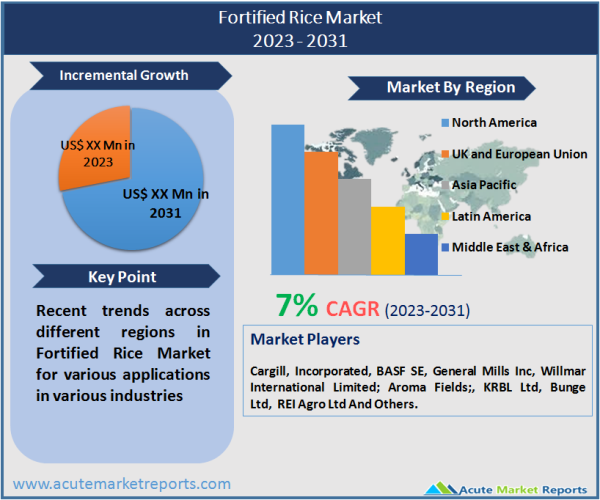

The market size for fortified rice is anticipated to grow at a CAGR of 7% during the forecast period of 2026 to 2034. The addition of essential micronutrients such as ascorbate calcium, vitamin B12, iron, and folic acid to rice to combat malnutrition in a specific population can be characterized as a cost-effective complementary strategy for rice fortification. Rice is categorized into various varieties and is renowned for its nutritional value. For example, black rice contains proteins, fibers, carbohydrates, antioxidants, and anthocyanins; however, their nutrient content is frequently lost due to infertile soil and inherent efficiencies. The Food and Agriculture Organization (FAO) and the World Health Organization (WHO) have adopted food fortification as one of their primary strategies to combat the problem of nutrient deficiency worldwide. Cereal grain fortification has emerged as a potential alternative to dietary supplements due to its cost-effectiveness, intact flavor, multiple nutrient sources, and negligible effect on consumption behavior. During the forecast period, the growth of the Fortified Rice Market is anticipated to be driven by skyrocketing global rice consumption, escalating government measures, rising health consciousness among individuals, widespread malnutrition in a number of Asian and African nations, improving distribution channels in developing nations, and rising disposable incomes.

Micronutrient deficiencies threaten the health, development, and productivity of millions of people around the world. In India, for instance, approximately fifty percent of children suffer from chronic malnutrition and vitamin & mineral deficiencies. In addition to micronutrient supplementation and diet diversification, enriching commonly consumed foods such as rice with minerals and vitamins is an effective means of addressing the problem. This has led to the fortification of rice, which is emerging as a sustainable and cost-effective method of providing nutrition to individuals worldwide.

Fortified Rice has emerged as the Key to Reducing People's Nutritional Deficiencies Globally

Nearly 2 billion people suffer from mineral and vitamin deficiencies, with devastating consequences for these individuals. Some of the most significant effects of nutrition deficiencies include impaired motor and cognitive development in children, diminished immune response, diminished capacity for performing physical work, high morbidity and mortality among newborns, adults, and mothers, and growth retardation. As rice is a globally consumed food and a staple in several developing nations such as China and India, fortified rice has emerged as the key to reducing the prevalence of malnutrition. Numerous demographic experiments and studies conducted around the world have demonstrated the efficacy and safety of consuming extruded fortified rice, as well as significant improvements in the vitamin and mineral status of the general population.

The Rising Consumption of Rice in Various Cuisines Is Anticipated to Increase Market Demand

Global rice consumption has increased significantly over the past decade. Global rice consumption has increased from 437.18 million metric tonnes in the 2008-2009 crop year to 509.87 million metric tonnes in the 2022-2026 crop year. A greater proportion of this consumption is attributable to Asia, where rice consumption is a cultural norm. China consumed approximately 154.9 million metric tonnes of rice in 2022, while India consumed approximately 103.5 million metric tonnes. The monthly rice consumption per capita in India has reached around 6.8 kilograms. In addition, consumers' increasing health consciousness and the improvement of the retail distribution network are driving the demand for fortified rice.

Government Initiatives to Combat Malnutrition in Low-Income Nations Are Anticipated to Increase Market Demand

According to the Women and Child Development Ministry, in 2022 there were approximately 17,7 lakhs (1.7 million) severely malnourished children in India. According to the International Food Policy Research Institute's Hunger Index, Somalia was the world's most malnourished nation in 2022, with a score of 50.8. In order to remedy the situation, international organizations such as the World Health Organization and the Food and Agriculture Organization have adopted food fortification as one of their core strategies. In addition, the government at each level is doing its best to address the situation. In 2022, for instance, the Indian government announced that by 2026, Mid-Day Meal and Public Distribution System programs would distribute fortified rice. These factors are fostering market expansion.

In recent years, the rice industry and development partners have spearheaded numerous initiatives to provide fortified rice through safety net programs and the open market. For instance, the Indian government, in collaboration with WFP and PATH, has distributed fortified rice through a variety of welfare programs, including the Mid-Day Meal, in several of its states. In accordance with this, U.S. Food Assistance Agencies have sought to diversify their portfolio of value-added nutritional food produced within the region's origin commodities for global nutritional and food assistance. Rice that has been fortified has remained a key component of these organizations' programs. This has led to an increase in the global production of fortified rice.

It Is Anticipated That Post-Pandemic Unemployment, Rising Inflation, And Environmental Hazards Will Inhibit Market Expansion

Extensive pesticide use in conventional agriculture is the primary cause of disturbances in the soil carbon sequestration process, as chemical use disrupts soil biotic communities. In addition, pesticides kill the worms and insects that maintain nutrients in the soil through the decomposition of dung and leaf litter; as a result, fertility issues are emerging on a scale never before seen. Nonetheless, rising global unemployment and inflation rates pose a significant threat to the aforementioned market. According to a report published by CMIE in 2025, the unemployment rate in India's metropolitan areas increased by 1.09 percent to 9.3 percent; the rural unemployment rate increased by 0.84 percent, from 6.44 percent to 7.28 percent. In addition, rising crude oil prices have unleashed a global wave of staggering inflation. These factors collectively impede the Fortified Rice Market.

The Conventional Fortified Rice Segment Dominates the Revenue, While Organic Segment Leads the Growth

In 2025, the conventional segment held the largest revenue share. The expansion is a result of the accessibility of conventionally produced cereal grains. In conventional agriculture, pesticides are utilized to increase crop yield to the greatest extent possible. Conventional farming requires less labor force and is conducive to producing more on less land; consequently, it reduces costs and maximizes farmers' income. Moreover, unlike organic products, conventionally produced rice is readily accessible in all regions. In spite of this, the organic segment is anticipated to have the highest CAGR during the forecast period of 2026-2034, at 8.5%. This is primarily due to the drawbacks of conventional farming, which include negative effects on the environment, health issues, animal cruelty, and a high risk of plant pests, among others. As consumers become increasingly concerned about their own health and the health of the environment, the global demand for organic products increases dramatically.

Online Distribution Channel to be the Fastest Growing Market During the Forecast Period

The Fortified Rice Market is segmented based on offline (supermarkets, convenience stores, brick-and-mortar stores) and online distribution channels. In 2025, the offline segment held the largest market share. The expansion is a result of the comprehensive existence in both urban and rural regions. In contrast, online or e-commerce services must meet certain requirements, such as a fully developed infrastructure, in order to operate efficiently; otherwise, it would not be feasible for them to offer doorstep delivery. In addition, the majority prefer offline shopping due to benefits such as instant purchases, hassle-free returns, bulk purchases, bargaining, and quality checks. In addition, the increasing prevalence of modern outlets such as supermarkets has attracted the interest of billions of people around the world due to their well-established nature, convenient shopping, lucrative sale deals, and one-stop solution. With a projected CAGR of 7.5% between 2026 and 2034, however, online is expected to be the fastest-growing segment. The expansion is due to the proliferation of technological innovations such as Google maps and online banking services. In addition, all-weather network access, the time-saving nature of e-commerce purchases, and the growing number of smartphone users are the factors attracting people to online platforms.

APAC Remains as the Global Leader

Geographically, the market for fortified rice can be subdivided into North America, Europe, Asia-Pacific, South America, and the Rest of the World. In 2025, Asia-Pacific held the largest market share with 45% of the total. This segment's growth is due to factors such as the presence of leading rice-producing nations in the region. China is the world's largest rice-producing nation, producing more than 210 million tonnes annually, followed by India with more than 170 million tonnes. Asia's leading producers include not only India and China, but also the Philippines, Indonesia, Bangladesh, Vietnam, Pakistan, and Thailand. Asia provides 90% of the global rice supply. According to a report, Asia accounts for 85% to 90% of global rice consumption, with Indonesia, India, and China accounting for nearly 60%. In addition, Asia-Pacific is anticipated to be the fastest-growing region during the forecast period of 2026 to 2034. This increase is attributable to high rates of malnutrition in Asia, rising disposable incomes as economies flourish, rising health consciousness among the populace, and soaring government initiatives to eradicate nutrient deficiency issues.

Countries of Asia-Pacific have a large and centralized rice milling industry, which makes rice fortification easier to implement. These nations have large safety nets that provide subsidized, fortified rice to the population living below the poverty line because they have an effective channel for reaching those in dire need of nutrition. In terms of revenue, APAC will continue to be the largest market for fortified rice in the near future. North America and Latin America will continue to be the largest contributors to the global market for fortified rice.

The selection of technology for the production of fortified rice has a significant impact on fixed expenses, such as the initial investment in facilities and equipment. Compared to other technologies, Coating & Encapsulation requires comparatively less capital investment. Through 2034, it is anticipated that the market for fortified rice will adopt this technology at a relatively faster rate. In terms of revenue, however, drying technology will continue to dominate the global market for fortified rice.

Market Competition to Intensify During the Forecast Period

New product introductions, mergers and acquisitions, joint ventures, and geographic expansions are the primary strategies utilized by market participants in the aforementioned market. The top companies in the fortified rice market include the following,

Cargill, Incorporated, BASF SE, General Mills Inc, Willmar International Limited; Aroma Fields;, KRBL Ltd, Bunge Ltd, REI Agro Ltd And Others.

Recent developments include the following:

On October 21, 2022, Cargill, a well-known food corporation headquartered in Minnesota, United States, announced that Sanderson farms' stockholders have approved the company's acquisition bid. The acquisition's total value is approximately $4.5 billion ($203 per share).

On January 20, 2022, "LT Foods," a rice milling company based in Gurugram, India, announced the successful acquisition of a 30 percent stake in "Leev.nu," a Dutch packaged food company. LT finalized the acquisition by means of organic food manufacturer Nature Bio Foods BV (a subsidiary of LT). The transaction was intended to strengthen Nature Bio's branded snacking business.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Fortified Rice market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Technology

|

|

End Users

|

|

Sales Channel

|

|

Nature

|

|

Micronutrients

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report