In addition, out of 11.8 million admissions, 7.0% involved an Intensive Care Unit (ICU) stay, 3.8% involved respiratory disease, and 10.3% had a separation mode indicating the patient died in the hospital. Such a rise in emergency critical care admissions creates a demand for ARDS treatment, which is anticipated to propel the growth of this market segment. Thus, the segment is anticipated to exhibit a healthy growth rate over the forecast period due to the aforementioned factors.

North America Remains as the Global Leader

North America held the largest share of the acute respiratory distress syndrome devices market in 2024. Increased incidence of ARDS and other respiratory disorders, rising healthcare expenditures, and the presence of major market players are likely to stimulate market growth in the foreseeable future. Due to the presence of major market players, an increase in product approvals, a developed healthcare system, and a high prevalence of acute respiratory distress syndrome, North America dominated the global ARDS treatment market.

According to the National Library of Medicine, a study titled "Acute Respiratory Distress Syndrome" published in February 2025, the incidence of ARDS in the United States ranges from 64,2 to 78.9 cases per 100,000 people per year. Initial ARDS case assessments place 25% of cases in the mild category, while 75% fall into the moderate or severe category. However, one-third of mild cases progress to moderate or severe illnesses.

Consequently, the increasing incidence of acute respiratory distress syndrome in the United States will support market expansion over the forecast period. It is anticipated that the adoption of various organic and inorganic strategies by market leaders will accelerate market expansion. In December 2020, for instance, the Food and Drug Administration (FDA) granted Fast Track designation to Remestemcel-L for the treatment of acute respiratory distress syndrome (ARDS) caused by coronavirus disease (COVID-19). Additionally, in September 2020, Athersys announced that the Regenerative Medicine Advanced Therapy (RMAT) designation was granted to MultiStem cell therapy for the acute respiratory distress syndrome (ARDS) program by the United States Food and Drug Administration.

During the forecast period, the industry in the Asia-Pacific market is projected to expand at a significant rate. The high prevalence of respiratory disorders, the increase in the geriatric population, and the growing awareness of advanced ARDS devices are anticipated to increase regional market statistics.

Market Competition to Intensify During the Forecast Period

The market for acute respiratory distress syndrome is highly competitive and dominated by a handful of major companies. The acute respiratory distress syndrome market is dominated by companies including Faron Pharmaceuticals, BioMarck Pharmaceuticals, GE Healthcare, and Hamilton Company, among others. Other key companies include Koninklijke Philips N.V., Medtronic, Fisher & Paykel Healthcare Limited, Dragerwerk AG & Co. KGaA, Smiths Medical (ICU Medical), ResMed, and Getinge AB. To expand their regional presence, businesses are adopting a variety of organic and inorganic strategies. Fisher & Paykel Healthcare Limited introduced its new Optiflow+ nasal high-flow therapy system in January 2021, which is designed to assist patients with ARDS and other respiratory conditions.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Acute Respiratory Distress Syndrome Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

End-user

| |

Injury

| |

Severity

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report