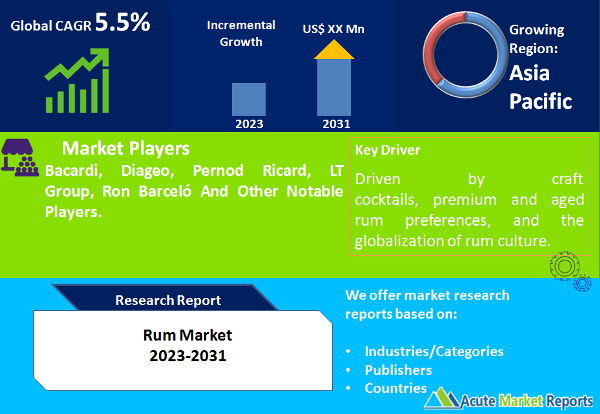

The rum market is a diverse and ever-evolving segment of the global alcoholic beverages industry. The rum market is expected to grow at a CAGR of 5.5% during the forecast period of 2026 to 2034, driven by craft cocktails, premium and aged rum preferences, and the globalization of rum culture. While supply chain disruptions pose a significant restraint, the market is expected to expand, especially in regions with a strong rum tradition and an emerging interest in the spirit. The competitive landscape is marked by key players dedicated to delivering high-quality rums and adapting to the changing tastes of consumers.

Rising Popularity of Craft Cocktails

Craft Cocktail Movement: One of the primary drivers fueling the rum market is the rising popularity of craft cocktails. In 2025, there was a surge in the craft cocktail movement, with bartenders and consumers alike exploring innovative and unique cocktail creations. Rum, known for its versatility, became a favored choice for mixologists looking to craft exciting and flavorful cocktails. This trend is expected to continue into the forecast period from 2026 to 2034, with consumers seeking artisanal and high-quality rums for their home bars.

Tiki Culture Resurgence: The resurgence of tiki culture is another significant driver. Tiki culture, with its exotic and vibrant cocktails, gained traction in 2025. These cocktails often feature rum as a primary spirit, contributing to the growth of the rum market. This trend is anticipated to persist during the forecast period, as tiki-inspired bars and beverages continue to captivate consumers, driving demand for a variety of rum styles.

Preference for Premium and Aged Rums

Aged Rum Appreciation: The second key driver is the increasing preference for premium and aged rums. In 2025, consumers displayed a growing appreciation for the craftsmanship and complexity of aged rums. These rums, often aged in oak barrels, offer rich and nuanced flavors that appeal to connoisseurs and those seeking a sophisticated drinking experience. This trend is expected to continue into the forecast period, with the demand for premium and aged rums on the rise.

Globalization and Rum Tourism

Rum Tourism Destinations: The third driver is the globalization of rum and the emergence of rum tourism. In 2025, regions known for their rum production, such as the Caribbean and Latin America, saw a significant influx of tourists interested in visiting distilleries and experiencing the culture behind rum-making. This trend is anticipated to persist during the forecast period, with more regions around the world positioning themselves as rum destinations and attracting travelers seeking a taste of local rum traditions.

Supply Chain Disruptions

Global Challenges: A significant restraint impacting the rum market is supply chain disruptions, which were experienced in 2025 due to various global challenges. These disruptions included transportation bottlenecks, import/export restrictions, and labor shortages, all of which affected the production and distribution of rum. This restraint is expected to persist during the forecast period, especially if global issues such as climate change and political instability continue to impact the industry.

Product (White Rum, Dark Rum, Spiced Rum, Rum Agricole, Overproof Rum, Others): In 2025, Dark Rum recorded the highest revenue due to its wide range of applications in classic cocktails and a growing demand for aged and premium dark rums. However, during the forecast period from 2026 to 2034, spiced rum is expected to exhibit the highest compound annual growth rate (CAGR). The unique and approachable flavor profile of spiced rum, suitable for both sipping and mixing, is anticipated to drive its growth. While dark rum is expected to maintain its revenue leadership, spiced rum will experience robust growth.

ABV Levels (Standard Strength Rum, Medium-Strength Rum, Navy-Strength Rum, Overproof Rum, Cask Strength Rum, Custom ABV Rum): In 2025, standard strength rum, falling within the 35% to 45% ABV range, generated the highest revenue due to its versatile use in a wide range of cocktails and mixed drinks. However, during the forecast period from 2026 to 2034, overproof rum is expected to exhibit the highest CAGR. Overproof rum, with an ABV above 68%, is gaining popularity among cocktail enthusiasts seeking stronger and more flavorful spirits. While standard-strength rum is expected to maintain its revenue leadership, overproof rum is poised for significant growth.

APAC remains the Global Leader

The region is expected to maintain its revenue leadership during the forecast period as it was in 2025, while the Asia-Pacific region, with its growing middle-class population and increasing interest in spirits, is anticipated to exhibit the highest CAGR. North America is expected to grow the highest CAGR during the forecast period of 2026 to 2034. A vast number of worldwide producers, increased demand for premium rums, and rising cocktail use of flavored and spiced rums are driving market expansion.

Product Development Strategies to Enhance Market Share among the Key Players

In the competitive landscape of the rum market, key players such as Bacardi, Diageo, Pernod Ricard, LT Group, and Ron Barceló have been at the forefront of innovation and product development. These companies have consistently invested in research and development to enhance their rum portfolios and have formed strategic partnerships with bars, restaurants, and retailers to ensure a widespread presence. In 2025, these industry leaders secured substantial revenue shares, and they are expected to maintain their positions during the forecast period from 2026 to 2034. Their strategies encompass producing high-quality rums, aligning with consumer preferences for premium and aged rums, and expanding their global footprint. Moreover, they are actively involved in addressing supply chain disruptions by implementing measures to ensure a consistent supply of rum to meet the growing demand.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Rum market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Alcohol (ABV levels)

|

|

Age

|

|

Packaging

|

|

Distribution Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report