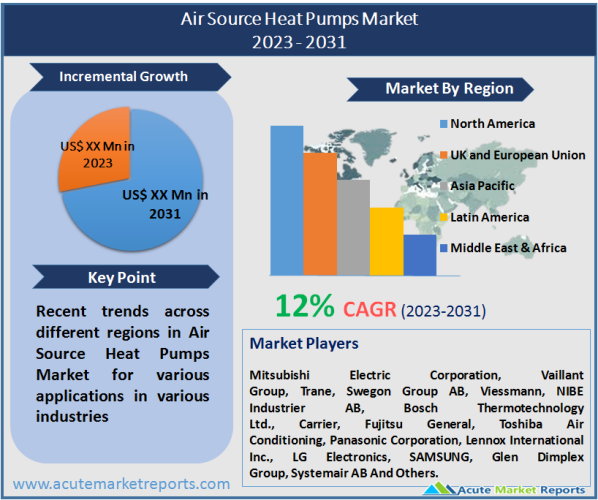

Air Source Heat Pump Market is projected to grow at a CAGR of 12% during the forecast period of 2025 and 2033, owing to the continuous trend toward low-carbon heating and cooling technologies. Climate change is becoming a driving force for energy efficiency, culminating in strict laws to minimize carbon emissions. According to the DOE, minimum energy efficiency criteria for heat pumps in the United States will increase by 1.0 SEER to 15.0 SEER in 2024. Air-source heat pumps offer the ability to reduce greenhouse gas emissions while achieving substantial energy savings. The preferred shift toward environmentally friendly refrigerants and low-carbon alternatives to meet space heating and cooling needs will increase the installation of air-source heat pumps.

Given the increased financial support from administrators, global expenditures on commercial and residential infrastructure renovations are likewise on the rise. These issues have prompted market participants to engage in R&D to create sustainable HVAC systems. In June 2025, for instance, Trane introduced the Ascend model ACX, an air-to-water heat pump system meant to help homeowners meet decarbonization goals via electric cooling and heating. During the forecast period, the rapid green shift will generate profitable growth prospects for electric air source heat pump developers.

Heat Pump Technology's Contribution to Reducing Carbon Impact

Energy is a vital source of power in homes, hospitals, and schools, among other locations. However, its manufacturing and consumption produce enormous greenhouse gas emissions. As a result, major economies throughout the world are striving to minimize their reliance on non-renewable energy sources and are gradually shifting toward renewable energy sources to reduce greenhouse gas emissions.

The technology of heat pumps is a viable method for reducing greenhouse gas emissions. By utilizing aerothermal and geothermal technology, heat pumps provide an energy-efficient method of space heating. When utilized in heating, ventilation, and air conditioning (HVAC) systems, the heat pump is frequently viewed as a sustainable technology. Heat pumps are widely utilized in the residential, commercial, and industrial sectors for space heating, cooling, and water heating. Air and land contain vast thermal energy reserves. Low-temperature heat pumps absorb ambient heat from the air and ground and raise the temperature by adding energy, primarily electricity. The heat pump is capable of capturing up to 77 percent of the air's energy. Thus, the usage of heat pumps can significantly reduce the consumption of fossil fuels when compared to other methods of heat transfer, thereby reducing the carbon footprint. This aspect is driving market expansion and boosting the number of heat pump installations across all industries.

Increasing IoT and Other Advanced Technology Integration to Drive Market Growth Prospects

Heat pumps based on the Internet of Things (IoT) provide predictive maintenance, real-time monitoring, and remote component diagnostics. The Internet of Things-based heat pumps have thermostats that detect environmental changes and communicate with their water heaters. Heat pumps are being adopted by end customers from various sectors. Their designs and operations, however, have stayed untouched. For the development of next-generation heat pumps that are easy to use, automation and remote control have been given significant priority. Currently, heat pumps are provided with LCDs and warning indicators for user-friendliness.

The leading industry companies, like Panasonic and Samsung, are incorporating many technologies into their heat pumps to make them easier to use and maintain. Globally, research is also being undertaken on the use of machine learning and artificial intelligence in heat pumps to minimize their electricity consumption and increase their efficiency. For example, researchers at the Swiss Federal Institute of Technology Lausanne (EPFL) are utilizing AI to build a compressor with a 25% reduction in electricity usage in mind. The team utilized machine-learning techniques to generate heat pump design chart equations based on the results of 500,000 simulations. The heat pumps equipped with machine learning and artificial intelligence can evaluate consumer usage patterns and their operating time and length, removing the need to manually turn them on or off. These factors are anticipated to increase heat pump demand and generate profitable prospects for market participants.

Lack Of Awareness concerning The Benefits of Heat Pumps in Emerging Economies

The heat pump is an intricate piece of machinery. End-users in emerging and undeveloped economies have a limited understanding of the energy efficiency, cost efficiency, and environmental benefits of heat pumps, as well as their technical know-how. It is anticipated that this feature may hinder their penetration rate in emerging economies. According to a report published by the United Nations Environment Program, contractors lack knowledge of the International Organization for Standardization (ISO) heat pump standards. The ISO standards play a significant role in ensuring the quality and safety of the given products and services. For example, ISO 13612-2:2014 specifies a calculation method for steady conditions that correspond to a single calculation step. The findings of this calculation are included in bigger building models, which account for the impact of external variables. Consequently, a lack of or limited understanding of the benefits of heat pumps and related ISO standards is anticipated to impede market expansion to some degree.

Increasing Costs and Accessibility of Conventional Heating Systems Remain a Key Restraint

Despite their energy efficiency and other advantageous characteristics, air-source heat pumps are more expensive to install than their conventional equivalents. Increased knowledge of the availability of cleaner energy technologies, such as solar heating and district heating, has led to their incorporation into a variety of institutions. The presence of alternative heat pump technologies and rising deployment costs may impede the commercial development of air-source heat pumps.

Increasing Integration of Internet of Things (IoT) And Other Cutting-Edge Technologies with Heat Pumps to Open New Market Avenues

Heat pumps based on the Internet of Things (IoT) provide real-time monitoring, predictive maintenance, and remote component diagnostics. The Internet of Things (IoT)-based heat pumps comprise intelligent thermostats that assist in monitoring environmental changes and communicating with their water heater equipment. Heat pumps are being adopted by end customers from various sectors. Their designs and operations, however, have stayed untouched. For the development of next-generation heat pumps that are easy to use, automation and remote control have been given significant priority. Currently, heat pumps are provided with LCDs and warning indicators for user-friendliness. The leading industry companies, like Panasonic and Samsung, are incorporating many technologies into their heat pumps to make them easier to use and maintain. Globally, research is also being undertaken on the use of machine learning and artificial intelligence in heat pumps to minimize their electricity consumption and increase their efficiency. As an example, researchers at the Swiss Federal Institute of Technology Lausanne (EPFL) are utilizing AI to build a compressor with a 25% reduction in electricity usage in mind. The team utilized machine-learning techniques to generate heat pump design chart equations based on the results of 500,000 simulations. The heat pumps equipped with machine learning and artificial intelligence can evaluate consumer usage patterns and their operating time and length, removing the need to manually turn them on or off. These factors are anticipated to increase heat pump demand and generate profitable prospects for market participants.

Cost of Initial Installation to Challenge the Market Growth

Heat pumps are utilized extensively in the residential, commercial, and industrial sectors because they improve energy efficiency, reduce energy expenses, and reduce carbon emissions. The demand for air-source heat pumps is high since they are less expensive and more effective at heating homes and small businesses. Geothermal heat pumps are normally more expensive to install, but they are more efficient and suitable for large structures. Underground installation of high-density polyethylene pipes for geothermal heat pumps requires at least three days and a team of specialists.

Numerous variables affect the installation cost of heat pump systems for residential, commercial, and industrial applications. For example, in residential applications, the installation cost of all types of heat pumps depends on the size of the home, the amount of ducting required, the type of equipment, and the British Thermal Unit (BTU) value of the equipment. It also relies on the heat pump's complexity, type, brand, and size.

Water Source Type Segment Anticipated to Be the Largest Section of The Heat Pump Market, By Type

The market for heat pumps is split by product type into air-to-air heat pumps, air-to-water heat pumps, water-source heat pumps, ground-source (geothermal) heat pumps, and hybrid heat pumps. By kind of heat pump, the market for water-source heat pumps is expanding the quickest. Their superior operating efficiency is relative to other heat pumps will be the primary market driver. A heat pump that draws thermal energy from water and converts it to heat. The primary benefit of water source heat pumps is their ability to run on water at a lower temperature than the air temperature.

R410A Refrigerant Type Segment to Be the Largest Section of The Heat Pump Market by Refrigerant Type

By refrigerant type, the heat pump market is split into R410A, R407C, R744, and others. The R410A segment has the biggest market share, followed by the R407C segment. The R410A refrigerant can increase the efficiency rating of the system. Additionally, replenishing the system with R410A is less costly. During the forecast period, the R410A refrigerant segment of the heat pump market is anticipated to be driven by the minimal impact on the ozone layer.

Up To 10 Kw Segment to Be the Greatest Contributor to The Heat Pump Market by Rated Capacity

By rated capacity, the heat pump market is split into up to 10 kW, 10–20 kW, 20–30 kW, and over 30 kW. In 2020, the up to 10 kW rated capacity segment represented 47% of the market. The up to 10 kW category is anticipated to be driven by the segment's primary advantages and suitability for single-family homes, which will enhance demand for heat pumps throughout the projection period.

Urban Migration and Inexpensive Housing Initiatives Will Fuel the Installation of Domestic Air-Source Heat Pumps

Based on the application, the residential segment is anticipated to exhibit a CAGR of over 13.2% through 2033, owing to the steady rise in population and fast urbanization. In 2024, 70% of the market was accounted for by the residential segment. Efforts by the government to improve energy efficiency in the residential sector are anticipated to propel the residential sector over the forecast period. In the United States, for example, the federal tax credit for new residential ground-source heat pumps was recently extended through the end of 2025.

In addition, government activities are being implemented to address the need for suitable housing infrastructure. In May 2025, for instance, the U.S. government announced a Housing Supply Action Plan to reduce the housing supply deficit and develop affordable housing units. These factors will increase the residential sector's adoption of clean heating technology such as air-source heat pump boilers.

APAC To Be the Lucrative Manufacturing Centre for Air Source Heat Pumps

Regionally, the Asia-Pacific air source heat pump market will rise at a CAGR of 10.5% through 2033, owing to rising building spending and population growth. According to the International Trade Administration, the construction-related sector in Korea, which includes civil engineering services and public and private infrastructure, grew by 9.2% in 2021. In addition, the increasing disposable income and optimistic prognosis for the implementation of energy-efficient heating and cooling solutions to reduce energy costs.

Product line expansion to Remain the Key Strategy Influencing Market Share

Due to the continued increase in demand for air conditioning in the coming years, the global market for heat pumps is made up of both multinational and local companies, making it one of the most competitive industries in the world. The companies market their products using multiple channels, including company websites, e-commerce websites, retailers, distributors, and end-users. Mitsubishi Electric Corporation, Vaillant Group, Trane, Swegon Group AB, Viessmann, NIBE Industrier AB, Bosch Thermotechnology Ltd., Carrier, Fujitsu General, Toshiba Air Conditioning, Panasonic Corporation, Lennox International Inc., LG Electronics, SAMSUNG, Glen Dimplex Group, and Systemair AB are among the major players in the air source heat pump market. These businesses intend to make substantial expenditures to develop sustainable and effective solutions and grow their presence on the global market. For instance, in November 2025, Mitsubishi Electric introduced the Ecodan CAHV-R, a line of cascaded air source heat pumps with output capacities ranging from 7.8 kW to 640 kW for use in hospitals, schools, and other commercial applications. The purpose of this project was to help the company build a strong presence in the industry.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Air Source Heat Pumps market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Refrigerant

| |

Rated Capacity

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report